After hitting a distinguished low of 0.019 BTC in opposition to Bitcoin, Ethereum reached 52.63%, reaching 0.029 BTC.

Ethereum choices present daring bets over $4,000

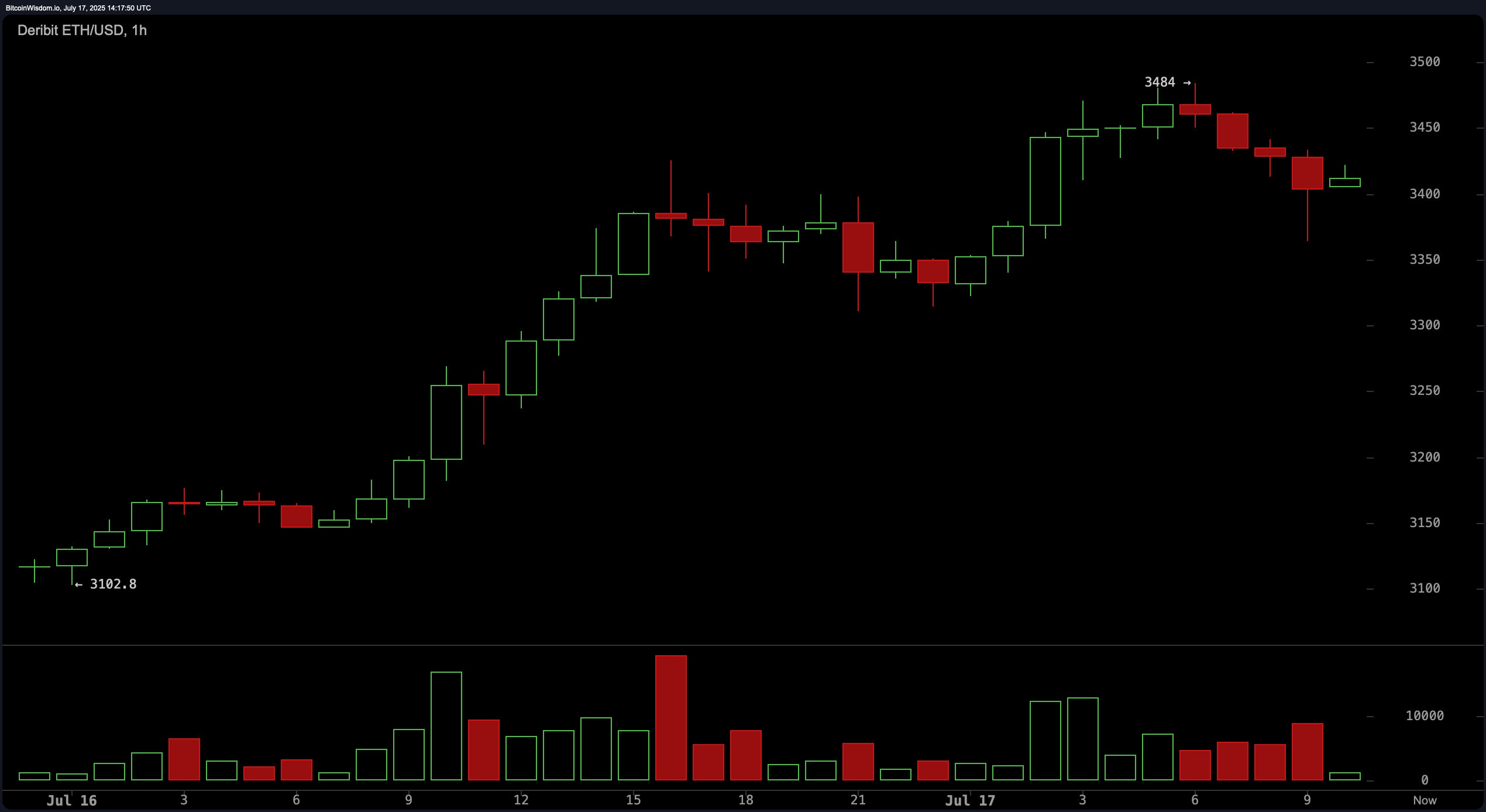

Ethereum (ETH) has made a big progress this week, displaying a 22.5% improve from July tenth. Only in the near past, ETH peaked at $3,484 per coin, buying and selling round $3,408 as of 10am on July seventeenth. Bitcoin has damaged a number of all-time highs this yr, however ETH has not hit a brand new document since November tenth, 2021. On the time, Ether modified palms at $4,878 per coin.

At as we speak’s costs, ETH ought to win 25% or extra to match the 2021 excessive. Wanting on the derivatives market, ETH is main the liquidation. Of the $583.42 million within the final 24 hours, ETH shorts, worn out of the crypto financial system, accounted for $251 million of that.

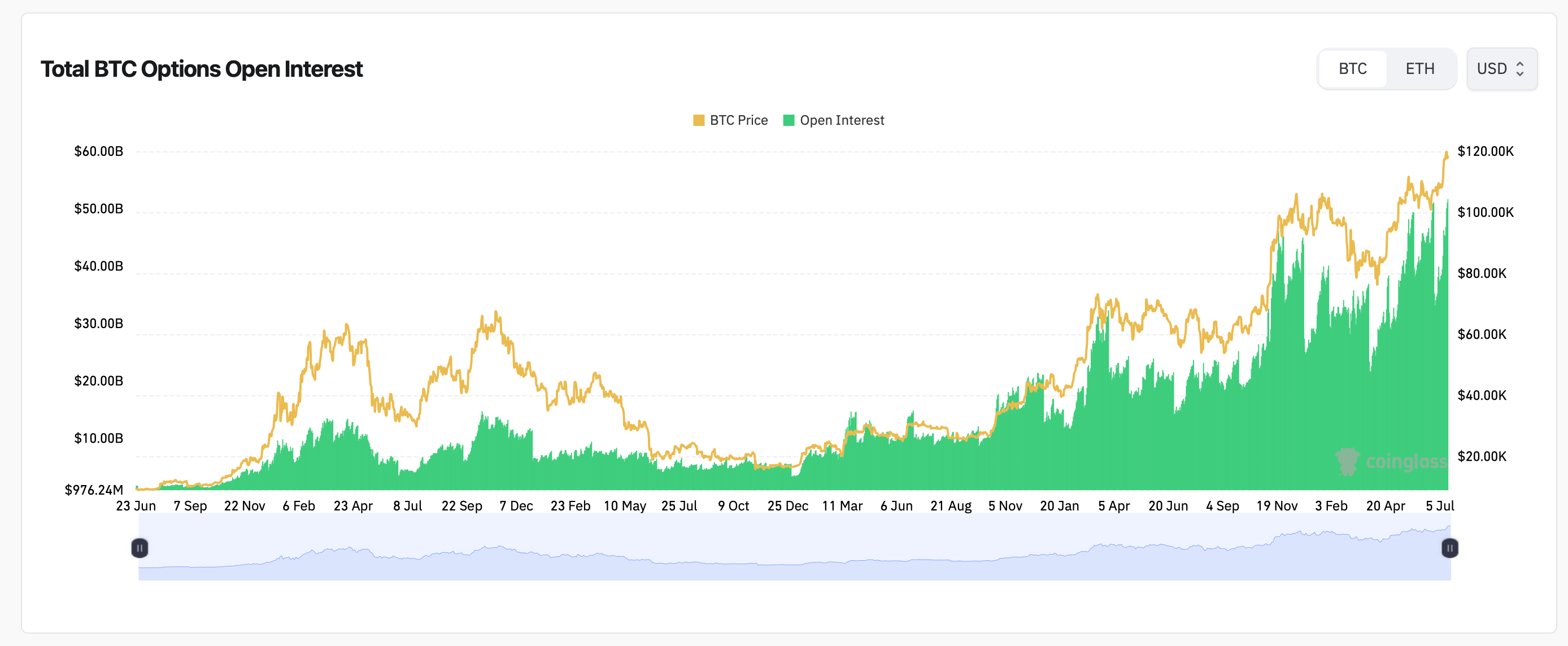

Ethereum Futures Open Interes jumped sharply, exceeding $50.42 billion, with 14.75 million ETHs locked down their spinoff contracts throughout all tracked exchanges. Over the previous yr, open curiosity has grown steadily as Ethereum costs recovered. Binance tops the record with $8.755 billion open curiosity (ETH 2.56 million), accounting for 17.36% of the full. CME follows at $6.04 billion (ETH of 1.77 million), or 11.98%.

Ethereum Choices Open curiosity has grown considerably, with ETH now standing at over 3.52 million, with name choices of 65.2% and PUTS of 34.8%. This exhibits a distorted market in the direction of optimism as merchants put together to settle increased in Ethereum worth. Deribit leads ETH choices exercise, specializing in $4,000 calls (93,891 ETH) on September 26, 2025, adopted by $3,600 calls (70,081 ETH) and December 26, 2025, $6,000 calls (59,832 ETH).

With $4,000, $4,200 and 6,000 factors, the deal with cash out of cash strikes has earned 6,000 factors on a bullish angle in the direction of fall and winter satisfaction. General, each open curiosity and up to date buying and selling volumes counsel that merchants place a distinguished breakout at Ethereum, considering the likelihood that choices markets may make vital earnings within the second half of 2025.