Whereas the Ethereum Ecosystem continues to broaden with a number of Layer 2 (L2) networks designed to enhance scalability and cut back charges, the info reveals that it’s not all the time financially viable for a distributed monetary (DEFI) protocol to deploy iterations throughout all these networks.

Defilama’s information reveals that for probably the most expanded protocol throughout the Ethereum Ecosystem, greater than 90% of charges or income comes from the mainnet, with L2S contributing solely a small share.

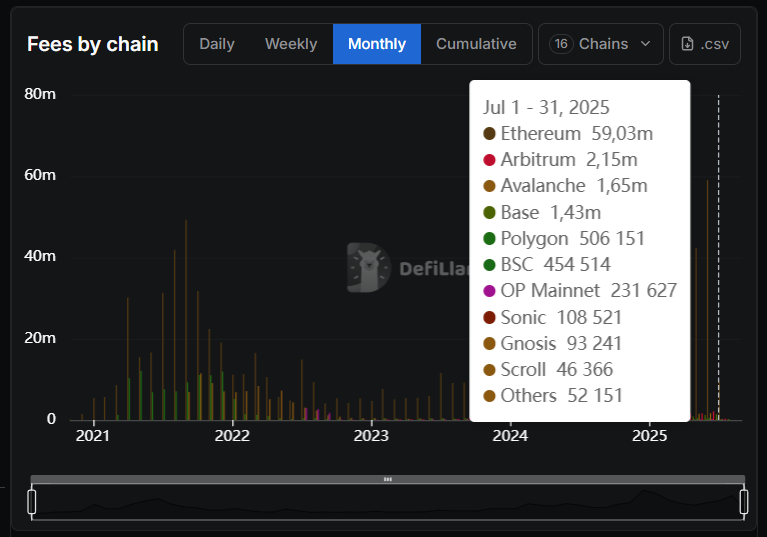

Aave, the biggest Defi Cash Market, which generated greater than $65 million in charges in July 2025, transformed roughly $9 million into income. However most of it got here from Ethereum Layer 1, which locked a complete of $29 billion.

Aave charges through blockchain

In the meantime, the mixed TVL (arbitrum, avalanche, base, polygon, optimism, Sonic, scroll, celero, soneum) of Layer 2 chain constellations pales as compared, and in addition contributes to payment income.

Scroll, for instance, generated solely $46,366 on Aave in June, below $1,500 per day, with Gnoss barely higher at $93,241.

I am going to discuss the identical with curve finance numbers. Over the identical interval, the charges had been about $2 million, with about $1 million being transformed into income. Ethereum pool dominated that tally, leaving solely a small L2 with a small portion of the pie. Though there are few granularity failures as a result of chain, the out there information attracts a conservative image of returns for a lot of of those new developments.

Saturation level

Ignas, co-founder of Defi Artistic Studio Pink Brains, mentioned in an X submit on August 1 that the trade might have hit “L2 saturation level.”

It has already raised considerations that some Layer 2 are barely chopping the $1,500 a day payment. In Curve’s discussion board, customers below the alias “Phil_00llama” prompt stopping all new Layer 2 growth. It takes lots of builders’ time and assets, however it solely brings about $1,500 a day to cost, which is simply too little to cowl the excessive upkeep prices of those quickly altering chains.

Nonetheless, the dialogue on the proposal was quiet and there have been few responses. Those that responded expressed skepticism about halting L2 growth utterly, suggesting that these chains could also be value pursuing.

The precise value of working a protocol on L2 just isn’t all the time clear, making it tough to measure profitability. For instance, increasing Aave to scroll required committing $500,000 value of Aave tokens within the security module, however shifting to GNOSIS required as much as $5 million in capital to assist GHO liquidity. Gho is Aave’s native Stablecoin with a market capitalization of round $300 million.

Already low costs and even decrease revenues – initiatives aiming to be anyplace in Ethereum could must rethink their technique. As a result of some deployments can require extra effort than they’re value it.