The Ethereum Validator exit queue may surge within the coming days, however crypto market members are not often nervous, says Anthony Sassano, an educator at Ethereum.

“This ETH will in all probability take a break utilizing the brand new Validator Keys. Alias, it will not be offered,” Sassano mentioned in an X put up Tuesday, citing the announcement of Kiln Finance following the hack of Swiss-based Crypto Wealth Administration Platform, Swissborg.

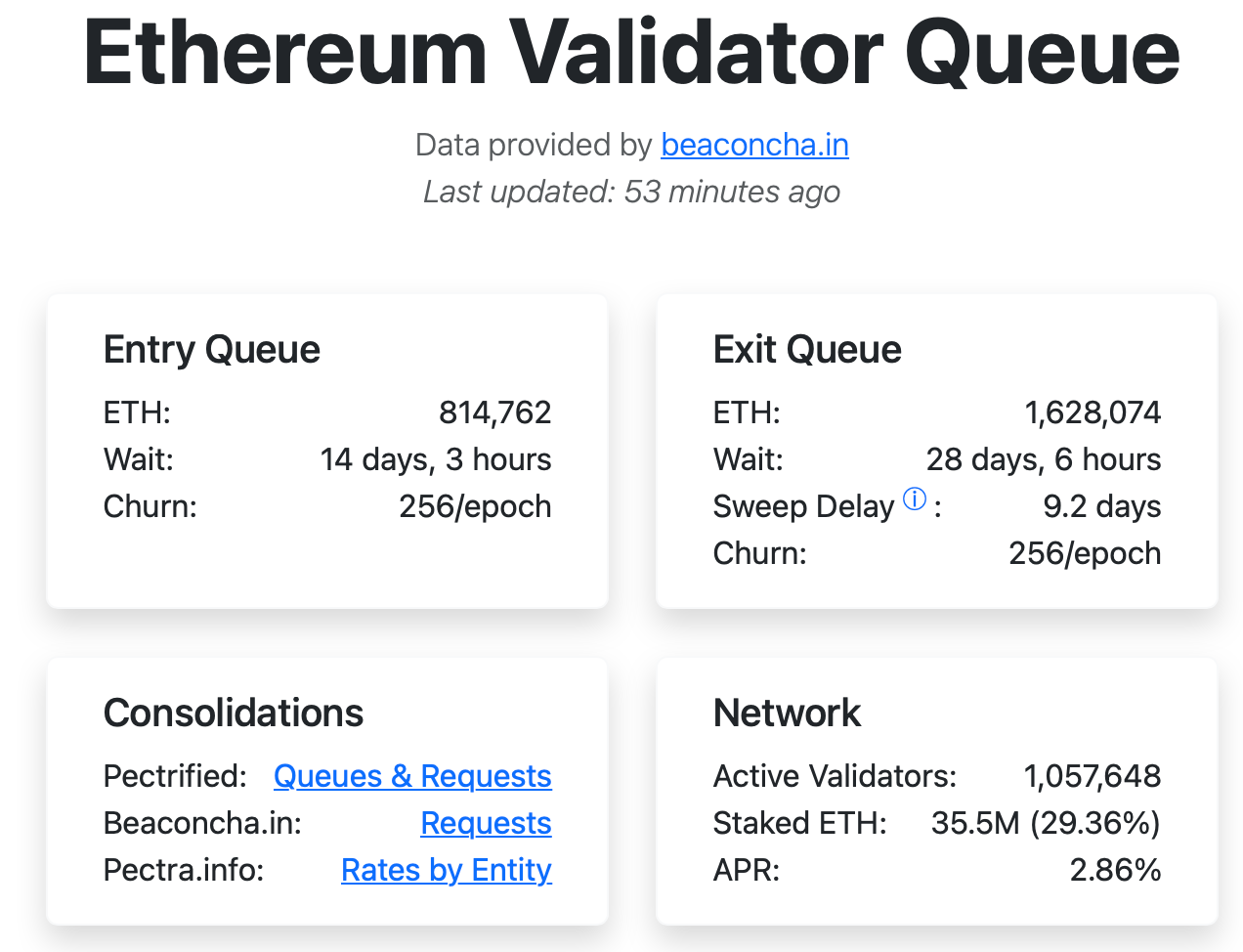

The dearth of a considerable amount of ether (ETH) may be thought of a bearish indicator, as merchants could also be afraid to point out future gross sales pressures. In line with information from ValidatorQueue, the ETH exit queue is sitting at 1,628,074. Roughly 35.5 million ETH have been staked, accounting for roughly 29.36% of the entire provide.

Kiln launches an “Strange Exit” for Ethereum Validators

“Following yesterday’s announcement concerning the Solana incident involving Swissborg, Kiln is taking extra precautions to guard consumer property throughout all networks,” Kiln Finance mentioned in Tuesday’s X-Submit.

Swissborg beforehand revealed that hackers have exploited the vulnerability within the API of their staking associate, Kiln, and have drained roughly 193,000 SOL tokens from their acquisition program.

“As a part of this response, immediately Kiln has begun an orderly exit of all its Ethereum validators. The exit course of is a precautionary measure designed to make sure the integrity of the piling property,” Kiln Finance defined.

The Ethereum Exit queue presently has round 1.63 million ETHs. sauce: Validatorqueue

The exit course of can take as much as 42 days, Kiln says

Kiln Finance defined that the exit course of is predicted to take 10-42 days relying on the validator.

In line with Coinmarketcap, Ether is buying and selling at $4,306 on the time of publication.

Associated: Ethereum Exit Queue hit document $500 million ETH raises considerations about promoting strain

This comes after Ethereum has skilled a time when it has surged entry and exit queues in current months.

On August 28, Cointelegraph reported that Ethereum noticed the escape of an important validator in crypto historical past, and is presently ready for greater than one million ether tokens to withdraw from retirement by way of Ethereum’s Proof Stake (POS) community.

In the meantime, on September 3, the quantity of ether underneath measurement surged to its highest stage since 2023, as facility merchants and cryptocurrency corporations goal to scoop up the rewards of their holdings.

journal: Can a tokenized stock of Robinhood or Kraken actually be decentralized?