Ethereum is displaying notable relative energy because it makes an attempt to recuperate the $3,150 degree and push larger, indicating early indicators of restoration after weeks dominated by huge promoting strain, worry, and uncertainty. A broad market rally has helped restore confidence, however ETH’s skill to outperform main altcoins highlights rising demand and bettering sentiment in direction of the asset.

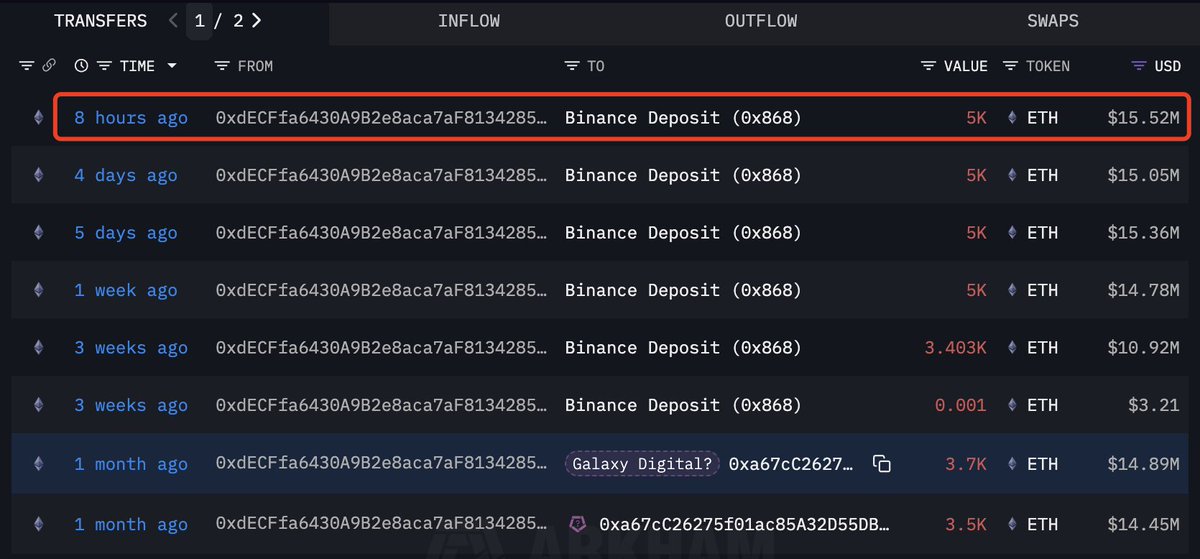

Including to the renewed optimism, new on-chain information from Lookonchain reveals a big transfer by probably the most acknowledged whales available in the market. Through the rebound, whale 0xdECF deposited a further 5,000 ETH into Binance, value roughly $15.52 million.

These wallets are well-known for sending giant quantities of ETH to exchanges throughout latest recessions, which regularly coincide with moments of heightened volatility and capitulation.

Current deposits counsel that whales are nonetheless very lively and attentive to market situations. Whereas these actions can generally create uncertainty, in addition they spotlight elevated liquidity and participation from main holders. With the worth recovering key ranges and whale positions shifting, Ethereum has entered a essential section the place continued energy might affirm broader modifications in market construction.

Ethereum Whale Distribution Highlights Market Warning

Based on Lookonchain, whale 0xdECF has bought 25,603 ETH (equal to roughly $85.44 million) on Binance and Galaxy Digital since October 28. Regardless of this vital distribution, the pockets nonetheless holds 5,000 ETH (about $15.52 million), suggesting that the whale is just not fully out of its place, however has considerably diminished its publicity throughout the latest market downturn.

These behavioral patterns present vital perception into the feelings of enormous holders. They don’t seem to be abandoning Ethereum fully, however they’re actively managing danger and responding to volatility extra aggressively than traditional.

This fixed promoting strain from giant wallets usually serves to pull costs down, particularly throughout bearish intervals when market liquidity is low. Nonetheless, the truth that whales proceed to carry significant positions indicators expectations of a possible restoration, or a minimum of a want to stay strategically uncovered to future upside.

Ethereum is now at a essential stage. Belongings have recovered key ranges, however medium-term buildings stay extremely delicate to macro situations and whale conduct. If promoting by main shareholders slows and accumulation outstrips distribution, the latest rebound might solidify into a unbroken development. In any other case, renewed gross sales flows might run the chance of Ethereum revisiting decrease assist areas.

ETH regains short-term momentum however faces vital resistance

Ethereum’s each day chart reveals a transparent enchancment in momentum after reclaiming the $3,150-$3,200 area, however the broader construction stays fragile. The bounce from the $2,750-$2,850 assist zone has resulted in a decisive change in purchaser conduct, with a powerful decrease wick indicating aggressive demand. This rebound has introduced ETH again above key near-term ranges, however the asset nonetheless faces a difficult scenario.

The value is at present approaching the 50-day SMA and is at present trending decrease simply above $3,250, which acts as quick resistance. This transferring common has capped each rally since late October and stays the primary main barrier to a return to energy. Moreover, the 100-day SMA close to $3,450 and the 200-day SMA close to $3,600 kind a decent cluster of overhead resistance that defines a medium-term downtrend.

Quantity on the newest rebound has been stronger than on earlier makes an attempt, suggesting patrons are displaying extra confidence in comparison with the mid-November restoration try. Nonetheless, the general development stays bearish till ETH crosses its 50-day SMA and begins closing a each day candle above $3,300.

Ethereum is at an vital inflection level. A maintain above $3,100 would strengthen the case for a continued restoration, whereas a rejection within the $3,250-$3,300 vary might set off one other retest of the $2,800 area. The subsequent few classes will decide whether or not this bounce develops right into a deeper development reversal.

Featured picture from ChatGPT, chart from TradingView.com