In early November, Ethereum (ETH) misplaced greater than 12% of its worth. Nonetheless, main holders purchased the drop and amassed the second-largest cryptocurrency by investing round $1.37 billion in simply three days.

This aggressive shopping for highlights sturdy conviction amongst massive buyers, although the general crypto market stays beneath stress.

Ethereum whale positive aspects momentum

BeInCrypto reported earlier this week that Ethereum skilled its largest every day decline in months. The altcoin fell to a low of round $3,000 on Tuesday, its lowest stage in practically 4 months.

On the time of writing, ETH is buying and selling at $3,384, reflecting a modest restoration of 1.45% per day, in keeping with information from BeInCrypto Markets. Though the coin has but to flip the $3,400 stage into help, holders appear to view the decline as a shopping for alternative quite than a cause for concern.

Ethereum (ETH) value efficiency. Supply: BeInCrypto Markets

On-chain analytics agency Lookonchain reported important accumulation by whales through the recession. The info revealed that eight main entities bought a complete of 394,682 ETH (price about $1.37 billion) over the previous three days.

The typical buy value was $3,462. Lookonchain has recognized the “Aave whale” as its largest purchaser. The corporate bought 257,543 ETH price $896 million.

The second largest purchaser was Bitmine Immersion Applied sciences, the most important company holder of ETH. The corporate acquired 40,719 ETH for roughly $139.6 million.

OnChain Lens information confirmed that Bitmine initially bought 20,205 ETH from Coinbase and FalconX. We then acquired an extra 20,514 ETH from FalconX.

This newest transfer is in step with Bitmine’s continued technique of accumulating Ethereum throughout market declines. In late October, the corporate made a big buy price $250 million, and shortly thereafter invested one other $113 million in ETH.

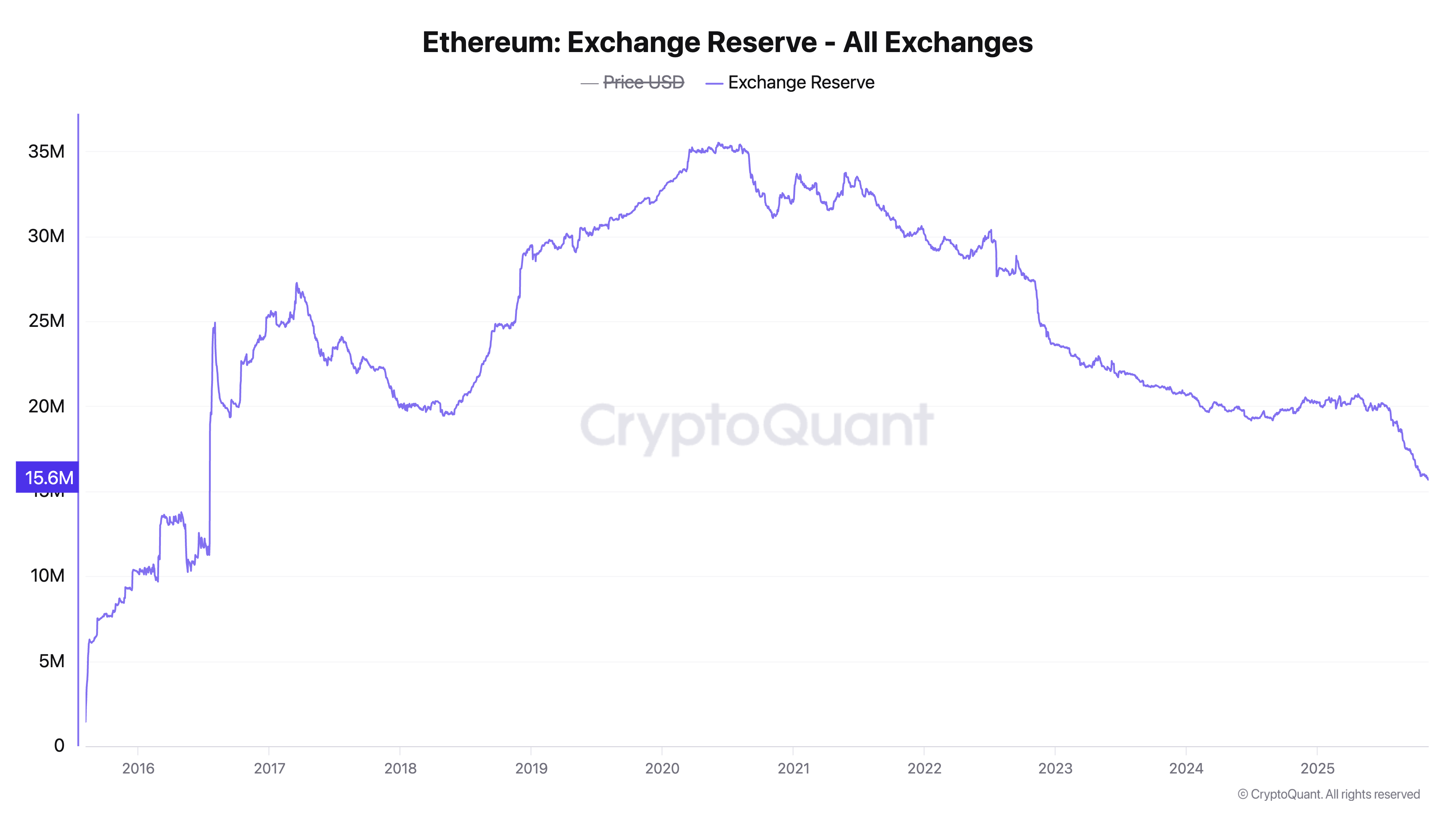

On the identical time, broader community information displays related investor conduct. Ethereum’s international alternate reserves have fallen to their lowest stage since 2016, in keeping with information from CryptoQuant.

A decline in international alternate reserves usually means that buyers are transferring their Ethereum holdings from buying and selling platforms to long-term storage, reflecting elevated confidence within the asset’s future. This pattern reduces the quantity of ready-to-sell provide, which may scale back promoting stress and help potential upward value momentum.

Lowered provide of Ethereum on exchanges. Supply: CryptoQuant

On-chain metrics ETH flash purchase sign

Santiment’s on-chain analytics helps this pattern. The info reveals that Ethereum suggests a robust shopping for alternative based mostly on the Market Worth to Realized Worth (MVRV) metric.

Merchants energetic previously 30 days now have a mean lack of 12.8%, Santiment mentioned, indicating that short-term ache is spreading.

From a long-term perspective, merchants who’ve been energetic over the previous 12 months have additionally fallen barely into the purple, with a mean return of -0.3%.

“When an asset’s short-term and long-term MVRV are each within the adverse vary, this traditionally signifies a robust alternative to purchase at low danger whereas there may be ‘blood within the streets,'” Santiment posted.

Total, the mixture of huge whale accumulations, declining alternate reserves, and favorable on-chain metrics means that investor confidence in Ethereum is rising. If these developments proceed, Ethereum may very well be poised for a value restoration as soon as broader market situations stabilize.

The put up Ethereum Whales Purchase $1.37 Billion of ETH Amid 12% Worth Drop in November appeared first on BeInCrypto.