Ethereum climbing in the direction of the much-anticipated $5,000 mark might face additional stalling as indicators within the chain recommend headwinds.

Information reveals that long-term holders of ETH (LTH) are actively distributing cash, creating potential gross sales strain for weight available in the market. On the similar time, persistent bearish emotions amongst futures merchants add one other layer of consideration, placing its current advantages in danger.

Incomes income by long-term holders will put ETH breakout on maintain

Eth’s one-month value consolidation has created a chance for long-term holders (LTHS) to lock in income following Altcoin’s late August rally.

This pattern is clear on Coin’s vibrant scale. This rose to a peak of 0.704 from the beginning of the yr, in response to Glassnode.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s each day crypto e-newsletter.

The vibrancy of ETH. Supply: GlassNode

Asset vitality tracks the motion of earlier dormant tokens by measuring the ratio of the property’ coin days to the whole coin days collected. As soon as that falls, LTHS is shifting property out of alternate. This is a sign that accumulation is ongoing.

In the meantime, because the vibrancy of the property climbs, extra dormant cash will likely be bought, indicating a rise in income from LTHS.

Thus, the rise in vibrancy of ETH means that its LTH is actively reaching income slightly than rising additional. This gross sales strain might restrict ETH’s means to stage crucial breakouts in the direction of the $5,000 degree within the brief time period.

Futures merchants keep heavy bought out strain

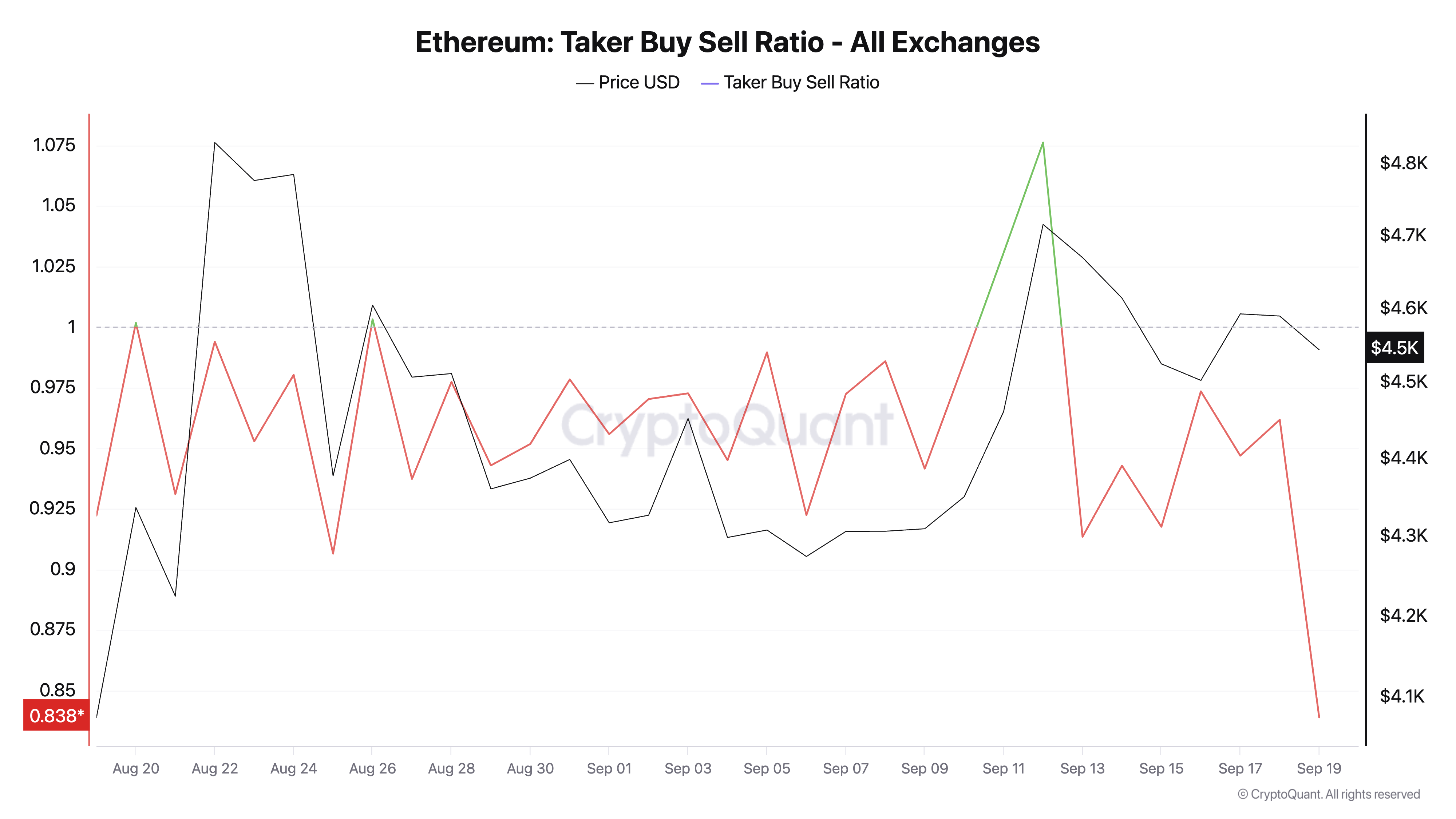

The persistent bearish sentiment within the derivatives market provides to this strain. Cryptoquant measurements present that ETH taker purchase and promote ratios remained primarily in purple for almost all of the previous month, highlighting a sustained exit amongst futures merchants.

Ethereum Taker shopping for and promoting ratio. Supply: Cryptoquant

The buy-and-sell ratio of property takers measures the stability of buy-and-sell quantity within the futures market. Values above 1 point out stronger purchases, whereas values under 1 point out heavier vendor exercise.

As seen on ETH, there have been sustained returns of worth over a month. This might delay ETH rallies to a further $5,000, because it factors to a bearishness amongst merchants.

$5,000 Breakout Hinge-On Demand Revival

On the time of writing, the main Altcoin traded for $4,542 and holds $4,211 above the assist ground. As bearish emotions get bolstered and promote continues, the coin can retest this assist line.

If it can’t be held it might decay deep to $3,626.

Ethereum value evaluation. Supply: TradingView

Nevertheless, a revival of demand for ETH might undermine this bearish view. In that instance, the worth of the coin might try and infringe resistance at $4,957. If profitable, new costs above $5,000 might peak.

Publish Ethereum’s $5,000 dream, delayed by long-term holder exits and bearish futures bets, first appeared in Beincrypto.