BitMine, as soon as hailed as probably the digital asset equal of Berkshire Hathaway, envisioned itself locking down 5% of Ethereum’s complete circulating provide.

Its core technique was to show company steadiness sheets into long-term, high-conviction bets on blockchain community infrastructure.

Immediately, that formidable imaginative and prescient is colliding with brutal market realities. Ethereum has fallen greater than 27% in a single month and is buying and selling under $3,000, leaving Bitcoin with greater than $4 billion in unrealized losses.

This large loss isn’t an remoted occasion. This displays a deeper, systemic disaster engulfing the whole digital asset treasury (DAT) sector, which is struggling because of the very volatility it was created to use.

ETH accumulation idea addresses existential stress

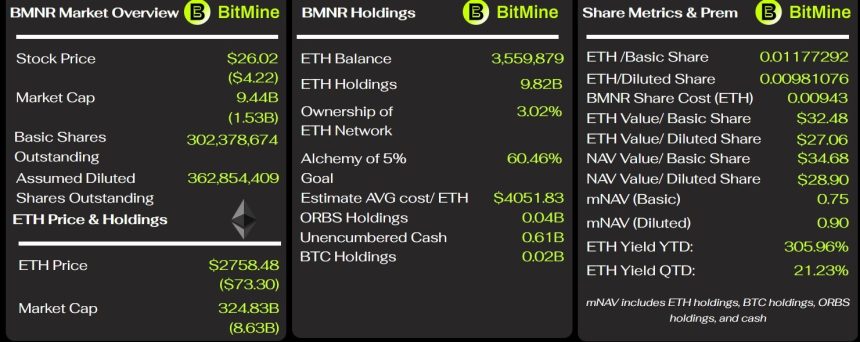

BitMine at the moment holds roughly 3.6 million ETH, which is roughly 2.97% of Ethereum’s circulating provide. Nevertheless, the steadiness sheet speaks to severe pressures.

The worth of the corporate’s holdings has fallen from a peak of properly over $14 billion to simply below $10 billion, with paper losses starting from an estimated $3.7 billion to $4.18 billion, relying on the valuation methodology.

An unbiased evaluation by 10x Analysis means that the corporate is successfully shedding about $1,000 on each ETH buy.

For a typical diversified firm, such impairments could also be manageable. However for pure DAT corporations, whose main and sometimes solely function is to build up and maintain cryptocurrencies, the implications are existential.

And it is not simply BitMine. In line with information from Capriole Investments, main ETH treasury corporations have recorded damaging returns of 25% to 48% on their core holdings. Firms comparable to Sharplink and Ethermachine have seen their holdings fall by as much as 80% from their yearly highs.

All through the DAT state of affairs, the speedy decline in ETH is quickly turning company steadiness sheets into debt, placing the sector below an actual stress take a look at.

This stress is forcing a dramatic reversal of company intent. FX Nexus (previously Basic World) has filed for shelf registration to boost $5 billion to amass Ethereum, aiming to change into the world’s largest company holder of the cryptocurrency.

Nevertheless, as costs fell, the corporate reversed course and offered over 10,900 ETH (roughly $32 million) to fund a share buyback.

This contradiction, the place an organization was based to build up cryptocurrencies and is now promoting them to guard the worth of its inventory, highlights a elementary distortion of the DAT mannequin. Quite than being an accumulator of final resort, because the bullish narrative had advised, DAT is quickly turning into a compelled deleverager.

When the mNAV premium collapses

The viability of a DAT firm will depend on a key metric: market worth to internet asset worth (mNAV). This ratio compares the corporate’s inventory market valuation to the precise worth of its internet cryptocurrency holdings.

In a bull market, if DAT trades at a premium (mNAV > 1), it could possibly problem new shares at a excessive value, elevate capital cheaply, and use the proceeds to amass extra digital property. This virtuous cycle of progress by way of accumulation and premiums is totally disrupted when the market turns.

In line with BitMineTracker, BitMine’s base mNAV is at the moment 0.75 and its diluted mNAV is 0.90. These numbers point out that the market is valuing the corporate at a big low cost to its crypto holdings.

If the premium shrinks or disappears fully, financing turns into almost unattainable. Issuing new shares doesn’t end in significant monetary growth and solely dilutes present holders.

Markus Thielen of 10x Analysis aptly described this case as a “Lodge California state of affairs.” As with closed-end funds, when premiums collapse and reductions emerge, consumers disappear, sellers pile up, liquidity evaporates, and present traders change into “trapped within the construction and unable to get out with out vital hurt.”

Importantly, DAT corporations typically layer in opaque charge buildings that resemble hedge fund-style administration charges, additional eroding income, particularly throughout financial downturns.

Not like exchange-traded funds (ETFs), which keep strict arbitrage mechanisms to maintain inventory costs near their internet asset worth (NAV), DATs rely solely on sustained market demand to shut the low cost. If the value falls sharply, that demand disappears.

What stays is an unstable construction like this:

- The worth of the underlying asset is declining.

- The inventory is buying and selling at a big low cost to its valuation.

- Advanced income fashions can’t be justified by efficiency.

- Present shareholders can be caught until they exit with vital realized losses.

Capriol’s evaluation confirms that this can be a sector-wide problem, exhibiting that almost all DATs are at the moment buying and selling under mNAV. This lack of premium successfully cuts off the first path to financing progress by way of fairness issuance, thereby disrupting its skill to meet its core mission of accumulating cryptocurrencies.

What’s subsequent for DAT?

Bitmine has pushed again on this declare, citing broader liquidity stress, likening the market state of affairs to a “quantitative tightening in cryptocurrencies,” however it’s nonetheless grappling with structural realities.

Finance corporations primarily rely for fulfillment on the triple whammy of rising asset costs, rising valuations, and rising insurance coverage premiums. If all three flip on the identical time, the mannequin goes right into a damaging spiral.

The rise of the DAT sector was impressed by MicroStrategy’s success with the debt-financed Bitcoin treasury. Nevertheless, Capriole’s Charles Edwards clearly states:

“Most monetary corporations will go bankrupt.”

This distinction is essential. ETH’s volatility profile is exclusive, its DAT enterprise mannequin is far more tenuous, and its capital construction is extra fragile than MicroStrategy.

Most significantly, they typically lack the robust unbiased working money stream wanted to resist long-term market downturns with out succumbing to asset gross sales.

For a DAT mannequin to resist this stress take a look at, three tough situations should be met:

- ETH value should rebound strongly and sustainably.

- To renew capital elevating, the mNAV ratio should return to a degree properly above 1.

- Particular person and institutional traders have to regain religion in a construction that has worn out billions of {dollars} of paper worth.

All three states are at the moment transferring within the flawed path. BitMine might proceed to carry giant ETH reserves and will attain its 5% provide goal if the market stabilizes.

However the firm, and the trade as a complete, now serves as a cautious case examine.

These spotlight the acute risks of basing a whole company technique and capital construction on a single, extremely unstable digital asset with out the structural safeguards, regulatory self-discipline, and steadiness sheet diversification wanted to climate main market reversals.

The digital asset finance period is at its first true second of reality, and the ensuing multibillion-dollar losses reveal a a lot weaker enterprise mannequin than its founders anticipated.