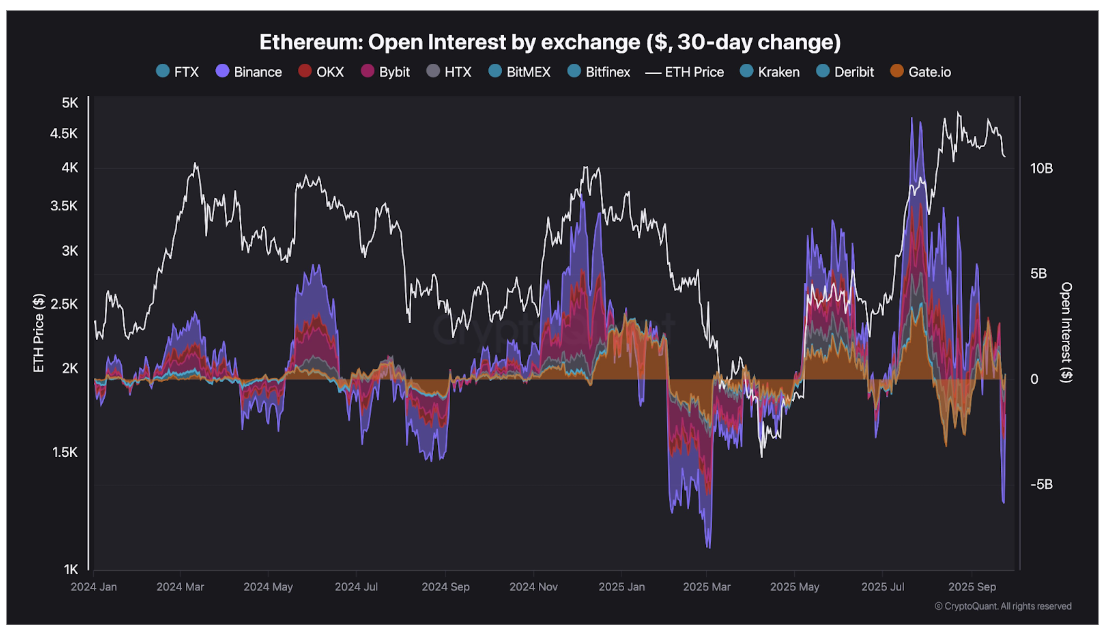

Ethereum has undergone probably the most essential resets for over a yr. That is attributable to a value falling under $4,000. This retest is most outstanding in open curiosity in futures, the place billions of {dollars} have been worn out at main exchanges. This speedy rewind comes as a revised transfer to weeks of extreme leverage in the course of the upward pattern that has pushed by-product exercise to unsustainable ranges.

Massive open curiosity wipeouts throughout main exchanges

The newest Ethereum value changes have been greater than only a dip, however a broader market reset, with leveraged merchants taking the brunt of losses. Information reveals that Ethereum’s open curiosity has skilled a sudden downfall over the previous week, simply during the last a number of crypto exchanges. In keeping with Information from The on-chain analytics platform’s encrypted billions of Ethereum positions have been worn out final week, with Binance main the recession with a month-to-month common decline.

Ethereum slides slide on the $4,000 mark It has confirmed to be a breakpoint of A stacked dealer. The transfer unleashed a wave of liquidation throughout the derivatives market and exacerbated gross sales strain.

Information reveals that on September twenty third, greater than $3 billion was worn out in vinanence alone, adopted by over $1 billion a day later. BYBIT additionally reduce its place by $1.2 billion, whereas OKX recorded a $580 million decline. The sudden reductions are seen as a complete of gross which have fallen to lowest ranges since early 2024.

As chart information reveals, futures leverage and open curiosity have been carefully linked to cost will increase in July and August, whereas on the similar time, the lockstep with costs fell.

Ethereum is open revenue from alternate

Spot Ethereum ETF spill provides to market burden

The decline in open income under the $4,000 break on Ethereum, coincides with a heavy week of spills from the US Spot Ethereum ETF. In keeping with To information from Farside traders, $795.56 million, went out over 5 days final week. That is the most important weekly departure because the product was launched.

The sale has been strengthened Heading into the weekend, Thursday recorded a $251.2 million spill, with one other $248.4 million on Friday. The participation of the declined lab has contributed drastically to sell-side strain, with traders being warned amid uncertainty about whether or not regulators would permit staking capabilities in these ETFs. This outlet from each synchronized derivatives and facility merchandise amplifies volatility and brings strain convergence throughout the Ethereum buying and selling ecosystem.

After a low soak of $3,845, ETH The bull managed to carry it Over $3,800. On the time of writing, Ethereum is buying and selling for $4,002. Regardless of this try and regain stability, main Altcoin has fallen by about 10% over the weekly timeframe, on condition that it traded round $4,490 this time final week. The bullish situation lies in whether or not ETH will be performed Get better and preserve the above actions $4,000.

Unsplash featured pictures, TradingView charts