In accordance with the info, the Etherum Reward Quantity has overturned the quantity of Bitcoin, and a sign that sturdy speculative curiosity is flooded with belongings.

Ether Leeum Reward Quantity was fired with Worth Rally.

In accordance with the info from the analytical firm GlassNode, Ethereum may surpass Bitcoin when it comes to future buying and selling quantity. Right here, the amount of buying and selling signifies the quantity of transactions that have been naturally given on one other centralized change. Within the present context of the subject, the quantity associated to the longer term market is very .

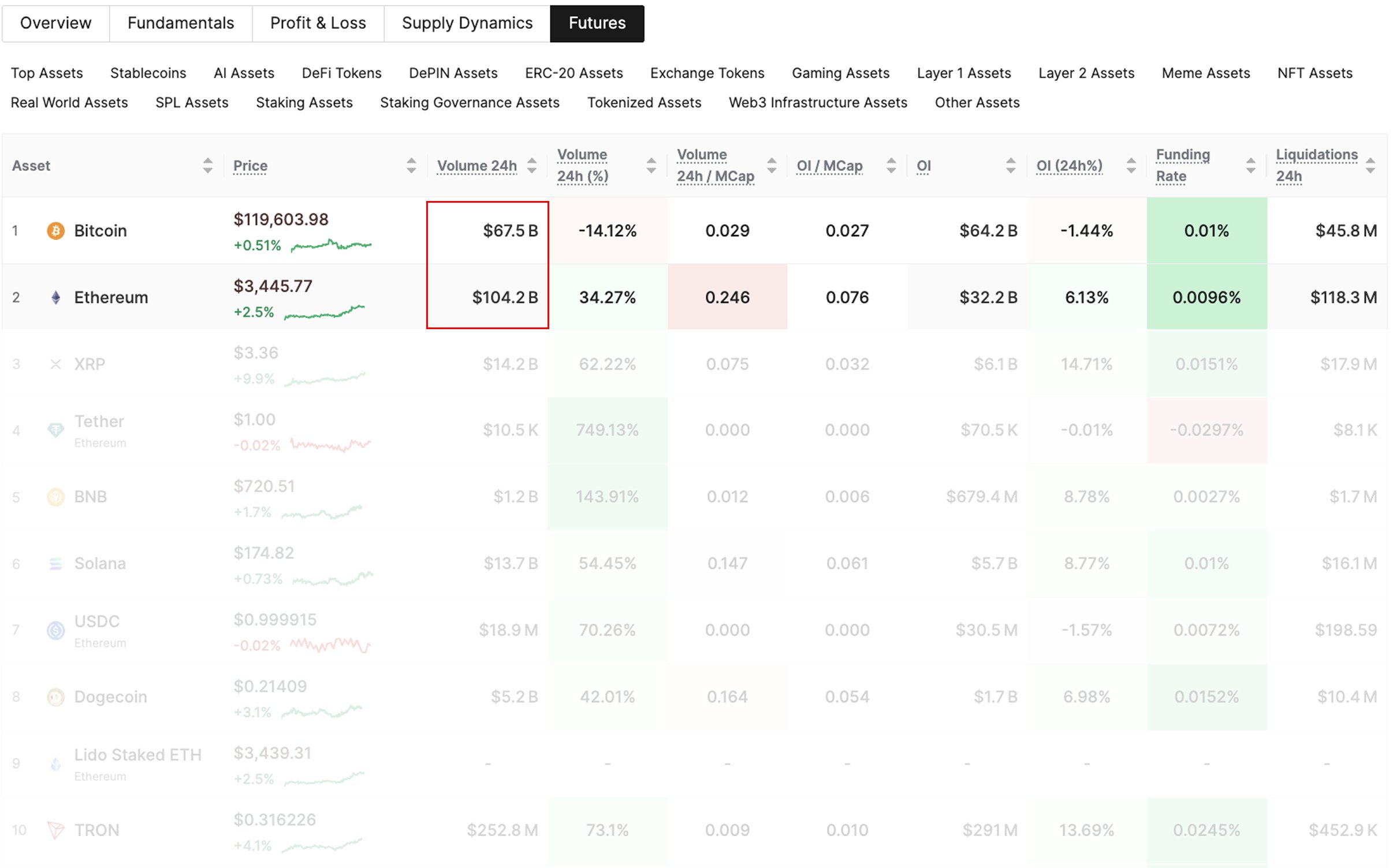

Under is a desk that reveals how the comparability between Bitcoin and Ethereum compares this metrics on the standpoint of GlassNode.

Appears just like the ETH futures quantity far outweighs the BTC one | Supply: Glassnode on X

As you possibly can see, Bitcoin has registered $ 67.5 billion in futures buying and selling, particularly decrease than $ 14.2 billion by Ethereum. Cryptocurrency often doesn’t occur as a result of it observes extra speculative demand than ETH or altcoins.

In the identical desk, the info from a number of different futures associated indicators are additionally displayed. The BTC Open Curiosity has reached $ 64.2 billion on the put up -post level of monitoring the overall future place on all derivatives platforms.

The identical indicator for ETH was $ 32.2 billion, and its unique digital belongings are nonetheless far forward of the overall market positioning. In different phrases, the 24 -hour change of this metric decreased 6.1% of Ether Leeum and 1.4% of Bitcoin.

New demand for ETH has occurred as the worth of sturdy inflows (ETF) has fallen from the market.

Curiously, all of those pursuits have been towards Cryptocurrency, however the common funding charge continues to be not constructive. The speed of financing is an indicator of a periodic payment that merchants change within the futures market.

When this metrics are inexperienced, lengthy traders imply that they pay a premium to quick traders to take care of their place. This development means that there’s a sturdy considering between retailers.

On this desk, it’s clear that the financing charge reached 0.0096percentof Etherrium even after the surge in future buying and selling quantity. That is lower than 0.01percentof Bitcoin. Due to this fact, a brand new positioning for ETH happens, however traders are nonetheless not optimistic.

“This setting has no indicators of sturdy dumping pursuits, OIs and overheating.”

ETH worth

On the time of writing, Ether Leeum trades $ 3,600, up nearly 21% final week.

The worth of the coin has surged throughout the previous few days | Supply: ETHUSDT on TradingView

DALL-E, GlassNode.com’s important picture, TradingView.com chart