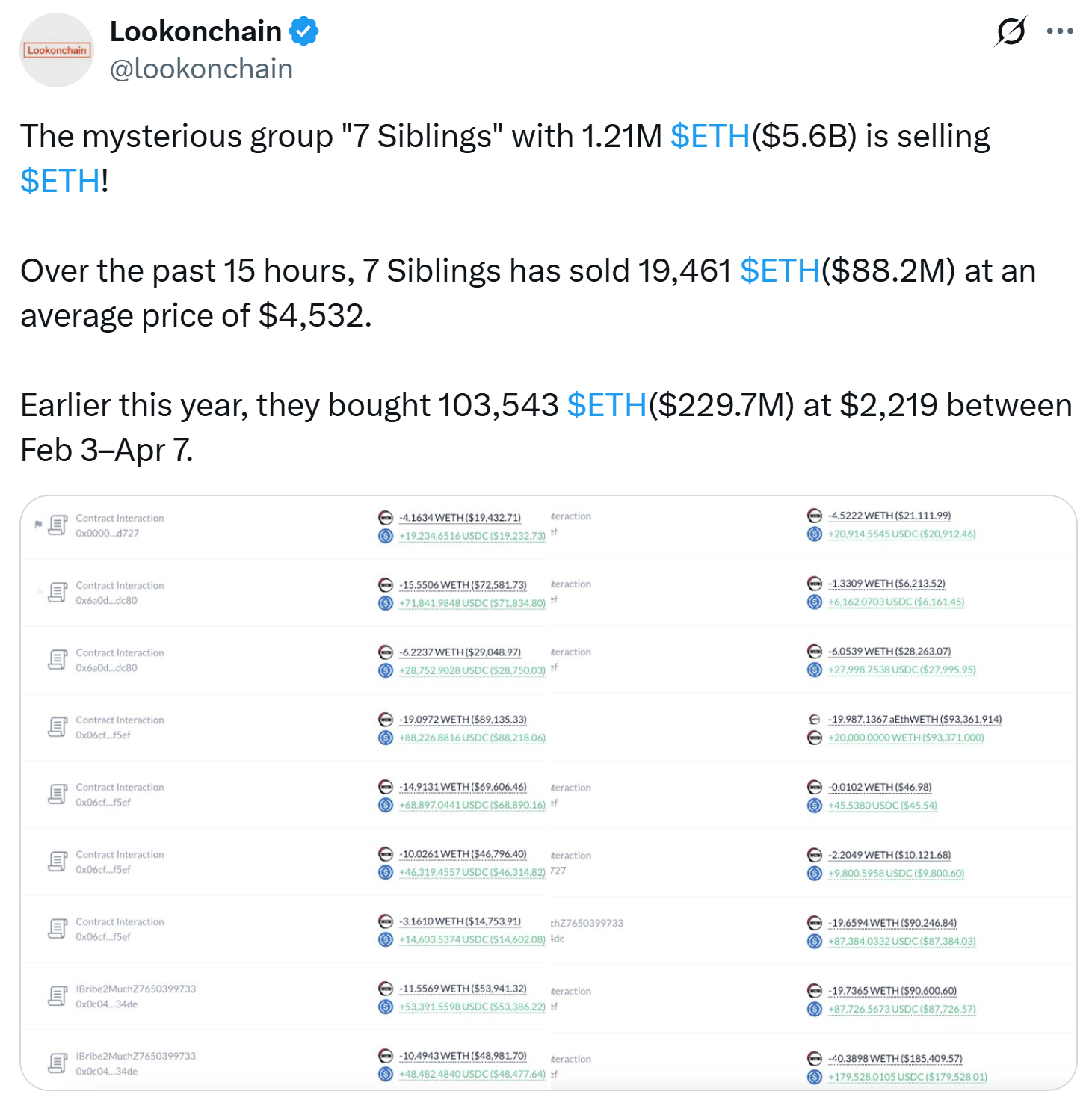

A mysterious group of Ethereum whales referred to as the “Seven Brothers” have offloaded $88.2 million value of ether over the previous 15 hours.

The group, which holds an estimated 1.21 million ethers (ETH), valued at round $5.6 billion, offered 19,461 ETH at a mean worth of LookonChain, a blockchain analytics platform, for $4,532, as revealed in X’s Wednesday put up.

Between February 3 and April 7, seven siblings acquired 103,543 ETH for a mean of $229.7 million, with a mean of $2,219. Information amassed by LookonChain reveals that early April included $42.2 million purchases of $24,817 ETH in early April for $1,700.

Transactional data present that whales’ exercise span a number of wallets, suggesting a deliberate technique to handle and obscure massive holdings. The largest motion signifies that ETH is deposited on the Aave V3. This can be a mortgage and borrowing platform.

The seven brothers dump ETH. sauce: Lookonchain

Associated: Ether Futures Open Open Curiosity hits excessive as far as Eth Worth goes over $4.5k – will it final?

Quick-term ETH holders will generate earnings

Ethereum is going through new profit-raising stress, with short-term holders main the charges as ETH is buying and selling round $4,600. GlassNode reported Monday that these buyers have achieved round $553 million in every day earnings, remaining comparatively inactive, far surpassing long-term holders cashing out on the stage they final noticed in December 2024.

GlassNode stated that regardless of a rise of 43% over the previous month, ETH’s present revenue ranges are 39% beneath its peak final month.

The Ethereum Basis offered 2,795 ETH, value round $12.7 million, as costs hit an annual excessive. The sale occurred in two transactions through foundation-linked wallets late Tuesday, decreasing its holdings to only 99.9 ETH and 11.6 million DAIs.

However regardless of earnings, some stay bullish. Over the weekend, BitMex co-founder and Bitcoin billionaire Arthur Hayes stated he purchased it again to Ethereum only a week after promoting $10.5 million whereas buying and selling for $3,507.

Associated: Michael Saylor just isn’t sweating the rise of the Ethereum finance firm

If Bitcoin reaches $150,000, ETH might attain $8,600

As reported, Crypto Dealer Yashasedu believes that if Bitcoin reaches $150,000, Ether might exceed $8,500, citing previous bull market tendencies, the place ETH’s market capitalization reached 30-35% of Bitcoin.

If ETH matches 35% of Bitcoin’s worth with $150,000, the value might attain $8,656. Even within the low vary of 21.7-30%, ETH can commerce between $5,376 and $7,420. The forecast predicts that Ethereum’s complete worth locked (TVL) will exceed $90 billion, with institutional earnings rising.

Particularly, the Spot Ether ETF recorded a $10.1 billion web influx on Monday. An inflow occurred as Bitmine Immersion Applied sciences introduced plans to lift $20 billion for ETH purchases.

journal: How Ethereum Finance Firms Can Trigger “Defi Summer time 2.0”