The corporate has disclosed by this main growth press launchit confirmed it has secured greater than $500 million in personal placement choices to help a brand new Bitcoin-centric monetary strategy.

Volcon adopts Bitcoin Treasury for $500 million

In keeping with the discharge, Volcon has reached buy agreements with a number of establishments and accredited buyers, promoting over 50 million shares On the worth of $10 every.

In the meantime, to drive the transfer, Volcon has partnered with Gemini Nustar, an affiliate of Gemini Belief Firm, for digital asset companies.

Along with this modification, Volcon has modified a number of management. Ryan Lane, co-founder of Emperry, has been appointed co-CEO and chairman of the board. Particularly, three different executives of the emperor joined the board and oversee the implementation of the brand new technique.

VLCN Inventory Spikes

Volcon additionally identified that it’ll give attention to a capital-efficient Bitcoin technique whereas sustaining its electrical automobile enterprise by its asset present mannequin. CO-CEO John Kim highlighted the transfer as a future-looking determination to guard shareholder worth Within the period of Rising issues concerning the collapse of the Fiat foreign money.

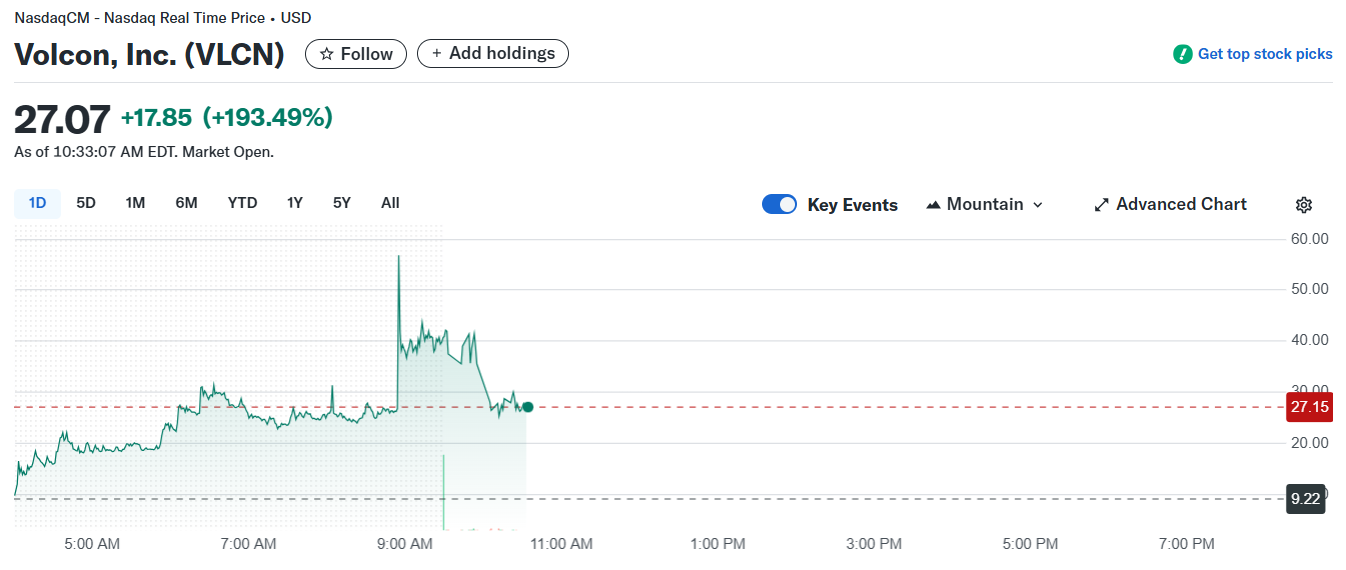

Volcon’s announcement had a direct affect on stock. The corporate’s inventory (VLTN) surged 366%, rising from $9.22 to a excessive of $43.38. This sample has I performed alongside different Bitcoin Treasury Corporations Previously. VLTN later pulled again to round $27.07, however the inventory worth is up 193%.

Volcon Inventory Spike in Bitcoin Monetary Planning

Volcon Inventory Spike in Bitcoin Monetary PlanningProgress tendencies in Bitcoin finance corporations

Surprisingly, current strikes have positioned Volcon inside a development group of corporations which have built-in Bitcoin into their monetary technique. This 12 months alone, a number of well-known corporations have joined the development. That is the transfer that attracted consideration on MicroStrategy’s now-famous Bitcoin Playbook.

2025, Enterprise Like Trump Media & Know-how Group, GameStopand twenty one capital They’ve each It was revealed Bitcoin monetary plan. As well as, different Much less recognized names similar to inexperienced minerals additionally participated within the dialog.

In keeping with information from Bitcoin Treasuries, 272 massive entities maintain Bitcoin, with public corporations main the pack. At present, 154 public corporations collectively personal greater than 860,000 BTC, price greater than $101 billion.

MicroStrategy is now rebranded technique601,550 BTC continues to manage the listing at practically $71 billion. Marathon Digital continues at 50,000 BTC, whereas Twenty One Capital and Riot Platform maintain 19,225 BTC and 16,352 BTC every.