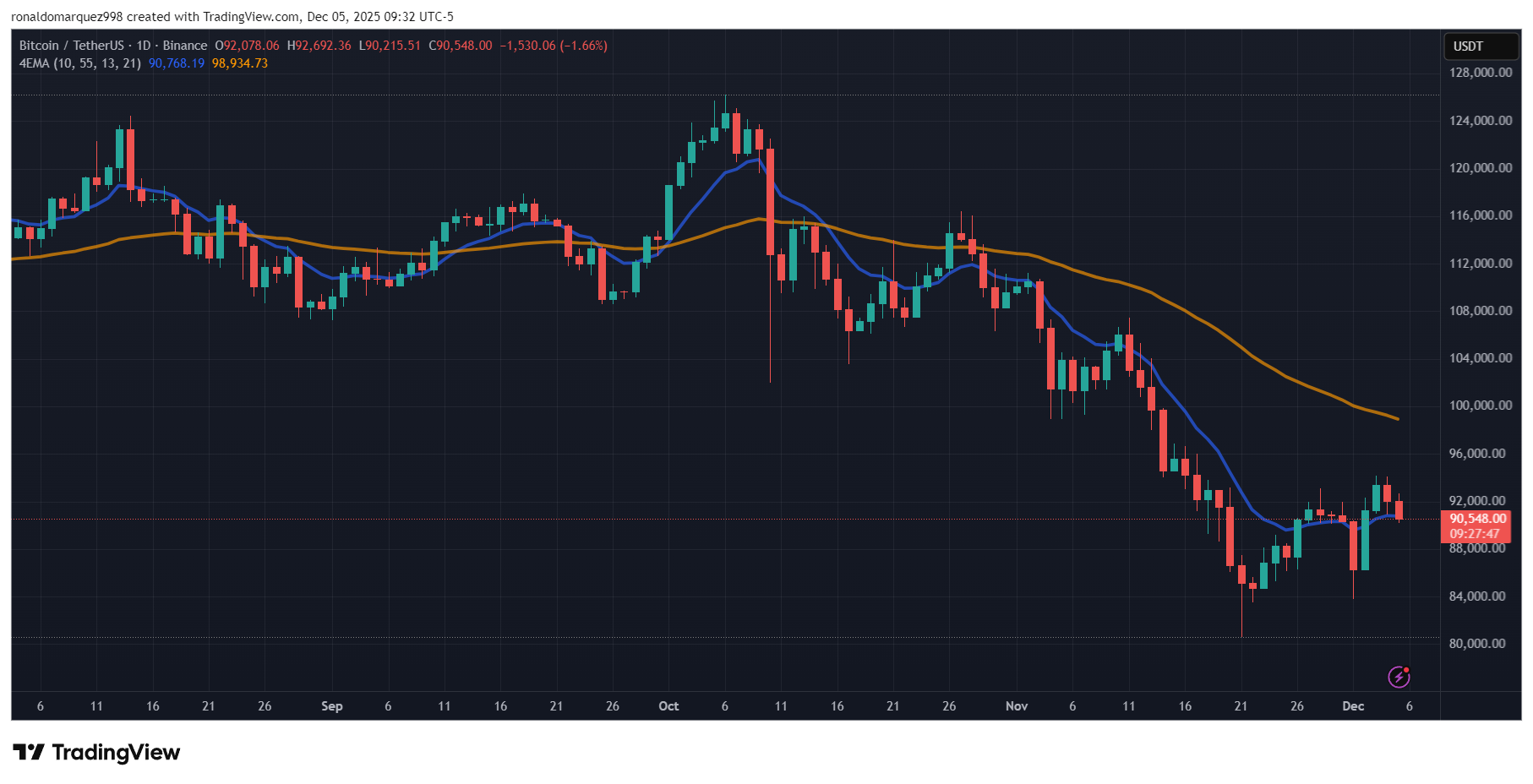

Despite the fact that Bitcoin value has recovered above $90,000, a key benchmark that has traditionally served as a help for the cryptocurrency, the market is displaying indicators {that a} additional correction could also be imminent.

Is Bitcoin value restoration in disaster?

Market skilled Recht Fenser not too long ago shared his insights on social media platform X (previously referred to as Twitter). counsel Bitcoin’s value could also be forming what he calls a “huge bull entice.”

This time period refers to a misleading bullish sign wherein the worth briefly exceeds a resistance degree (on this case, the $90,000 mark) earlier than reversing and turning decrease. Such a transfer may entice buyers who purchased in on the peak, leading to giant losses.

Fencer pointed to a troubling sample harking back to early 2022, when Bitcoin regained its place. 50 week transferring common (MA) – Presently sitting above $102,300, it has since skilled a major decline of roughly 60%, falling under $20,000 by June of that yr.

He famous that the current value restoration after a major drop to $84,000 shouldn’t be interpreted as a sign of short-term success, particularly since Bitcoin costs are presently buying and selling under their 50-week transferring common.

If previous traits repeat, this might imply a major drop in Bitcoin, doubtlessly reaching round $36,200, which may mark a low for Bitcoin. bearish cycle For cryptocurrencies. However, some analysts preserve a bullish outlook.

Is the underside of BTC in sight?

Market researcher and analyst Miles Deutscher expressed assured sentiments, saying: I imagine Primarily based on his evaluation of key traits, there’s a 91.5% likelihood that Bitcoin value has hit its backside.

He famous that current weeks have been dominated by detrimental information tales, together with issues over Tether (USDT) and the affect of China’s actions on cryptocurrencies, which he argues usually sign a all-time low for native costs.

Moreover, Deutscher pointed to a shift in market traits from primarily bearish to bullish. He defined that the buying and selling surroundings has been on an upward pattern once more not too long ago. Shopping for pressuregiant buyers, or “OG whales”, stopped promoting. This alteration is mirrored within the order e-book, indicating that market sentiment could stabilize.

Moreover, market situations have tightened in current months, and the liquidity state of affairs seems to be altering. The potential appointment of a brand new Fed chair recognized for dovish insurance policies, coupled with the formal finish of quantitative tightening (QT), may additional affect market dynamics in favor of consumers.

Mr. Deutscher concluded by emphasizing that given the intense degree of catastrophe: worry, anxiousness, doubt He believes that the (FUD) market, coupled with improved commerce flows, is more likely to help the concept Bitcoin costs have certainly hit backside.

Featured picture from DALL-E, chart from TradingView.com