Trade specialists are reportedly calling on regulators in Hong Kong and mainland China to additional cooperate in growing the cryptocurrency sector throughout the two areas.

abstract

- Trade leaders attending the International Blockchain Summit in Shanghai emphasised the necessity for additional cooperation between Hong Kong and mainland China, which might considerably advance the crypto and fintech sectors in Asia.

- Regardless of China’s continued ban on crypto buying and selling, rising curiosity in renminbi-pegged stablecoins and potential joint initiatives recommend the 2 areas could also be shifting in direction of nearer cooperation in digital finance and blockchain innovation.

Based on a current report within the South China Morning Publish, a partnership between the 2 areas might increase Asia’s crypto and monetary know-how sector. Trade specialists who attended the eleventh International Blockchain Summit in Shanghai stated the 2 markets will enormously profit from joint cooperation.

Regardless of implementing a ban on cryptocurrencies on the mainland since 2021, China has allowed the Hong Kong Particular Administrative Area to develop as a crypto hub. Investor curiosity in stablecoins has elevated on this area, particularly because the stablecoin ordinance was handed on August 1st.

Based on the report, Hong Kong is establishing itself as a digital asset hub, whereas China is shifting into the digital finance sector by growing digital funds and leveraging synthetic intelligence know-how.

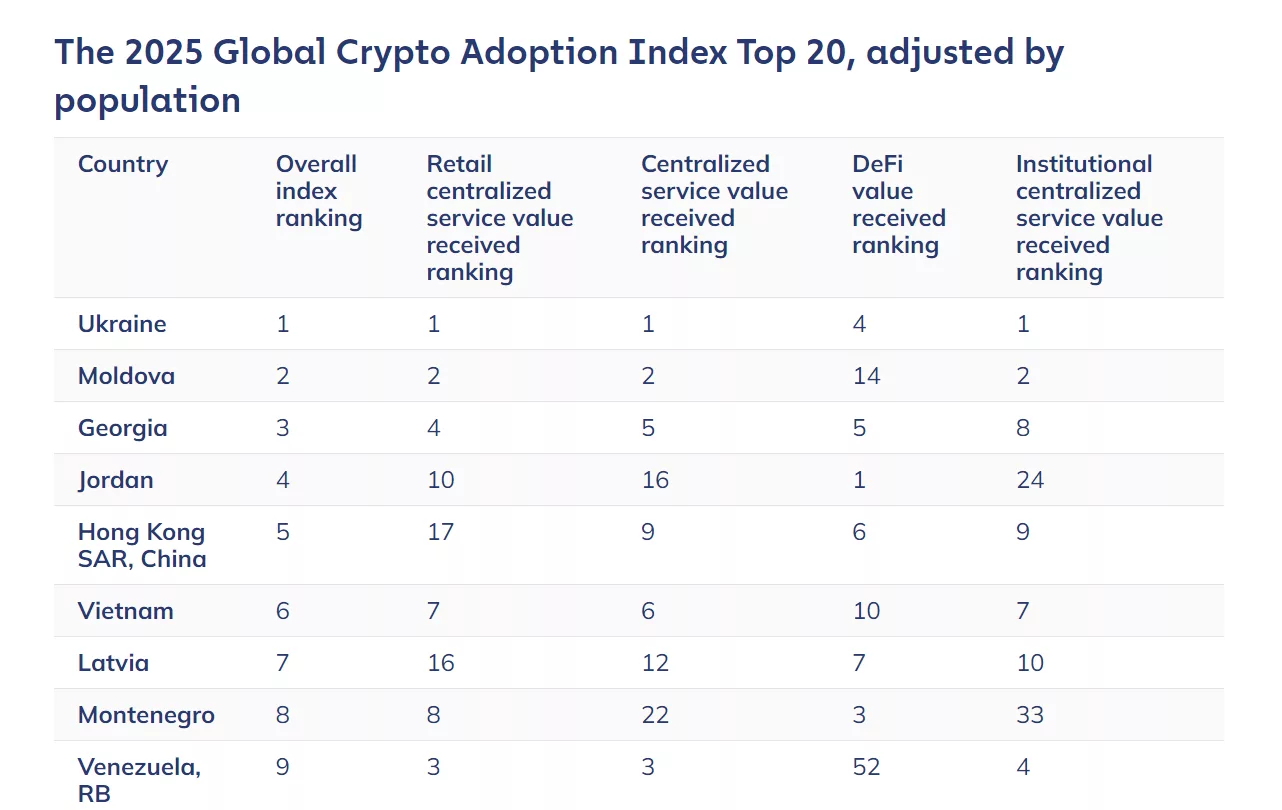

Nevertheless, in accordance with Chainalysis information, these two areas nonetheless have low cryptocurrency adoption charges in comparison with different Asian nations corresponding to India, Japan, Vietnam, and Indonesia. Presently, India ranks first when it comes to retail and institutional providers worth in cryptocurrencies, whereas Vietnam ranks third. In the meantime, Hong Kong and China rank seventeenth when it comes to receipts for retail centralized providers.

Hong Kong and China rank low in comparison with different Asian areas when it comes to international cryptocurrency adoption | Supply: Chainalysis

You may additionally like: China Retailers Financial institution unit ventures into cryptocurrencies by means of Hong Kong gateway

In his keynote speech, Xiao Feng, chairman of Shanghai-based Wanshan Blockchain and Hong Kong cryptocurrency trade Hashkey Group, declared that he appears to be like ahead to additional cooperation to create “extra requirements and guidelines” within the quickly rising crypto business.

“Blockchain know-how has moved from the early stage of know-how improvement to the stage of large-scale software,” Xiao stated.

He additionally highlighted the rising pleasure surrounding the convention, which displays the hype surrounding crypto property. He stated tickets for the occasion bought out inside days earlier than the occasion began, which “hasn’t occurred in years.”

Curiosity in digital currencies grows in Hong Kong and China

Rachel Li, director of blockchain and digital property at Hong Kong-based Cyberport, stated on the summit that her firm needs to work extra intently with mainland Chinese language stakeholders to foster the event of the cryptocurrency business.

In 2023, the corporate acquired a $50 million funding from the Hong Kong authorities to assist progress on this sector.

In the meantime, Solana Basis Chairman Lily Liu stated the inspiration is making vital investments in China’s developer ecosystem. Liu stated the inspiration want to discover cooperation in areas corresponding to decentralized funds and synthetic intelligence.

With a inhabitants of greater than 1 billion individuals within the area, she deemed China the “chief” when it comes to the dimensions of the nation’s funds business.

China continues to harden its stance on crypto buying and selling on the mainland, however a number of regulators are calling for the ban to be eased in mild of current developments in selling stablecoins pegged to the renminbi. Some Chinese language firms have additionally expressed curiosity in making use of for licenses for Hong Kong-issued stablecoins, earlier than pausing within the wake of presidency warnings.

Furthermore, current paperwork from the Hong Kong Legislative Council appear to trace at future cooperation with the mainland authorities. The particular report stated that Hong Kong is at the moment looking for assist from the Chinese language central authorities because it considers issuing an offshore renminbi-denominated stablecoin.

Issuing a renminbi-backed stablecoin might strengthen Hong Kong’s place as a world hub for digital property and Web3 innovation. In the meantime, the Chinese language authorities may gain advantage from growing its personal stablecoin to facilitate cross-border commerce funds and counter the dominance of the US greenback within the stablecoin market.

You may additionally like: Hong Kong parliament hints at improvement of RMB stablecoin