Brief vendor James Chanos vindicated his bearish argument by closing out his brief place in Technique Inc. after the corporate’s premium for Bitcoin holdings narrowed.

James Chanos takes income with brief technique after value compression

James Chanos, founding father of Kynikos Associates and one among Wall Avenue’s most distinguished skeptics, has lengthy criticized Technique for what he calls an overreliance on Bitcoin as its core enterprise mannequin.

Underneath CEO Michael Saylor, the corporate has amassed over 641,000 BTC by way of debt purchases and fairness points, turning its inventory right into a leveraged agent for Bitcoin.

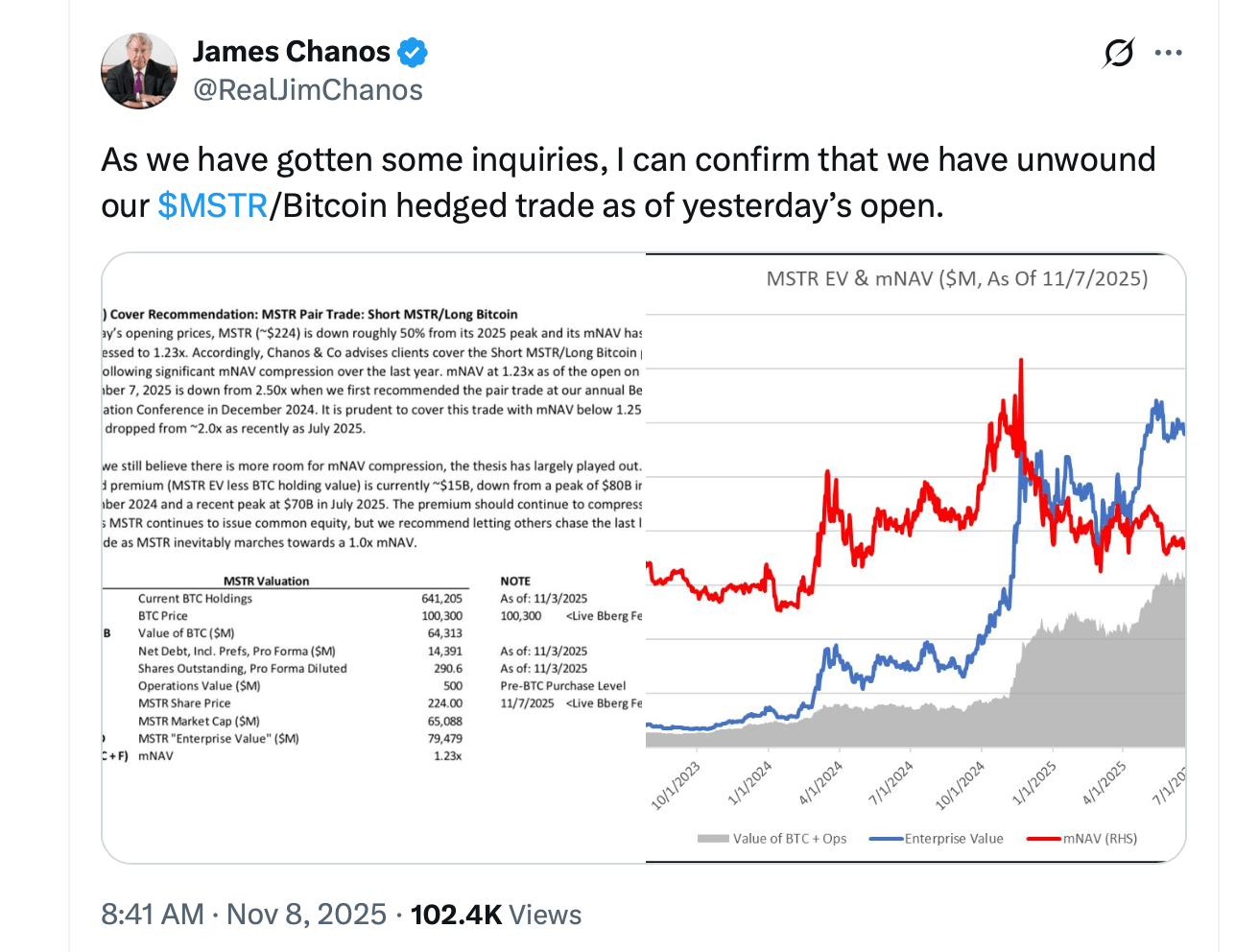

In Might 2025, Chanos took the motion of going lengthy Bitcoin whereas shorting the technique. The method was a traditional arbitrage wager that Technique’s inventory value, which was buying and selling at about 2.5 occasions its adjusted web asset worth (mNAV) on the time, would ultimately method parity with Bitcoin reserves.

By November 7, 2025, Chanos had ceased buying and selling. The technique’s mNAV a number of has compressed by roughly 1.23x, down from its lofty highs at first of the 12 months. Bitcoin’s spot value has hovered round $63,405, whereas Technique inventory has fallen about 50% from its 2025 peak. The premium on the corporate’s Bitcoin holdings, which as soon as hovered round $80 billion, has shrunk to only $15 billion, successfully confirming Chenos’ declare.

The deal basically achieved its unique purpose as Technique’s premium trended towards parity. His exit probably locked within the beneficial properties from unfold compression and averted rebound danger if Bitcoin costs recovered or investor enthusiasm for the technique rekindled.

Chanos’ current wins mirror his longstanding fame for recognizing bubbles earlier than they burst. From Enron to Technique, his technique has been constant: establish overvaluation, wager on gravity, and step down earlier than the group catches up.

Whether or not Technique’s mannequin represents a forward-looking type of Bitcoin leverage or an over-the-top debt play remains to be up for debate, however for Chanos, the mathematics already speaks for itself, no less than within the brief time period. On the identical day, Mr. Saylor mentioned to Mr.

“₿Come on.”

Steadily requested questions ❓

- What did James Kanos shorten?He took an extended place in Bitcoin whereas shorting Technique shares.

- Why did Chanos goal Technique?He thought-about Methods inventory to be overvalued attributable to its premium over Bitcoin’s market worth.

- When did Chenos finish his technique prematurely?He exited his place on November 7, 2025 after the premium had compressed to close parity.

- What’s Technique’s Bitcoin publicity?The corporate holds over 641,000 BTC acquired by way of bond and inventory issuance.