In response to one crypto analyst, the Federal Reserve’s aggressive rate of interest cuts in 2026 will decide whether or not retail buyers return to the crypto market subsequent yr.

However there are questions on how doubtless the Fed is to proceed reducing charges after already chopping charges 3 times in 2025.

Clear Road managing director Owen Lau advised CNBC on Tuesday that the Fed’s rate of interest resolution is “one of many key catalysts for the crypto business in 2026.”

“Retailers are going to be extra enthusiastic about stepping into cryptocurrencies, and monetary establishments are going to be much more enthusiastic about stepping into cryptocurrencies,” Lau mentioned.

Decrease rates of interest are sometimes bullish for crypto property, as conventional investments resembling bonds and stuck deposits develop into much less engaging and buyers flip to riskier property resembling Bitcoin (BTC) and different cryptocurrencies searching for greater returns.

Fed ‘prepared to regulate financial coverage stance’

The Fed’s December minutes launched Tuesday point out the central financial institution is open to adjusting rates of interest subsequent yr in keeping with broader financial objectives.

“The Committee stands able to make acceptable changes to its financial coverage stance ought to any dangers come up that impede the Committee’s achievement of its aims,” the minutes learn.

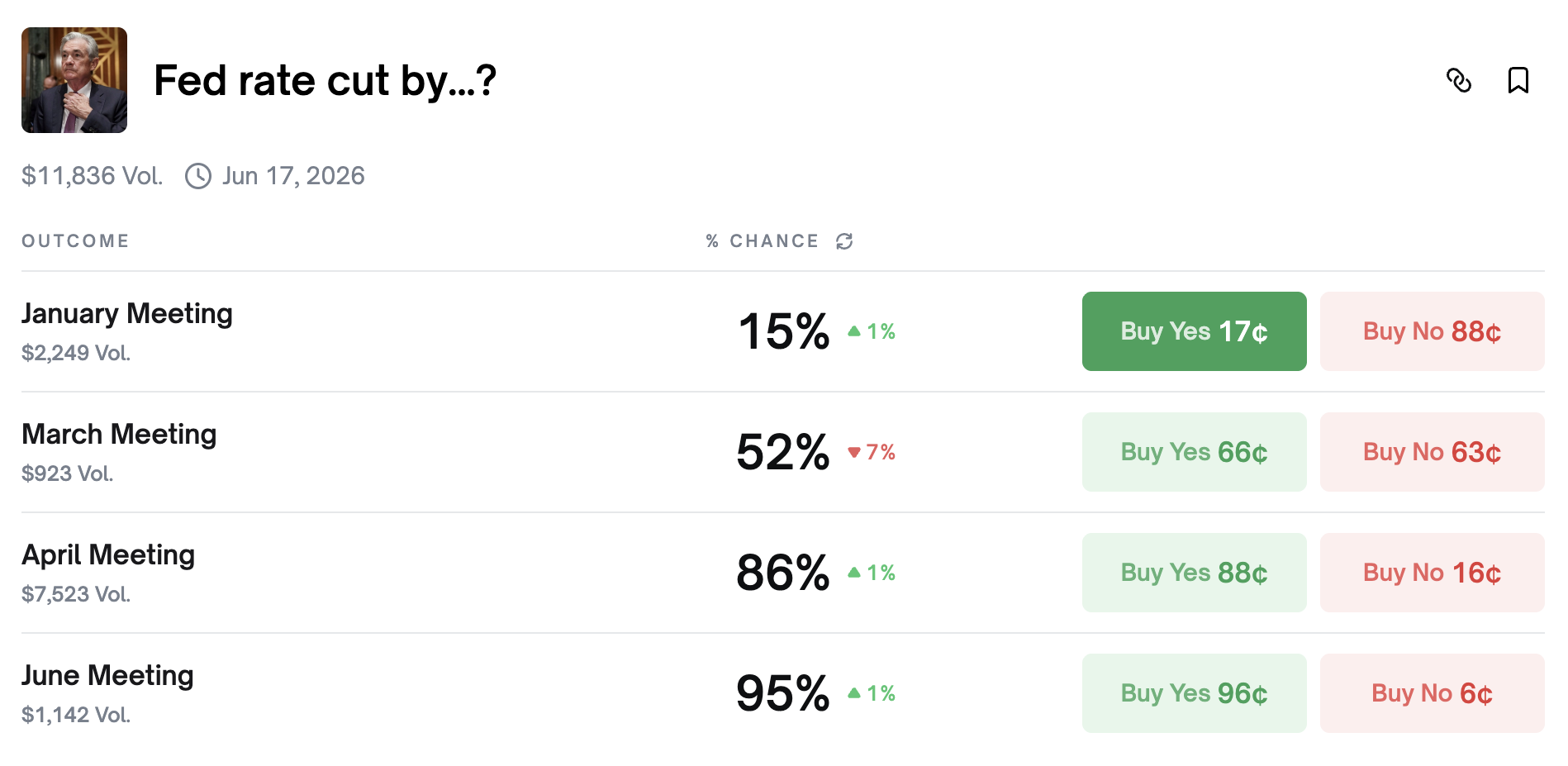

Nevertheless, some information suggests the market is skeptical whether or not the Fed will proceed to chop rates of interest within the first few months of the yr, in keeping with crypto prediction platform Polymarket.

If the Fed cuts rates of interest in April, the likelihood of a polymarket will increase considerably. sauce: Polymarket

In response to Polymarket information, the likelihood of a charge reduce in January is simply 15%, however confidence in a charge reduce in March is excessive at 52%.

The Fed has reduce rates of interest 3 times in 2025, and the market anticipated most of them. The primary charge reduce, 25 foundation factors, came about in September. A few month later, on October fifth, Bitcoin soared to a brand new excessive of $125,100.

Nevertheless, Bitcoin’s upward pattern was short-lived as an enormous liquidation occasion on October 10 worn out $19 billion in leveraged positions.

Cryptocurrency market sentiment continues to say no

That was adopted by one other 25 foundation level charge reduce in October and one other 25 foundation level reduce in December, however minutes of the assembly confirmed that Fed members have been divided on whether or not a December charge reduce was vital.

In response to CoinMarketCap, Bitcoin is down 29.3% from its all-time excessive in October, buying and selling at $88,439 on the time of publication.

Associated: Bitcoin’s $90,000 Rejection: Is BTC’s Digital Gold Story Dropping to Bonds?

Bitcoin’s decline led to a decline in sentiment in direction of the broader cryptocurrency market.

The Crypto Concern & Greed Index, which measures general crypto market sentiment, has been in “excessive worry” territory since December thirteenth.

On Wednesday, the index recorded an “excessive worry” rating of 23.

journal: Bitcoin “by no means” actually reached $100,000, SEC’s crypto “dream crew”: Hodler’s Digest, December 21-27