The “third mission” from the US Federal Reserve may change long-term financial coverage if motion happens.

The Fed has lengthy been thought to have a double order of value stability and most employment, however President Donald Trump’s election for federal governor Stephen Milan cited “third mission” earlier this month, sparking hypothesis about the way forward for central financial institution financial coverage.

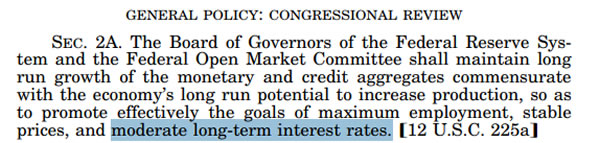

The third mission is a statutory requirement buried within the Fed institution doc, with central banks saying that in apply they want three aims: most employment, value stability and reasonable long-term rates of interest.

The Trump administration seems to be prepared to make use of this forgotten statutory requirement by way of doubtlessly yield curve management or expanded quantitative easing and cash printing as justification for extra aggressive intervention within the bond market, Bloomberg reported Tuesday.

Federal Reserve Act 1913 Word a Third mission (spotlight) for medium long-term rates of interest. sauce: US Authorities Publishing Bureau

Lengthy-term rate of interest discount

This third objective has been largely ignored for many years as he considers this pure by-product of reaching the primary two, however Trump officers at the moment are citing it as authorized compensation for potential yield curve management insurance policies.

Trump has lengthy advocated decrease charges, calling federal authorities governor Jerome Powell “too late” or “too late.”

Associated: Crypto market prepares for Fed charge discount amid the shaking of governors

The administration desires to actively curb long-term rates of interest, and potential instruments embrace elevated Treasury invoices, bond repurchase, quantitative easing, or direct yield curve management.

A decline within the long-term charge will scale back authorities borrowing prices when nationwide debt reaches a document $37.5 trillion. The administration additionally desires to stimulate the housing market by decreasing mortgage charges.

Constructive affect on cryptography

Christian Psateli, founding father of the Cryptographic Protocol Thoughts Community, mentioned on Wednesday that the third mission was “aka monetary suppression,” including “very related” yield curve management.

“The value of cash is underneath tighter management because the aged steadiness between debt and GDP is turning into extra unstable,” he mentioned.

“Bitcoin is able to take up large capital as a beneficial hedge in opposition to the worldwide monetary system.”

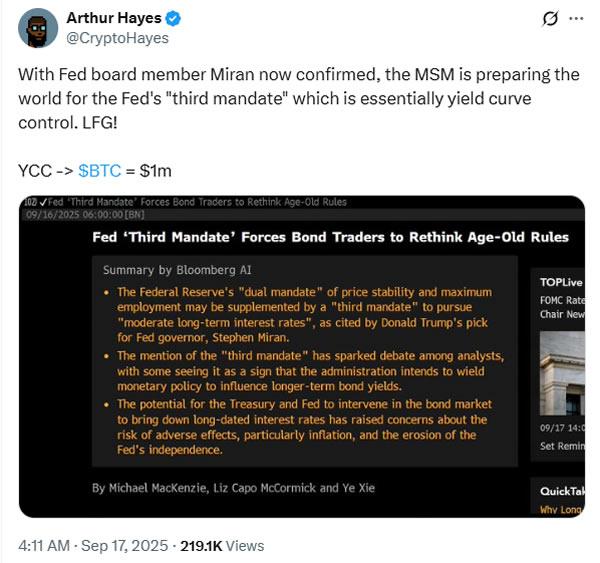

Outspoken Bitmex founder Arthur Hayes additionally mentioned he was bullish for Crypto, suggesting that yield curve management may ship Bitcoin to $1 million.

sauce: Arthur Hayes

journal: Will XRP retest the highs? Bitcoin would not lie down for lengthy: Hodler’s Digest