Regardless of billions of {dollars} being invested in blockchain scaling software program, validators nonetheless depend on the identical public web infrastructure that slows down streaming video and on-line gaming. Double Zero goals to resolve that bottleneck with a devoted fiber optic community. In late September 2025, the mission obtained a no-action letter from the SEC, confirming that its 2Z token doesn’t qualify as a safety. Whereas offering regulatory readability, the mission goals to realize blockchain speeds corresponding to conventional monetary programs reminiscent of Nasdaq.

as a substitute of constructing one other Layer 1 blockchain (e.g. Ethereum) or layer 2 scaling resolution (e.g. Ethereum) or layer 2 scaling resolution (e.g. arbitrator), Double Zero calls itself the “N1” community. This time period refers back to the bodily community layer that underlies all blockchain protocols. It’s not a brand new blockchain, it’s a “new web” for the prevailing one. Consider it as a substitute for the general public web, however constructed particularly for blockchain communication. Launched in late 2024, the mission adheres to at least one core precept:Improve bandwidth and cut back latency” (IBRL). Preliminary analysis is targeted on the Solana ecosystem, the place the founders are from, however the protocol will work on any high-speed blockchain.

Background and Historical past: Who Constructed Double Zero?

A workforce with mixed experience in blockchain, high-frequency buying and selling, and telecommunications based Double Zero in 2024. The important thing co-founders deliver the next experience:

- austin federa – Former Head of Technique at Solana Labs

- andrew mcconnell – HFT Community Infrastructure Specialist

- mateo ward – Specialists in carrier-grade fiber and shortwave know-how

This concept was born whereas engaged on Solana’s Firedancer consumer. Builders have realized that public web infrastructure creates a elementary bottleneck for high-performance blockchains. No quantity of software program optimization can resolve these bodily constraints. This perception led them to think about whether or not devoted networks may resolve issues that consensus algorithms alone can’t resolve.

From announcement to funding

Double Zero Basis introduced this protocol on December 4, 2024. From the start, they positioned this as an infrastructure reasonably than a blockchain platform. Funding shortly adopted. The token spherical in March 2025 raised $28 million at a valuation of $400 million. Multicoin Capital and Dragonfly Capital led the spherical, with MH-Ventures and GSR becoming a member of as taking part traders.

Breaking via and implementing rules

A significant regulatory milestone occurred on September 29, 2025, when double zero went into impact. secure one thing by no means seen earlier than SEC no motion letter. This determination confirms that 2Z doesn’t qualify as a safety and that the programmatic distribution of tokens to contributors will not be a securities transaction. mainnet beta model launched Testnet staking went dwell in early that September, permitting customers to stake SOL for dzSOL and assist community testing previous to the mainnet beta rollout.

What issues does Double Zero tackle?

Issues come up when blockchain depends on public web infrastructure designed for common internet site visitors reasonably than high-frequency monetary transactions. Issues shortly pile up.

- site visitors jam – Blockchain site visitors competes with video streams and file downloads for bandwidth.

- Routing inefficiency – Compounding latency throughout a number of hops between validators

- packet loss – Interrupt validator communication and power retransmission

- jitter – Efficiency turns into unpredictable even when common latency seems acceptable

These limitations stop blockchain from reaching the efficiency ranges that conventional finance routinely handles. NASDAQ processes 1000’s of transactions per second with microsecond latencies. Most blockchains can’t come near it when restricted by commonplace web connectivity.

Why software program alone will not be sufficient

Software program optimizations will help, however finally attain a restrict. Validators can depend on web service suppliers and routing protocols constructed for quite a lot of functions whereas operating totally optimized code. Double Zero claims that by addressing these elementary infrastructure constraints, it could take away bottlenecks that can’t be solved with software program alone.

What’s the resolution? A devoted international fiber optic community that utterly avoids public web congestion. The community goals to leverage multicast protocols, low-latency routing, and darkish fiber infrastructure to realize speeds as much as 10 occasions sooner than commonplace connections. This mix of {hardware} and software program permits us to course of as much as 1 million transactions per second on supported chains.

How does Double Zero’s community structure work?

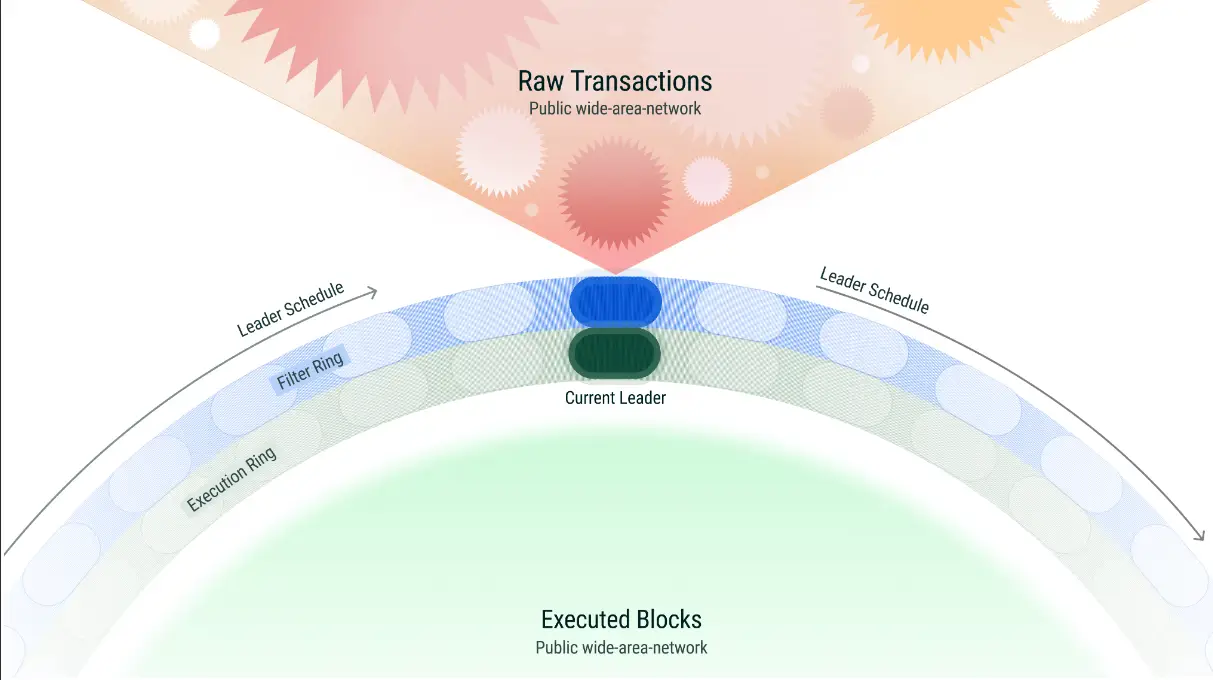

Two interconnected rings kind the core design. The outer ring interfaces with the general public Web and handles connections to customers and functions. The interior ring manages optimized personal blockchain site visitors between validators and nodes. Crucial consensus communications happen over devoted channels reasonably than competing for bandwidth on a shared infrastructure.

Double Zero Ring (Double Zero White Paper)

Contributing to distributed infrastructure

The development of the community is finished in a decentralized method. Members donate unused bandwidth, optical gear, or fiber capability in change for token rewards. As an alternative of 1 firm proudly owning every thing, possession is unfold throughout contributors. These might embrace:

- Knowledge facilities with extra fiber capability

- Telecommunications supplier with unlit darkish fiber

- Place operators geared up with optics on helpful routes

Liquid staking lowers the barrier to entry. Validators can stake SOL and obtain dzSOL, permitting them to take part within the community with out the necessity for specialised {hardware} or negotiating fiber entry agreements. In the meantime, growth stays open supply. Malbec Labs and the Double Zero Basis will contribute to the repository, which might be revealed in October 2025 to allow community-driven growth.

technical implementation

This structure makes use of a multicast protocol that effectively delivers information to a number of recipients concurrently. Routing algorithms choose the trail that minimizes delay primarily based on availability in addition to real-time community situations. Darkish fiber, cables that sit unused and are activated solely for blockchain site visitors.

The core repository was made publicly out there in October 2025. Malbec Institute and double zero basis On GitHub. This transfer to open supply helps community-driven growth by permitting exterior builders to overview the code, counsel enhancements, and construct functions on prime of our infrastructure.

This design targets blockchains that obtain 1 million transactions per second. Though preliminary work is targeted on Solana, the structure helps any distributed system that requires high-bandwidth, low-latency communications.

What’s the position of the 2Z token within the community?

native $2Z Tokens maintain the community operating via a number of key capabilities.

- Contributor compensation – Bandwidth and fiber suppliers earn programmatic rewards primarily based on precise utilization metrics

- Community entry payment – Customers pay connection charges with 2Z tokens

- community safety – Safe your infrastructure and generate rewards with staking mechanisms

The SEC’s determination removes vital regulatory uncertainty for U.S.-based companies. The ruling confirmed that 2Z acts as an infrastructure utility, not a safety one, to create a compliance framework for programmatic supply.

Dialogue on token distribution

The allocation construction, which favors groups and traders over the neighborhood, has drawn some criticism. Critics spotlight market makers’ allocations, reminiscent of 28% to Leap Buying and selling, that they see as favoring insiders. Nevertheless, the founders emphasize long-term locks and programmatic rewards to match community utility. Compliance with the SEC supplies extra regulatory oversight to discourage fraud. Nonetheless, skepticism persists in some elements of the neighborhood.

financial mannequin

Programmatic emissions reward continued contributions to community capability. Distribution is tied to measurable infrastructure additions. Contributors who add fiber capability to new areas earn rewards so long as their infrastructure stays up and in use. Contributors can earn revenue primarily based on the bandwidth supplied. Customers pay primarily based on utilization. Stakeholders safe infrastructure via financial bonds.

Improvement progress: from announcement to mainnet

After a number of growth phases, this announcement led to the launch of the mainnet (beta model). The December 4, 2024 announcement launched the idea of the protocol and defined why devoted infrastructure can resolve blockchain efficiency limitations that can’t be totally addressed by software program approaches.

Main growth milestones

A funding spherical in March 2025 accelerated growth and enabled the primary fiber contract. Throughout the testnet part, technical points, optimized routing algorithms, and refined contributor rewards had been recognized, all of which had been resolved earlier than the mainnet beta launch. Taking part neighborhood members supplied suggestions that formed the ultimate design choices.

Regulatory approval and mainnet launch occurred inside days of October 2025, suggesting cautious coordination is required to make sure authorized compliance earlier than token distribution begins. Open supply code releases permit exterior builders to discover the codebase and contribute enhancements.

Put up-launch priorities

Put up-launch priorities will deal with a couple of key areas.

- Increasing the scope of fiber software – Visualized via a map displaying areas that flip blue as capability is added

- Validator integration – Simplify connection setup and cut back technical limitations.

- Multi-chain assist – Adaptation to totally different consensus mechanisms and information buildings past Solana

- Mainnet stability – Transition from beta to full mainnet primarily based on metrics and neighborhood suggestions

Ecosystem, partnership and neighborhood constructing

A number of tasks have built-in Double Zero’s infrastructure.

- pais community – Ship oracle value feeds sooner

- Crypto.com – Added 2Z token buying and selling for liquidity

- flash commerce – Improved connectivity permits leveraged buying and selling

- deflo – Incorporate networks into DEX aggregation companies

Validators together with Unruggable and Figment have joined the community. These established operators enhance their credibility via participation. That is important as a result of your complete worth proposition depends on rising validator communication pace.

As of early October 2025, the community has achieved fast adoption and is approaching a 25 p.c stake in Solana with over 40 areas and a 10x capability improve from the testnet. This early traction demonstrates validator curiosity in devoted infrastructure for high-performance blockchain communications.

Neighborhood participation

Neighborhood constructing is primarily carried out within the following methods: discordwith almost 73,000 members, customers earn roles via verification and content material creation. Verification programs exclude bots from real individuals. Contributors who create instructional content material, establish bugs, or assist others get acknowledged may additionally obtain extra token allocations.

The X account has grown to over 60,000 followers. The audio area permits real-time discussions the place neighborhood members ask questions and founders clarify technical choices. Social media focuses on technical updates reasonably than value hypothesis.

Does double zero characterize a brand new scaling method?

Most blockchain tasks deal with software program reminiscent of consensus mechanisms, information buildings, sharding schemes, and computational effectivity. Ethereum Implement sharding. Solana optimizes parallelism. Layer 2 options transfer computations off-chain. All of those approaches assume that the underlying Web infrastructure stays fixed.

Bodily layer and software program optimization

Double Zero takes a unique view. Software program approaches finally run into constraints imposed by the bodily layer. By addressing this basis, the mission goals to eradicate bottlenecks that stay regardless of software program enhancements.

Excessive-frequency buying and selling corporations have carried out one thing comparable, investing in devoted fiber connections to shave milliseconds off. As a result of these milliseconds generated hundreds of thousands of {dollars} value of buying and selling benefit.

Financial feasibility questions

This financial mannequin differs from high-frequency buying and selling firms, which justify infrastructure prices via direct buying and selling income. Blockchain validators depend on block rewards, transaction charges, and token incentives to cowl infrastructure prices.

The testnet part of the mission supplied preliminary efficiency information. Full validation comes from widespread adoption throughout a number of chains and real-world utilization situations.

Regulatory precedent

The SEC’s determination creates a framework for the way infrastructure tokens can obtain compliance, probably offering a template for different tasks searching for regulatory certainty.

conclusion

Double Zero launched its mainnet beta with $28 million in backing, SEC regulatory clearance, and fiber optic infrastructure, with the aim of accelerating blockchain pace by 10x. With early integration with Pyth Community, Crypto.com, and varied different programs, this mission will tackle infrastructure bottlenecks that can’t be resolved via software program optimization alone. Solana Ecosystem tasks to show early adoption.

The token allocation construction and {hardware} necessities create totally different decentralization trade-offs than software-only protocols. Nevertheless, long-term token locks and regulatory compliance present some assurance.

Actual-world efficiency will decide whether or not devoted blockchain infrastructure turns into the subsequent frontier of scaling or stays a specialised resolution for high-performance functions. This method requires coordination throughout technical, financial, and regulatory dimensions whereas overcoming the sensible challenges of constructing a worldwide bodily infrastructure.

For extra data, please go to the official web sitedouble zero Web site and please comply with@doublezero X for updates.

supply of data

- double zero of x:Discover (December 2024 to October 2025)

- double zero web site: Normal data

- Alea Analysis: “DoubleZero: Rewiring Blockchain Networks – What You Must Know” (2025)

- Double Zero/Malbec Institute: Technical paperwork

- Github.com: Malbec Labs and Double Zero Basis repositories

- Cryptorank.io: Funding spherical data