Constancy Digital Belongings’ newest report on Ethereum outlines three totally different improvement trajectories for the most important good contract platform available in the market.

It additionally locations Ethereum’s decentralization method as a halfway between Bitcoin’s excessive safety and Solana’s speed-centric mannequin.

Three situations for Ethereum from Constancy

In Bull’s situation, good contract platforms can reshape the best way individuals work collectively to construct belief, positioning Ethereum as a worldwide coordination infrastructure for its transparency, censorship resistance and safety. Person prices stay low because of dense transaction exercise in Layer 2.

Within the primary situation, good contracts strengthen particular monetary and non-financial sectors and act as “examine and steadiness protocols” inside conventional methods managed by governments and huge firms.

Ethereum continues to develop amidst rising monetary constraints and competitors, however stays the lead because the dominant platform. Its market share is built-in in sectors that require excessive safety and belief.

Within the bear situation, good contract platforms are categorized into speculative cycles and battle to create merchandise that meet mainstream wants. Slowing consumer progress can weaken the money stream accumulation of ETH homeowners and erode market share by opponents who present cheaper and sooner experiences.

Modular scaling and its affect on worth: Ethereum vs. Solana

Constancy highlights that demand for ETH (gasoline charges, safety, staking) is more likely to improve as software demand will increase. Nevertheless, Ethereum’s modular scaling technique (offloading processing to Layer-2 and utilizing “blobs” for information) sacrifices some worth seize at Layer-1.

“The ether necessities for utilizing networks are on the coronary heart of its funding paper. In concept, if the demand for utilizing purposes on Ethereum networks will increase over time, there’s a want for tokens, ether,” the report states.

Latest post-upgrade information reveals that Layer 2 charges account for under about 1% of the entire price, reflecting the more and more “staying” of its financial worth within the roll-up. On the identical time, Ethereum maintains its position as an deliberately open, safe, distributed information layer. This advantages customers at a decrease charge, however raises considerations for buyers about whether or not layer-2 progress can compensate for the decline in layer-1 worth seize.

This worth trade-off results in a big comparability with Solana, taking a essentially totally different method. Ethereum prioritizes decentralization and safety, whereas Solana optimizes uncooked efficiency (TPS/price) at Layer-1.

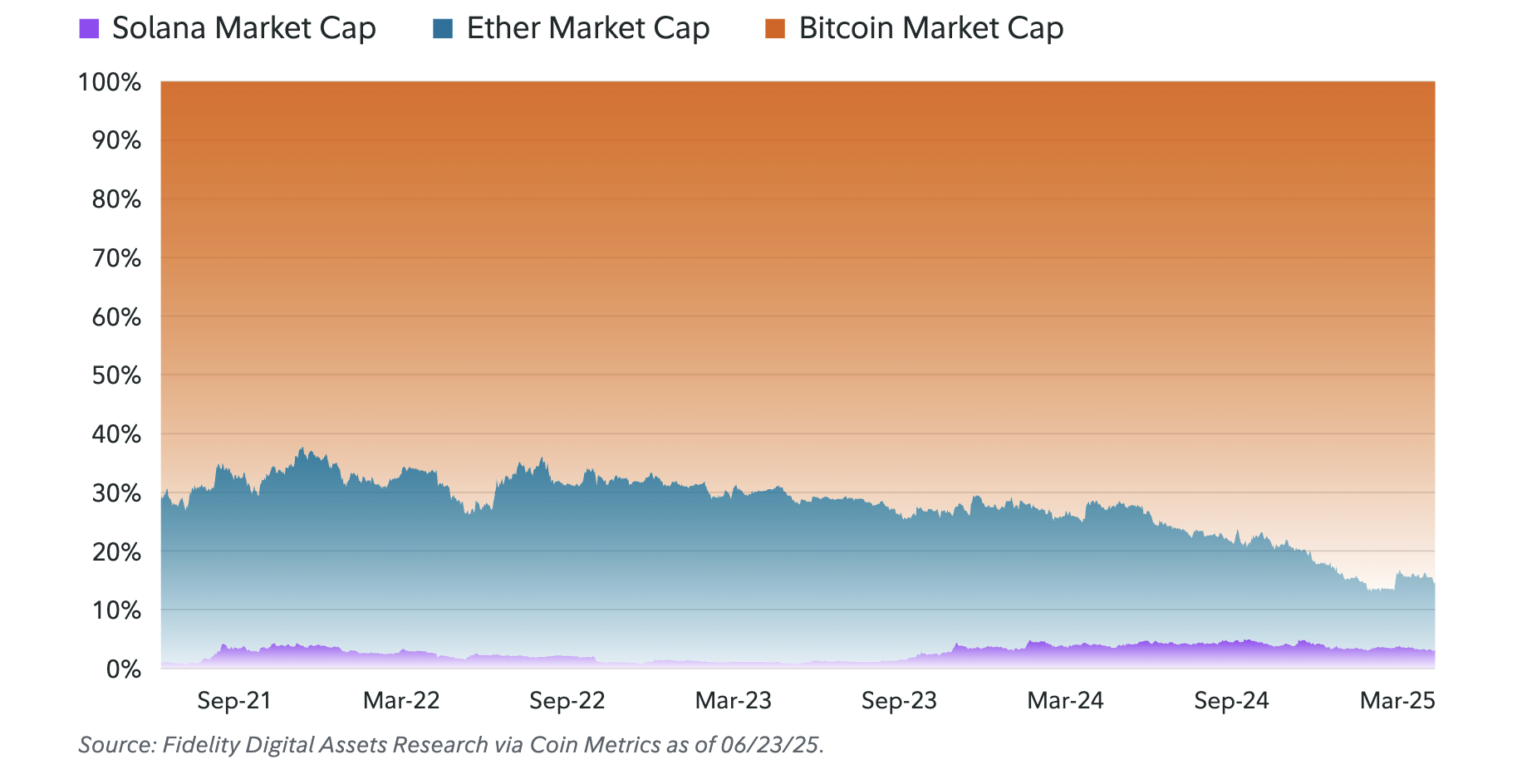

Market capitalizations of Bitcoin, Ethereum and Solana. Supply: Constancy

The price of this method is that Ethereum “zeds” the worth era (web charge) that’s current within the roll-up layer. In the meantime, Solana’s uncooked efficiency might be translated immediately into the worth of Sol Holders. This poses an actual aggressive danger within the quick time period, because it captures market share with cheaper and sooner experiences, on the expense of decentralization.

In the long term, the important thing challenge is what features of the “blockchain tri-rema” the market values most: decentralization, safety, or scalability.

Put up-Constancy highlights Ethereum’s distinctive place between Bitcoin and Solana.