Main Bitcoin holding establishments might ultimately lose endurance with Bitcoin builders who do not shortly deal with quantum computing issues, in accordance with enterprise capitalist Nick Carter.

“The massive establishments that at present exist in Bitcoin are going to get fed up and hearth builders and herald new ones,” Carter stated throughout his speech. bits and bips Podcast episode revealed Thursday.

“I do not suppose the builders will proceed to do something,” Carter stated.

sauce: cointelegraph

“Should you’re BlackRock and you’ve got billions of {dollars} of shopper belongings on this downside and it is not being resolved, what alternative do you have got?” he stated.

Carter additionally talks about the potential of a “company takeover”

BlackRock, the world’s largest asset administration firm, holds roughly 761,801 Bitcoins (BTC), value roughly $50.15 billion on the time of publication. This corresponds to roughly 3.62% of Bitcoin’s whole provide.

Carter warned of a “company takeover” if Bitcoin builders don’t transfer shortly to implement quantum-proof cryptography, which he claimed will “succeed.”

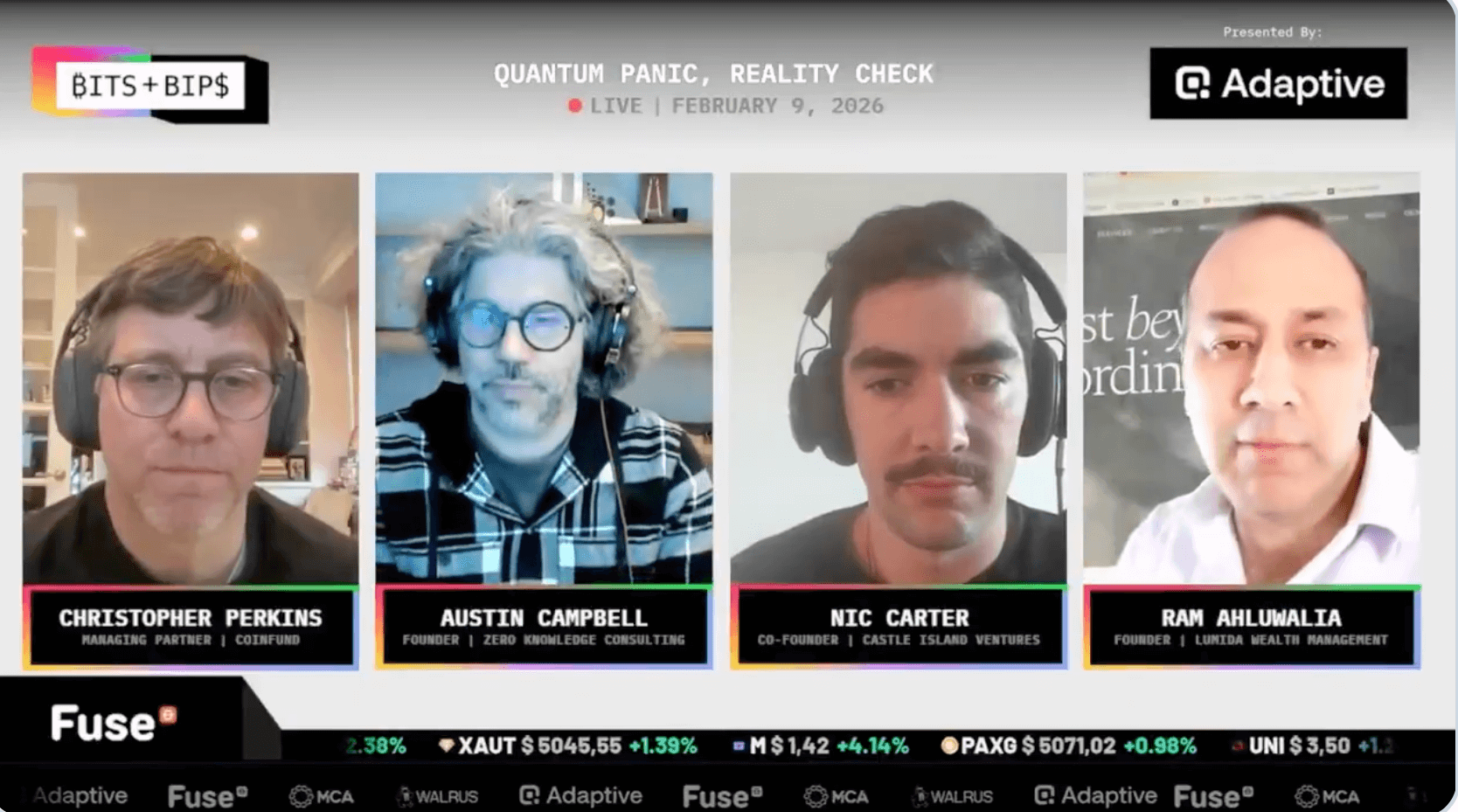

Nick Carter appeared on the Bits and Bops podcast on Thursday with three different crypto executives. sauce: Laura Shin

Austin Campbell, founding father of Zero Information Consulting, echoed comparable sentiments. “If there is a structural downside right here they usually have a much bigger perspective, ultimately they will be requested to talk up,” Campbell stated.

Carter has lately been vocal concerning the menace quantum computing poses to Bitcoin. On January 21, he stated Bitcoin’s “mysterious” value underperformance was “quantum pushed” and “the one story that issues this yr.”

Based on CoinMarketCap, Bitcoin was buying and selling at $70,281 on the time of publication, down 26.25% previously 30 days.

However not everybody agrees that establishments attempt to affect networks. Ram Ahluwalia, founding father of Lumida Wealth Administration, stated the primary establishments in Bitcoin are “passive” buyers. “They don’t seem to be activists,” he stated.

Business break up over the urgency of Bitcoin quantum danger

This comes amid an ongoing industry-wide debate about how imminent the menace to Bitcoin actually is.

Associated: Bitcoin exceeds $69,000 resulting from stoop in US CPI, however chance of Fed fee reduce stays low

Charles Edwards, founding father of Capriol Investments, believes quantum computing is a possible “existential menace” to Bitcoin and argues that upgrades are wanted now to strengthen community safety.

In the meantime, Christopher Bendixen, head of Bitcoin analysis at CoinShares, claimed in a put up on Friday that of the 1.63 million Bitcoins, solely 10,230 Bitcoins reside in pockets addresses with publicly uncovered cryptographic keys which can be weak to quantum computing assaults.

Some Bitcoiners, together with Technique Chairman Michael Saylor and Blockstream CEO Adam Again, consider the quantum menace is overstated and will not disrupt the community for many years.

journal: Brandt says Bitcoin hasn’t bottomed out but, however there’s hope for polymarkets: commerce secrets and techniques