Gold’s document rally lastly blinked this week, and Bitcoin merchants are ready to see what occurs subsequent.

Spot gold soared to an all-time excessive of $5,594.82 an oz earlier than falling to round $5,330 as buyers took income, down about 4.7% from its all-time excessive.

The Kobisi Letter famous that the risky worth actions of valuable metals led to a $5.5 trillion fluctuation in its market capitalization, the most important in historical past.

On the similar time, Bitcoin fell 7% to round $82,381, reflecting a split-screen second for the 2 belongings, which are sometimes marketed as “laborious cash” hedges.

Due to this fact, the necessary query for crypto markets will not be whether or not gold can appropriate itself after a near-vertical transfer.

The query is whether or not gold’s decline will catalyze a rotation, liberating up capital, consideration, and narrative house for “degraded buying and selling” that might later move into Bitcoin, or whether or not it indicators a macro regime that can put stress on each belongings.

Gold, crowded macro buying and selling

Gold’s rise has been fueled by a robust mixture of geopolitical dangers, coverage uncertainty and a weaker greenback.

The valuable steel’s surge above $5,000 was pushed by a rush into safe-haven belongings, with the steel gaining a unprecedented 64% in 2025, its greatest annual achieve since 1979.

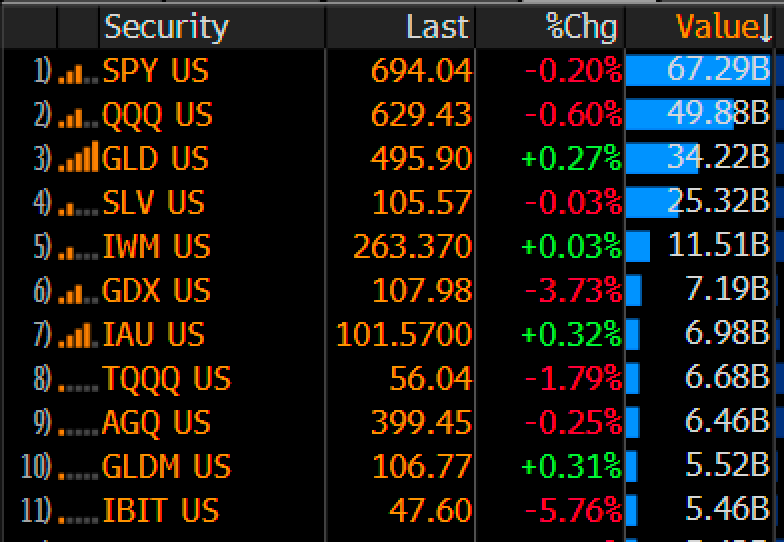

Notably, large-scale ETF demand has additionally strengthened market positioning.

Eric Balchunas, senior ETF analyst at Bloomberg, pointed to the historic nature of the present quantity. In line with him:

“GLD buying and selling volumes are essentially the most spectacular, exceeding the outdated all-time document by roughly 50%.

This follows a World Gold Council report that bodily backed gold ETFs will entice $89 billion in 2025, bringing international gold ETF belongings below administration to a document $559 billion and holdings to a document 4,025 tonnes.

In analyzing the components behind this development, the WGC emphasised “momentum shopping for,” together with decrease alternative prices because of decrease U.S. bond yields and a weaker greenback. These situations might shortly reverse if rates of interest or the greenback rebound sharply.

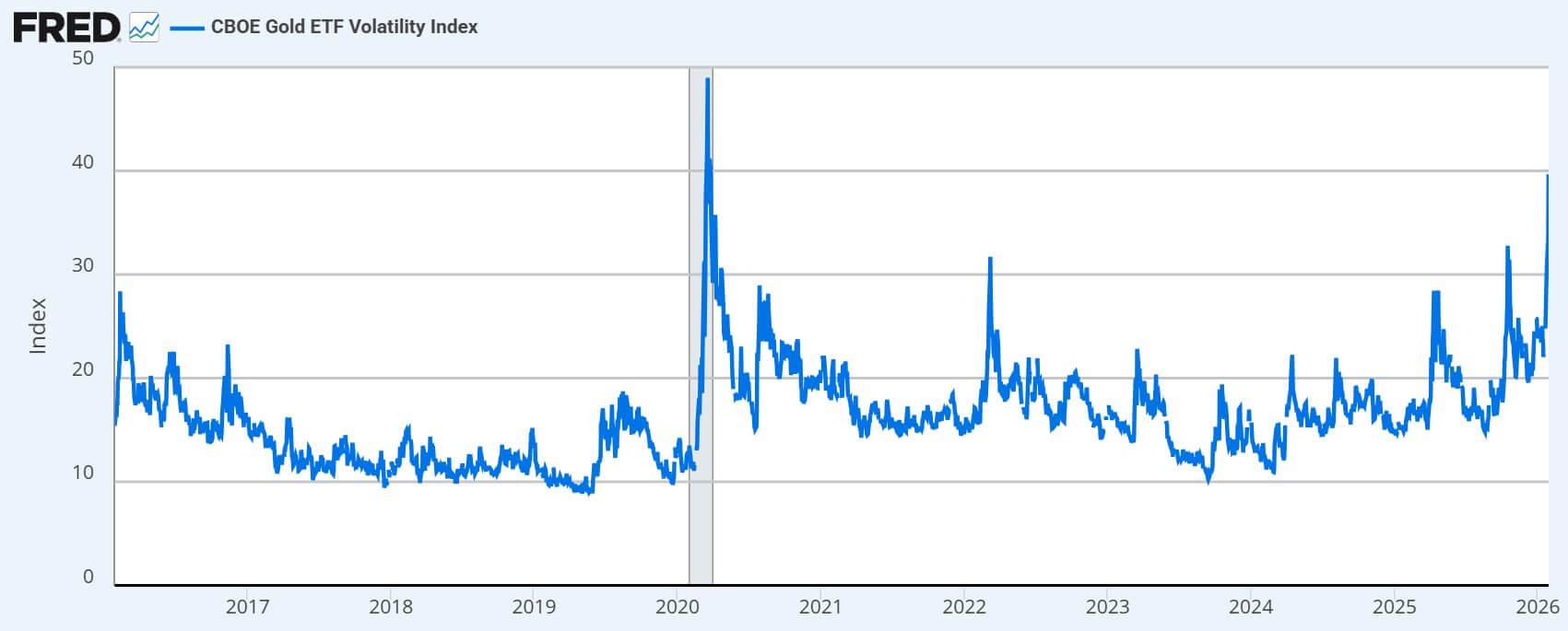

In the meantime, the pace of gold’s uptrend is now displaying in its volatility. The CBOE Gold ETF Volatility Index (GVZ) rose from 30.01 on January twenty third to 39.67 on January twenty eighth.

This sharp change is the best stage since 2020 and is commonly accompanied by compelled danger aversion when buying and selling is crowded.

$39 trillion referendum

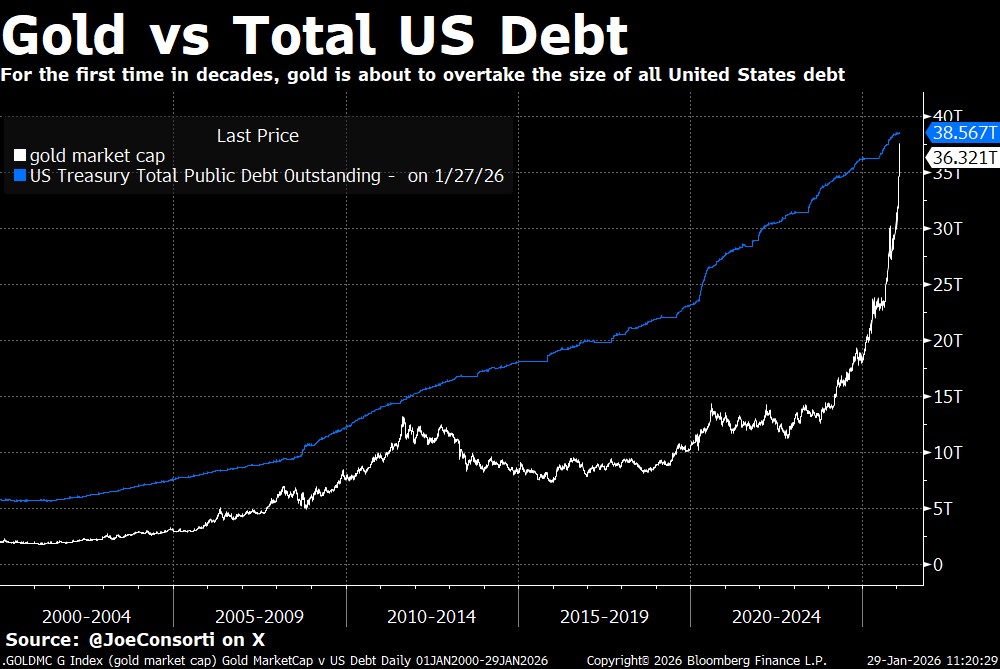

At document costs, the full “above floor” worth of gold is rising relative to a number of the greatest benchmarks in international finance.

The World Gold Council estimates that roughly 216,265 tonnes of gold has been mined all through historical past. At about $5,088 per ounce, meaning the worth of above-ground gold is about $36 trillion.

This quantity is surprisingly near the $38.54 trillion complete U.S. authorities debt recorded on January twenty eighth.

This comparability is necessary as a result of it frames gold’s rally as greater than only a commodity squeeze. Market analysts mentioned this gave the impression to be a macroeconomic “steadiness sheet” commerce, or a referendum on sovereign debt and forex credibility.

If that framework is what attracted marginal patrons to gold, there isn’t a want for gold’s decline to undermine the idea.

Bitcoin analyst Joe Consorti mentioned:

“Gold is about to surpass the $38.5 trillion US debt. That is what a worldwide forex reset appears like.”

So, as this gold correction unfolds, it might trigger a reassessment of the place to put worth decline hedges, particularly now that Bitcoin is beginning to change into extra mainstream than in previous cycles.

How narrative handoff works

The case for Bitcoin as a subsequent beneficiary will not be based mostly on a easy “fall in gold.” $BTC We are going to clarify intimately the idea of “up” and the construction and correlation of portfolios.

$ARK Make investments famous that the correlation between Bitcoin and gold since 2020 has been low (0.14 utilizing weekly returns), suggesting that the highest cryptocurrency could act as a diversifier in comparison with conventional asset allocation.

Specifically, whereas a low correlation doesn’t assure an uptick, it does assist a situation the place gold can go up even when Bitcoin does not mechanically comply with.

This creates room for later “catch-up” trades if capital is directed again in the direction of larger convexity hedges.

However, there may be additionally a “narrative handoff” impact. The hovering worth of gold is a really seen expression of monetary instability.

If that uncertainty persists, however gold buying and selling seems stagnant, Bitcoin turns into an apparent different danger bucket for buyers preferring liquidity and 24/7 pricing.

Curiously, Bitcoin analyst James Van Straten famous that the flagship digital asset is at present trending within the crimson towards gold for six consecutive months.

This sample is identical as that noticed in 2018 and 2019, after which $BTC Generated inexperienced candles 5 instances in a row each month.

Capital rotation to Bitcoin

A helpful method to mannequin the following step is to deal with the decline in gold as a sign and ask what macro components are behind it.

In a “light unwind” situation, gold cools because of revenue taking that washes out leverage and volatility spikes (corresponding to a leap in GVZ). On this path, the macro background of liquidity expectations and a weak greenback won’t reverse.

In consequence, Bitcoin will initially lag, however could catch up as buyers take dangers in “digital laborious asset” buying and selling once more.

Mr. Jiaoao Wesong, CEO of AlphaRactal, mentioned:

“As soon as gold enters the Purchase Climax (BC) stage, the following transfer is often a pointy decline.”

Wesson famous that after such a correction, gold usually enters a sideways consolidation part, after which danger belongings corresponding to Bitcoin are inclined to react positively. He added:

“Traditionally, this part unfolds over a number of months and seems to align intently with the historic fractal that Bitcoin has adopted all through the cycle, a window wherein giant institutional buyers actively reallocate to Bitcoin.”

Nonetheless, if gold’s decline displays widespread deleveraging throughout danger markets, Bitcoin typically behaves as a high-beta asset and will fall together with equities earlier than recovering.

This can be a path the place Bitcoin as a macro hedge can lose the primary battle however win the second as soon as the funding state of affairs stabilizes.

In the meantime, essentially the most bearish path for each belongings could be a stronger greenback and better actual rates of interest.

$ARK Make investments’s outlook makes enjoyable of the robust greenback regime by evaluating the U.S. coverage state of affairs to the early days of Reaganomics, when the greenback soared. On this situation, draw back buying and selling will decline and Bitcoin’s upswing will change into extra depending on crypto-native catalysts.

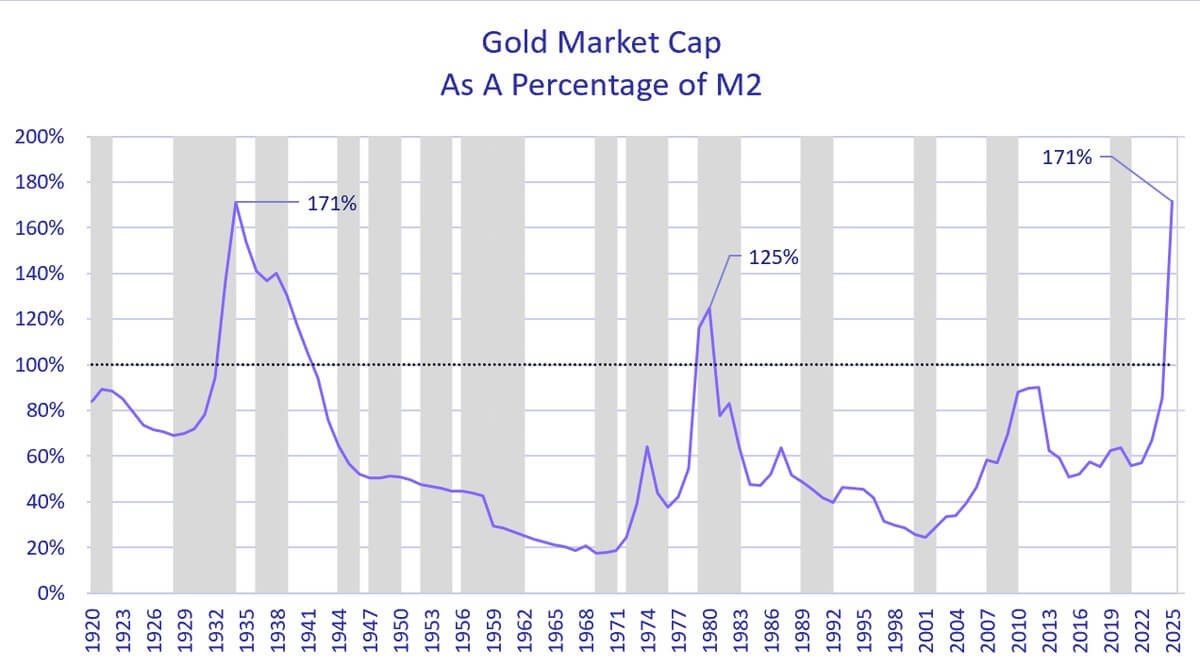

$ARK Make investments’s Cathie Wooden warned that “as we speak’s bubble is in gold, not AI,” suggesting {that a} rising greenback might burst that bubble.

He identified that the ratio of gold to the US cash provide (M2), which is roughly $22.69 trillion, has lately reached ranges paying homage to the Eighties and the Nice Despair.

Nonetheless, if the correction in gold proves to be orderly and the macro components that triggered the laborious asset bid stay intact, Bitcoin could possibly be subsequent.

Nevertheless it doesn’t work as a golden mirror. Slightly, it is going to be an expression of the identical underlying monetary instability with larger market volatility.