Harvard economist Kenneth Rogoff as soon as predicted that Bitcoin would crash to $100 earlier than it reached $100,000, however admitted that his feedback hadn’t modified seven years in the past, nevertheless it seems he hasn’t come to Bitcoin but.

“Practically ten years in the past, I used to be a Harvard economist. I mentioned that Bitcoin is more likely to be price $100 greater than $100,000. What do you miss?” he wrote on X on Wednesday, referring to the March 2018 section of CNBC’s “Squawk Field.”

Rogoff is the previous Chief Economist and creator of the Worldwide Financial Fund (IMF).Our bucks, your drawback‘It was launched in Could.

In 2018, Rogoff mentioned authorities restrictions would trigger a fall in Bitcoin costs.

Nevertheless, for the reason that Trump administration received the November election, it has crushed $100,000 in December 2024, profitable greater than 80%, reaching its highest ever excessive.

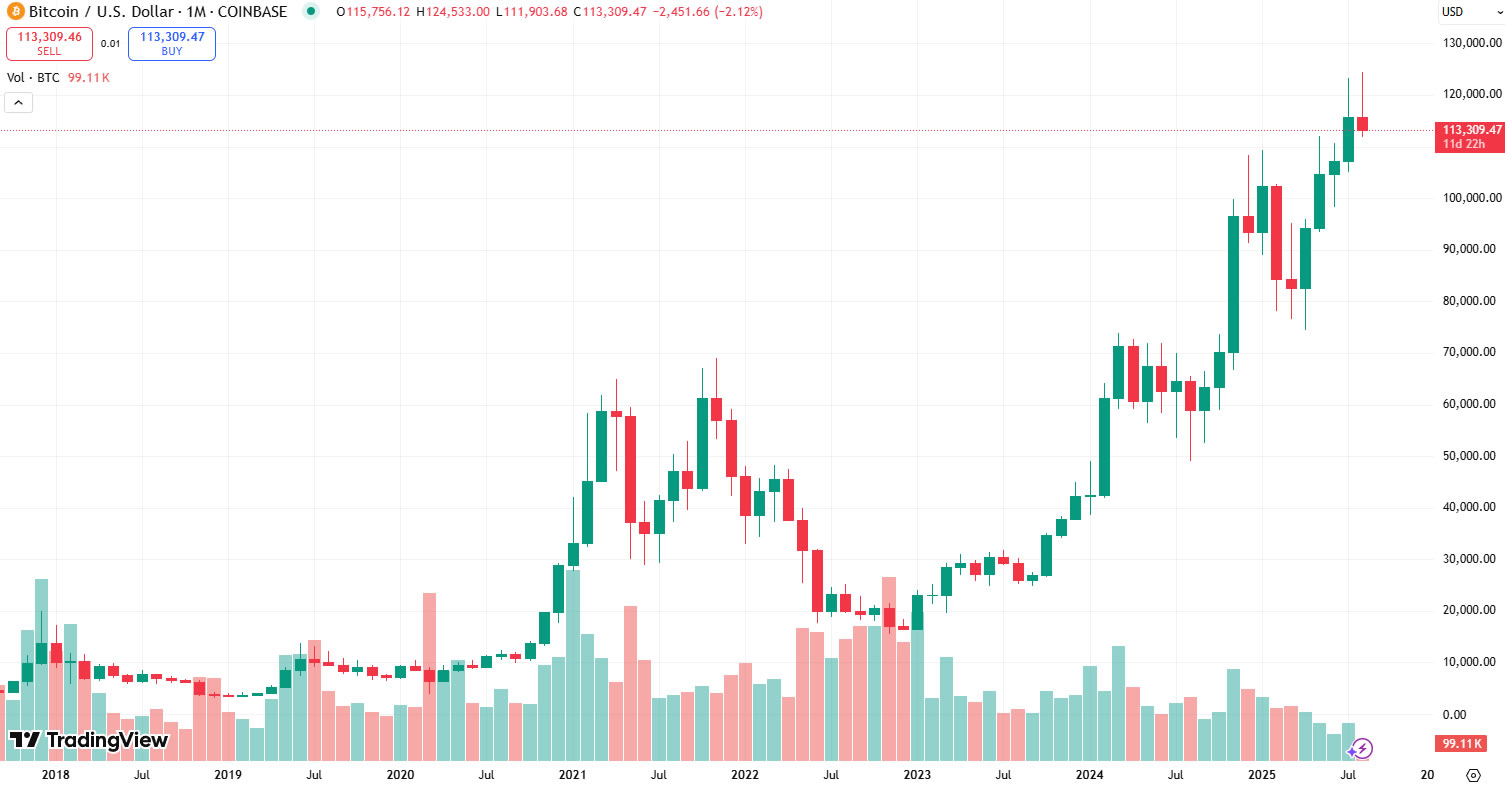

Bitcoin has skyrocketed over 1,000% since Rogoff’s 2018 forecast. sauce: TradingView

“I used to be too optimistic in regards to the US coming to the senses about smart cryptocurrency laws,” he mentioned.

Bitcoin competes with Fiat forex

“Secondly, I did not respect how Bitcoin competes with Fiat forex to function a particular buying and selling medium within the $27 world underground economic system,” he continued with X.

Nevertheless, Bitcoin has grow to be an inflation hedge in lots of nations the place native forex is closely undervalued by the federal government.

The unlawful actions associated to Chaptocurrencies had been round $50 billion in 2024, a decline within the ocean, lower than 1% of these which can be washed utilizing money.

“Third, we did not count on a state of affairs the place regulators, particularly the most effective, would have the ability to bravely maintain seemingly tons of of tens of millions of {dollars} (if not billions) with out penalties given the blatant battle of curiosity.”

Associated: Trump-linked American Bitcoin is looking for Asian acquisition to spice up BTC Holdings: Report

Crypto X determined to take it as a victory anyway

Matt Hougan, chief funding officer at Bitwise, responded, saying that Rogoff “did not think about an enormous success in a decentralized undertaking that pulled energy from folks moderately than centralized services.”

In the meantime, David Lawant, a researcher at Digital Property Brokerage Falconx, mentioned in his ebook he was “very grateful” to Rogoff.The curse of money“It was ‘so dangerous’ so it was ‘one of many issues that pushed me as much as BTC’.

Matthew Sigel, head of digital belongings analysis and Vaneck’s, ranked Bitcoin’s greatest critics at No. 9 on Tuesday. He “places Bitcoin obituary from his echo room too early,” Shigeru mentioned.

“Possibly you missed it since you stay in an echo chamber and similar to once you lock,” he added, noting that Rogoff prevents folks from replying to his posts on X.

“Elementary points: unlawful decline, modifications in demographic wealth, and world demand for impartial reserve belongings.”

Satirically, the Harvard Administration Firm, which manages the college’s $53 billion fund fund, reported a $116 million funding in BlackRock’s spot Bitcoin ETF earlier this month.

⚡ Flashback: In 2018, Harvard Economists mentioned $BTC is more likely to attain $100 than $100,000.

Now they’ve invested $116 million. pic.twitter.com/yddzylmzdk

– Cointelegraph (@cointelegraph) August 10, 2025

journal: Solana Seeker Assessment: Is a $500 crypto cellphone price it?