Bitcoin has remained under its 365-day transferring common of $102,000 since final Friday, sparking debate amongst analysts about the potential for a bear market. The Worry and Greed Index fell to 10, matching panic ranges final seen in early to mid-2022.

By way of Thursday, greater than $700 billion had disappeared from the market over the previous month. Regardless of rising fears and main technical failures, combined indicators from macro developments and whale exercise have divided consultants on the near-term course of cryptocurrencies.

Technical breakdown raises bear market considerations

Bitcoin fell under $100,000 for the second time in every week, setting off alarm bells. It’s at present buying and selling under its 365-day transferring common, a stage that signaled regime change in the course of the 2018 and 2021 bear markets. An in depth evaluation reveals that this indicator successfully separates bullish and bearish phases all through the cycle.

The decline isn’t restricted to costs. In response to on-chain knowledge, Bitcoin is under the realized value of $94,600 for cash held for 6-12 months. That is the associated fee foundation for the so-called “bull cycle conviction consumers.” If the worth stays under this stage, many buyers will endure losses and promoting strain could improve.

Bitcoin perpetual futures noticed open curiosity surge by greater than $3.3 billion, the largest weekly improve since April. As Bitcoin fell under $98,000, many merchants positioned restrict orders to purchase the push. Nevertheless, costs continued to fall, triggering these orders and creating leveraged publicity in a declining market.

Veteran dealer Peter Brandt is more and more involved about his technical evaluation. Brandt highlighted {that a} important reversal occurred on November eleventh, adopted by an eight-day sample of accelerating lows and highs. His draw back predictions are $81,000 and $58,000.

Might the whole reversal ((November eleventh), adopted by eight days of decrease highs and the completion of a major upside improve, represent a bear market?

Implied targets are 81k and 58k

Those that declare to be large consumers at $58,000 now will probably be bullshit by the point BTC hits $60,000 pic.twitter.com/Z01KKDSGmV— Peter Brandt (@PeterLBrandt) November 19, 2025

However some consultants say these situations don’t assist a full-blown bear market. They name the present stage a “mid-cycle breakdown,” a dangerous interval the place extra indicators are wanted to verify the pattern. There are three components that assist a bear market.

- Bitcoin has remained under its 365-day transferring common for 4-6 weeks.

- Lengthy-term holders who bought greater than 1 million BTC inside 60 days,

- The MACD of all the market is detrimental.

Whale accumulation challenges bearish sign

Whereas concern indicators recommend capitulation, on-chain knowledge exhibits elevated accumulation of Bitcoin whales. Regardless of falling costs, the variety of addresses holding greater than 1,000 BTC is growing. This means that institutional and enormous buyers view the financial downturn as a shopping for alternative fairly than the start of a protracted bear market.

That is an attention-grabbing graph.

Though concern and panic plagued many buyers, the variety of BTC whales has been surging just lately.

Massive holders are staying calm and shopping for from panic sellers at a reduction.

Be robust. pic.twitter.com/z1yWE4U0Ms

— Bradley Duke (@BradleyDukeBTC) November 19, 2025

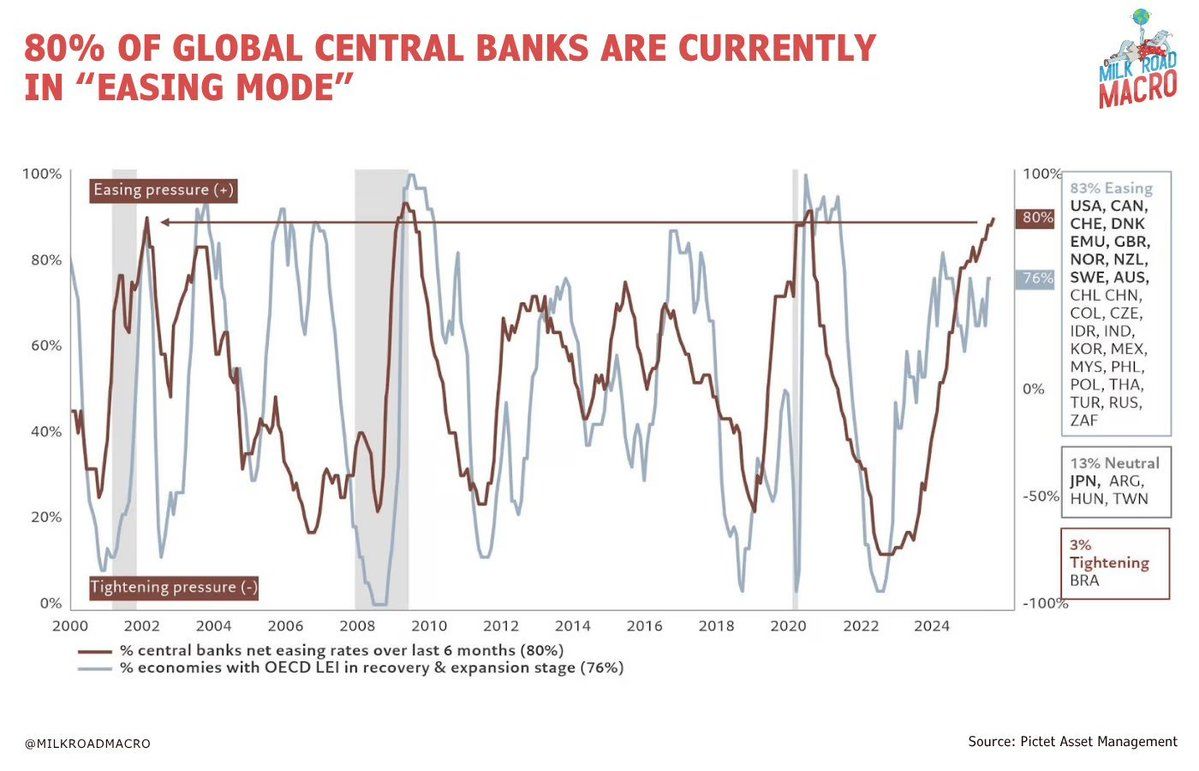

The strongest case for a bear market comes from macro fundamentals. World liquidity has reached an all-time excessive, with greater than 80% of central banks easing coverage. This widespread financial easing has traditionally benefited danger property, and cryptocurrencies are vulnerable to liquidity waves.

Macro analysts emphasize that central banks are slicing rates of interest and including liquidity. Knowledge from the Financial institution for Worldwide Settlements helps this pattern. By way of the second quarter of 2025, USD credit grew by 6% year-on-year and euro credit by 13%. Credit score enlargement typically drives asset value will increase.

Greater than 80% of the world’s central banks will probably be in easing mode in 2024, creating favorable liquidity situations for danger property. Supply: Milk Highway Macro

Historic knowledge helps this speculation. Danger property typically rise when liquidity will increase. Cryptocurrencies can profit essentially the most from being a frontier asset. The present setup is paying homage to bull markets the place short-term corrections occurred as the cash provide expanded. Except this liquidity pattern reverses (which central banks haven’t indicated), cryptocurrencies will stay structurally supported.

Nonetheless, the IMF’s April 2025 World Monetary Stability Report pointed to the overestimation of expertise property. The OECD expects international GDP progress to gradual subsequent yr to 2.9% from 3.3% in 2024. These might restrict the quantity liquidity can push costs up. Consequently, analysts are weighing financial headwinds towards the abundance of liquidity in at this time’s markets.

The publish Has Bitcoin entered a bear market?The publish Analyst Break up appeared first on BeInCrypto.