Ethereum stays below stress as robust draw back momentum places the bears in cost, with merchants centered on whether or not key assist zones will be capable to stabilize the worth.

Ethereum ($ETH) has been below intense promoting stress, falling almost 10% up to now 24 hours. The altcoin market chief has been unable to interrupt above latest intraday highs round $2,435 and is at present buying and selling round $2,207.

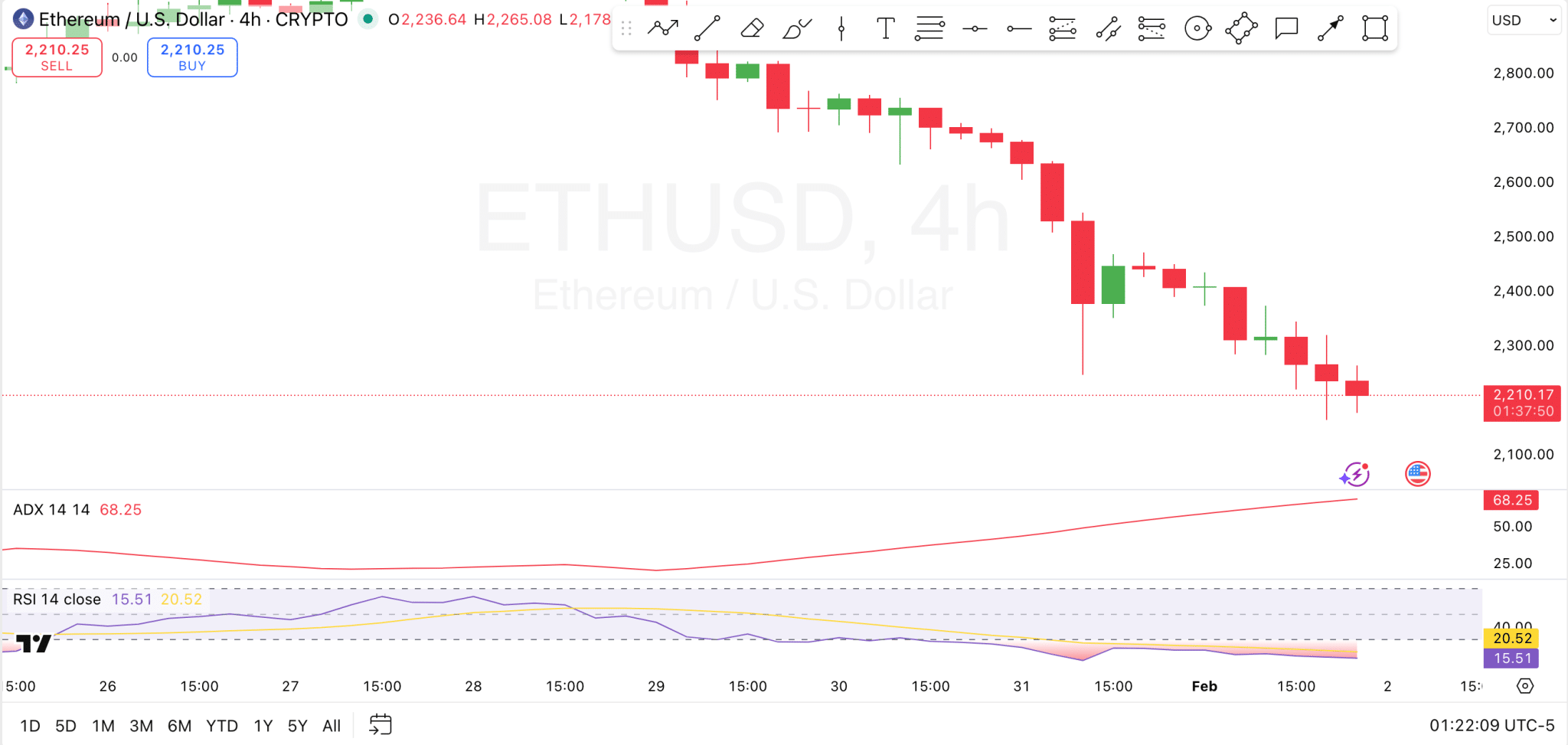

The chart exhibits a gradual decline punctuated by sharp declines, reflecting weakening short-term sentiment. $ETH It is also down about 23% over the previous week and greater than 31% over the previous 14 days. Regardless of buying and selling quantity rising to almost $51.9 billion, Ethereum underperformed each the broader market and Bitcoin in 24 hours as consumers struggled to stabilize the worth.

Ethereum worth evaluation

ethereum worth motion The 4-hour chart exhibits continued downward stress. $ETH After a pointy decline, it’s now holding agency simply above the $2,200 space. This zone serves as instant assist. A full break under this stage might result in additional weak point for Ethereum in direction of the following psychological assist close to $2,100, with consumers probably making an attempt short-term protection.

$ETH 4 hours evaluation

The excellent news is that the previous zone of consolidation has was a transparent line of resistance. Particularly, the $2,300 to $2,350 space stands out as the primary main space of resistance, coinciding with earlier breakdown ranges and up to date failed rebound makes an attempt. Past that, the $2,450-$2,500 zone represents a stronger ceiling, the place sellers had been beforehand actively intervening.

Furthermore, momentum indicators strengthen the bearish construction. The Relative Energy Index is extremely oversold and is hovering round 15, indicating excessive promoting stress. Nevertheless, promoting exhaust fuel additionally will increase the chance of a short-term bailout rebound.

In the meantime, the common directional index is rising above 65, confirming that the present pattern is robust and firmly established to the draw back. This mix means that Ethereum will stay firmly in a bearish pattern till indicators of a reversal seem.

Will you obtain $6,000 from Ethereum reversal?

Analyst CryptoGVR outlined each a possible reversal zone and upside targets for Ethereum in a social media commentary. analyst observed that $ETH It might begin forming a basis within the $1,800 to $2,200 vary, an space seen as a key demand zone following the latest selloff.

$ETH prediction

As soon as costs stabilize and a reversal from this area is confirmed, we anticipate Crypto GVR to proceed a broader restoration part. He has set an upside goal for the inventory within the vary of $4,000 to $6,000.