Bitcoin faces pivotal Fibonacci retracement ranges as assist and resistance amid bearish MACD indicators and prevailing lengthy liquidations.

Bitcoin is teetering on the point of a possible market reversal, with the worth falling by 0.6% in 24 hours to $89,675.70. However additional pink flags are clear. Whereas 24-hour buying and selling quantity of $35.43 billion suggests continued curiosity, efficiency indicators paint a worrying image, together with a 2.0% weekly decline, a 6.8% month-to-month decline, and an 11.8% annualized decline.

Nevertheless, the 14-day efficiency stands out as a modest vibrant spot amidst the broader pullback, with a +3.7% achieve suggesting near-term resilience. The rise over the past 14 days is trigger a reboundor will there be a pause earlier than additional draw back stress takes maintain?

Bitcoin worth evaluation

A weekly chart that delves deep into Bitcoin worth tendencies by a technical lens, revealing Fibonacci ranges that act as essential guides for assist and resistance. From the October peak close to $126,030 to the swing low close to $74,458, these ranges spotlight essential zones.

Bitcoin worth prediction

Close to-term resistance is the 61.8% retracement ($94,235), a golden ratio that always acts as a powerful barrier to restoration, adopted by the 50% midpoint ($100,344) and 38.2% ($106,453) as potential upside targets if bullish momentum reestablishes.

On the draw back, assist has been realized close to the 78.6% stage ($85,537), and the worth seems to be consolidating after a spike simply above $80,000. This might sign a deeper ground if damaged, with a 100% extension again to $74,458 as the subsequent essential buffer in opposition to additional decline.

Moreover, technical indicators additional emphasize warning with the MACD (Transferring Common Convergence Divergence) flashing a bearish sign. The MACD line is under the sign line and the histogram exhibits an enlarged pink bar, indicating an acceleration of downward momentum and a attainable continuation of the correction.

Bitcoin clearing knowledge

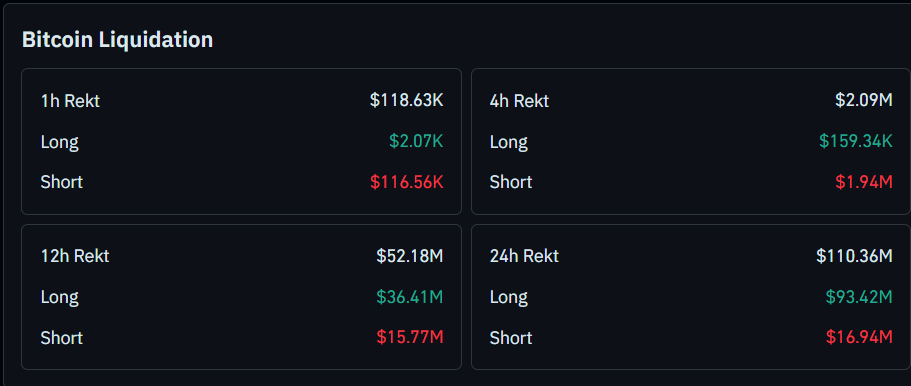

Elsewhere, Coinglass Liquidation dashboard It reveals a narrative of burgeoning ache, significantly within the medium time period, with a bias towards lengthy positions.

Previously 12 hours, whole rekt (liquidation) amounted to $52.18 million, with longs of $36.41 million and shorts of $15.77 million, indicating a downward development in worth that caught bullish speculators unexpectedly.

Bitcoin liquidation

Increasing to the 24-hour timeframe, the wreckage grows to $110.36 million total, dominated by $93.42 million in lengthy liquidations in comparison with comparatively small brief liquidations of $16.94 million. This may occasionally have contributed to the noticed volatility and suggests bearish dominance within the session.