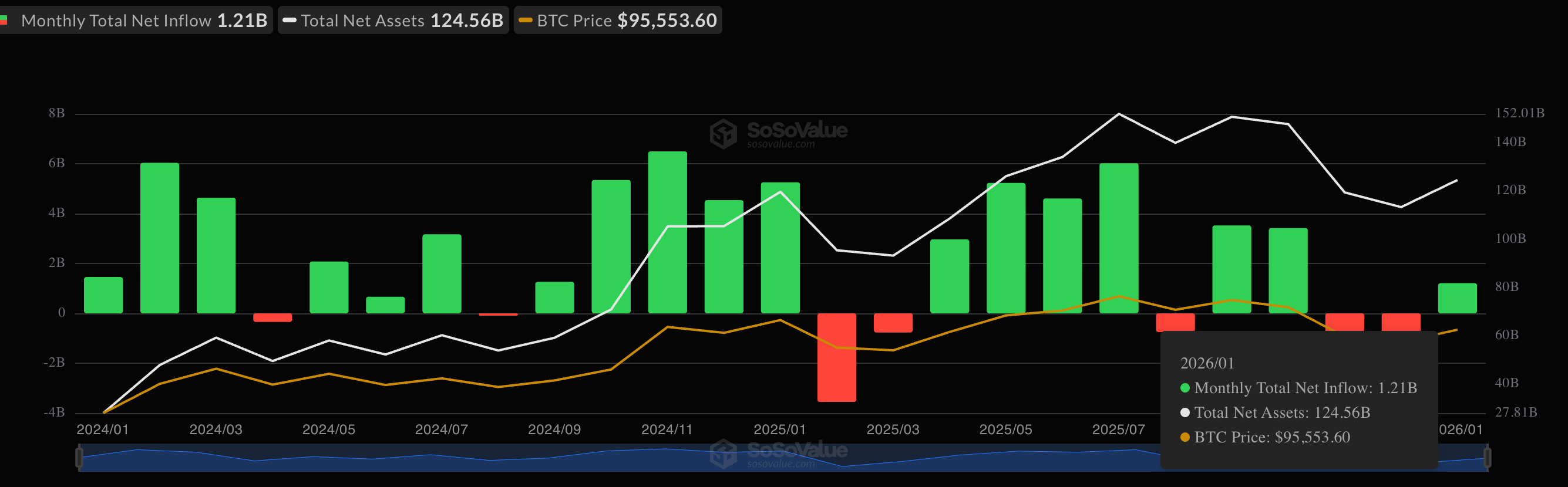

The 11 bodily exchange-traded funds (ETFs) listed within the U.S. have recorded web inflows of $1.2 billion to date this month, reversing December redemptions, based on SosoValue knowledge.

Whereas influx numbers are optimistic, digging deeper into the information reveals even stronger bullish alerts. Massive buyers are forgoing common arbitrage and betting extra on the potential for long-term value will increase.

Bitcoin ETF inflows this month are $1.2 billion (SoSoValue)

Let’s break it down.

For some time, main buyers used a boring (however protected) technique referred to as “cash-and-carry” arbitrage to revenue from Bitcoin buying and selling.

This commerce labored for some time by exploiting the worth discrepancy between the spot and futures markets. However current inflows into U.S.-listed spot Bitcoin exchange-traded funds (ETFs) counsel that merchants are shifting away from refined arbitrage and more and more looking for directional bullish bets.

Let’s take into consideration buying and selling like this: Think about you purchase a gallon of milk immediately for $4 as a result of somebody signed a contract to purchase milk from you for $5 subsequent month. You’ve got already made a $1 revenue, so you do not care if the worth of milk crashes or spikes within the meantime.

Within the cryptocurrency world, buyers used to do that by shopping for spot Bitcoin ETFs and “shorting” (betting) Bitcoin futures. It wasn’t concerning the value of Bitcoin going up. It was only a matter of narrowing down the small value distinction between the 2.

Learn extra: Bitcoin futures ETF may increase cash-and-carry yields

Now that the hole between every now and then has narrowed and the price of financing such commerce has risen, commerce has misplaced its luster, not less than that is what the information exhibits.

Nonetheless, massive buyers nonetheless need publicity to Bitcoin, so they’re buying and selling the old school approach, eschewing refined trades and betting on the potential for long-term value appreciation.

disappearing earnings

CME’s whole variety of open or energetic commonplace and micro Bitcoin futures contracts elevated by 33% to 55,947, whereas US spot ETFs recorded web inflows of $1.2 billion.

This mixture of ETF inflows and elevated CME open curiosity is often related to “money and carry” arbitrage.

However the newest ETF inflows are unlikely to be a part of a carry commerce, because the “foundation,” the worth distinction between CME futures and spot ETFs, has narrowed to a degree that hardly covers buying and selling and funding prices.

“This view is strengthened by the low month-on-month foundation, presently round 5.5%. Given funding and execution prices, implied carry seems to be near zero, with restricted incentive to re-enter the commerce,” Mark Pilipchuk, analysis analyst at CF Benchmarks, advised CoinDesk in a Telegram message.

One of many essential causes might be how boring Bitcoin’s value actions have been. Bitcoin value has been “caught” at round $90,000 since its steep drop from its all-time excessive final October.

There’s much less volatility, much less likelihood of value discrepancies, and fewer revenue from buying and selling “gaps”. And the information exhibits simply that.

Bitcoin’s annualized 30-day implied volatility, represented by Volmex’s BVIV index, has fallen to 40%, the bottom degree since October. Analysts at crypto change Bitfinex say this exhibits that expectations for value actions have reached their lowest degree in three months.

A “sticky” bullish guess

This modification alerts a big shift available in the market microstructure and is bullish for Bitcoin.

Do not get me flawed. Traders are nonetheless flocking to identify ETFs, as evidenced by $1.2 billion in inflows. However this guess shouldn’t be for carry trades. Moderately, it favors direct value appreciation for long-term investments.

Bitfinex analysts name these new buyers “sticky.” As a result of they don’t seem to be right here to make short-term earnings based mostly on value variations, however moderately long-term earnings provided that volatility is gone. Primarily, massive establishments really feel it’s safer to diversify their funds into different belongings like Bitcoin, which has lagged behind different belongings reminiscent of treasured metals and shares.

Analysts defined the ETF inflows by saying, “Monetary establishments usually add (long-term) publicity in low volatility circumstances or as liquidity regularly strikes down the danger curve after gold and silver rally.”

Merely put, these buyers aren’t right here for a 5-minute gamble for “fast cash.” That is “sticky” cash from critical buyers who wish to keep available in the market for the long run.

Rise of the “speculator”

So who’re the “sticky” buyers who’re betting on the upside with out establishing arbitrage?

The reply lies in knowledge on how a lot buyers are shorting Bitcoin.

Open curiosity in CME-listed Bitcoin futures has elevated as a consequence of speculators betting on a bullish end result moderately than promoting quick as a part of a carry commerce. The current enhance in open curiosity means that non-commercial merchants and huge speculators are looking for earnings moderately than hedging threat via quick promoting, growing their bullish publicity.

“Participation by non-commercial merchants, a class that pulls extra speculative funds, has elevated considerably. Open curiosity in CME Bitcoin futures held by this group has elevated to greater than 22,000 contracts, broadly according to the current enchancment in value sentiment,” Benchmarks’ Pylipchuk mentioned.

This means that the current growth in open curiosity is primarily pushed by institutional buyers reminiscent of hedge funds seeking to drive long-term Bitcoin value appreciation via regulated futures markets, moderately than by re-leveraging foundation trades, he added.

He additionally mentioned that leveraged funds, or hedge funds, which generally quick futures as a part of carry trades, have been steadily lowering their quick publicity.