Bitcoin merchants are trying intently on the Federal Reserve as we speak, following a sample of robust worth actions after previous FOMC conferences.

Particularly, Merlijn The Dealer, a widely known market analyst Posted At X, “Bitcoin loves FOMC” and notes that 5 of the final seven conferences led to an upward motion. Knowledge from The accompanying chart confirms this disclosure, with Bitcoin rising no less than 10% shortly after the final three conferences.

For context, after the 16% assembly in October 2024, and after the November 2024 assembly, Bitcoin surged by 40%. In the meantime, previous FOMC conferences in 2025, April, June and July led to a surge in Bitcoin by 18%, 10% and 14%, respectively.

Given this historic sample of primarily optimistic worth switch, Merlijn predicts the chance of one other upward shift if related situations unfold. Particularly, Bitcoin has been buying and selling at $117,558, a 1.2% decline previously day, decreasing its month-to-month revenue to 9.2%.

No charge adjustments are anticipated. Give attention to Powell’s feedback

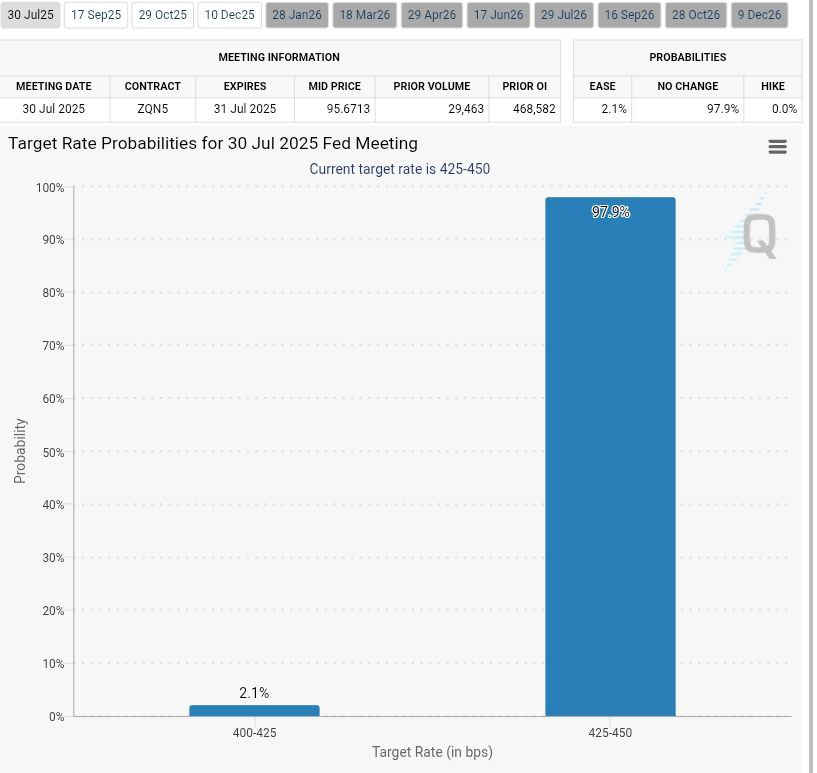

In the present day’s FOMC choice is scheduled till 2pm. Market information reveals that the Fed has a 97.9% likelihood of holding rates of interest regular. This displays the present financial outlook and up to date inflation measures.

Nevertheless, the market doesn’t deal with price choices as the principle occasion. As a substitute, merchants deal with what Powell says at a post-announced press convention.

Monetary Analyst Abbott Case Highlighted The sharp market potential reveals the motion surrounding as we speak’s occasion, pointing to its significance as a key second by which Jerome Powell’s press convention may foster volatility.

He stated a latest assembly between political leaders, together with Powell and Donald Trump, raised hypothesis that Powell may need a extra devish tone.

Dovish sign can set off a rally

In financial coverage, Dub’s stance signifies the potential for rate of interest reductions or a reasonable monetary place. If Powell signaled such a shift, merchants consider they might improve dangerous belongings, notably Bitcoin.

Bitcoin is usually strongly conscious of the Fed’s steeragedisplays broader sentiment about fluidity and risk-taking. If Powell suggests that it’ll ease the easing within the coming months, merchants can flip it into inexperienced gentle and switch capital into crypto and technology-related belongings.

Particularly, Merlin Additionally identified The robust hyperlink between rising world liquidity and Bitcoin’s latest worth income highlights that Bitcoin is intently monitoring the rise in world M2.

Bitcoin liquidity stacks on either side | ETH Coiling | Altcoins Bleeding – However FOMC is scorching!

Test it out right here: https://t.co/65imkqetan pic.twitter.com/tih5pbwjba

-merlin the Dealer (@merlijntrader) July 30, 2025

He emphasised that fluidity was constructed forward of as we speak’s FOMC assembly and positions the occasion as a key catalyst. With Ethereum integration and altcoins weakening, he means that the result of the Fed’s choice may drive the following main transfer within the crypto market.

Bitcoin worth evaluation

Bitcoin, in the meantime, is firmly built-in inside a symmetrical triangle sample forward of as we speak’s FOMC convention. Costs vary between $117,000 and $118,700 over the previous 72 hours, with volatility anticipated to extend because the sample approaches its vertex.

Regardless of the short-term weaknesses demonstrated by technical alerts such because the parabolic SAR close to $118,099 and VWAP rejection, Bitcoin defends the ascending development line.