James Wynn, a high-risk crypto dealer who made headlines for his aggressive leveraged buying and selling technique and the losses that include it, made greater than $500,000 as we speak and made income. This marked his largest revenue since Might twenty fifth.

This marks a dramatic shift for Wynn. Wynn reveals that luck was dry after seeing all earlier advantages being worn out by the extremely leveraged areas of excessive lipids.

James Wynn’s buying and selling curler coaster ends with inexperienced

In June, Beincrypto reported a big lack of $100 million in excessive lipids. Regardless of the blow, he continued his excessive stakes guess.

This month, blockchain analytics platform LookonChain highlighted that Wynn transferred 27,522 USDC to Hyperliquid and picked up a referral bonus of $3,960.84 on July tenth.

Nonetheless, as soon as once more, betting available on the market was not an excellent factor for Winn. Lower than 12 hours later, Wynn’s excessive stakes shorts have been absolutely liquidated, leading to a brand new lack of $27,921.63. A day later, Wynn deactivated his X (previously Twitter) account.

“James Wynn has disabled his X account! What occurred? Did he explode utterly? The steadiness between his pockets and excessive lipids mixed makes every thing $10,176,” Lookonchain posted.

Nevertheless, the silence didn’t final lengthy. On July fifteenth, Wynn reappeared, claiming a referral reward of 6,792.53 USDC. This time he went to Pepe for a very long time with ten instances leverage.

Lookonchain then noticed that the dealer added about 468,000 USDC to the excessive lipids. He took one other daring step, opening up a protracted place 40x leveraged to Bitcoin. Regardless of going through partial liquidation, Winn was capable of profit from altering his technique.

“He fell for a protracted brief in BTC and hype. He lowered income by $473.9K,” the corporate added.

HyperDash knowledge additionally revealed that he made $105,948 and $345,456 on July 18th and nineteenth, respectively. Moreover, yesterday Wynn deposited a further 536,573 USDC in excessive lipids. He then opened two new leveraged positions. It is 25 instances the size for Ethereum and 10 instances the size for Pepe.

Right now he concluded each offers, incomes an unimaginable quantity of $33,386 from ETH and $521,313.86 from Pepe. The latter represents his most worthwhile single commerce since his $18 million victory on Might twenty fifth.

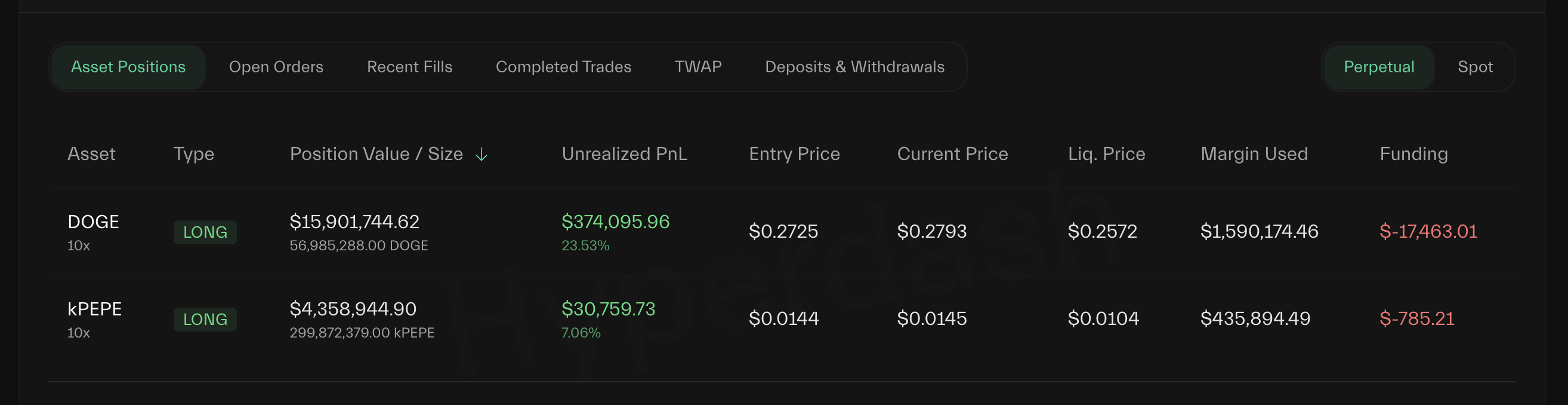

Wynn nonetheless has two open leverage positions. This consists of 10 instances the size of Doge and sits with an unrealized revenue of $374,095. One other 10 instances longer than Pepe now reveals an unrealized revenue of $30,759.

James Wynn Hyperliquid Open place. Supply: HyperDash

Since returning to the market on July fifteenth, merchants have achieved advanced performances with seven worthwhile trades and eight web losses recorded. On the time of writing, he had a victory fee of 36.6%.

None of those income are enough to reverse his losses, however they nonetheless provide merchants a faint hope.

In the meantime, Lookonchain highlighted one other dealer, not for an enormous loss, however for a sequence of timing strategic bets that received almost $30 million in simply seven days.

He used 4 wallets for lengthy ETH and SOL, “The White Whale,” a prime high-fat dealer who made simply $30 million previously week, with “Meet ‘The White Whale,” and he used 4 wallets for his lengthy ETH and SOL.

Thus, the contrasting efficiency of James Wynn and “White Whale” highlights the high-risk, extremely reward nature of leveraged transactions that may create or lose destiny in just a few hours.