The BNB chain and XRP ledger (XRPL) place themselves because the forefront of the real-world asset (RWA) sector. Each reported a major enhance in RWA values, main development in August.

Nonetheless, this development comes amid a wider decline in sectors, with RWA nonetheless reaching behind different blockchain sectors.

BNB chain and XRPL lead RWA development is declining in broad sectors

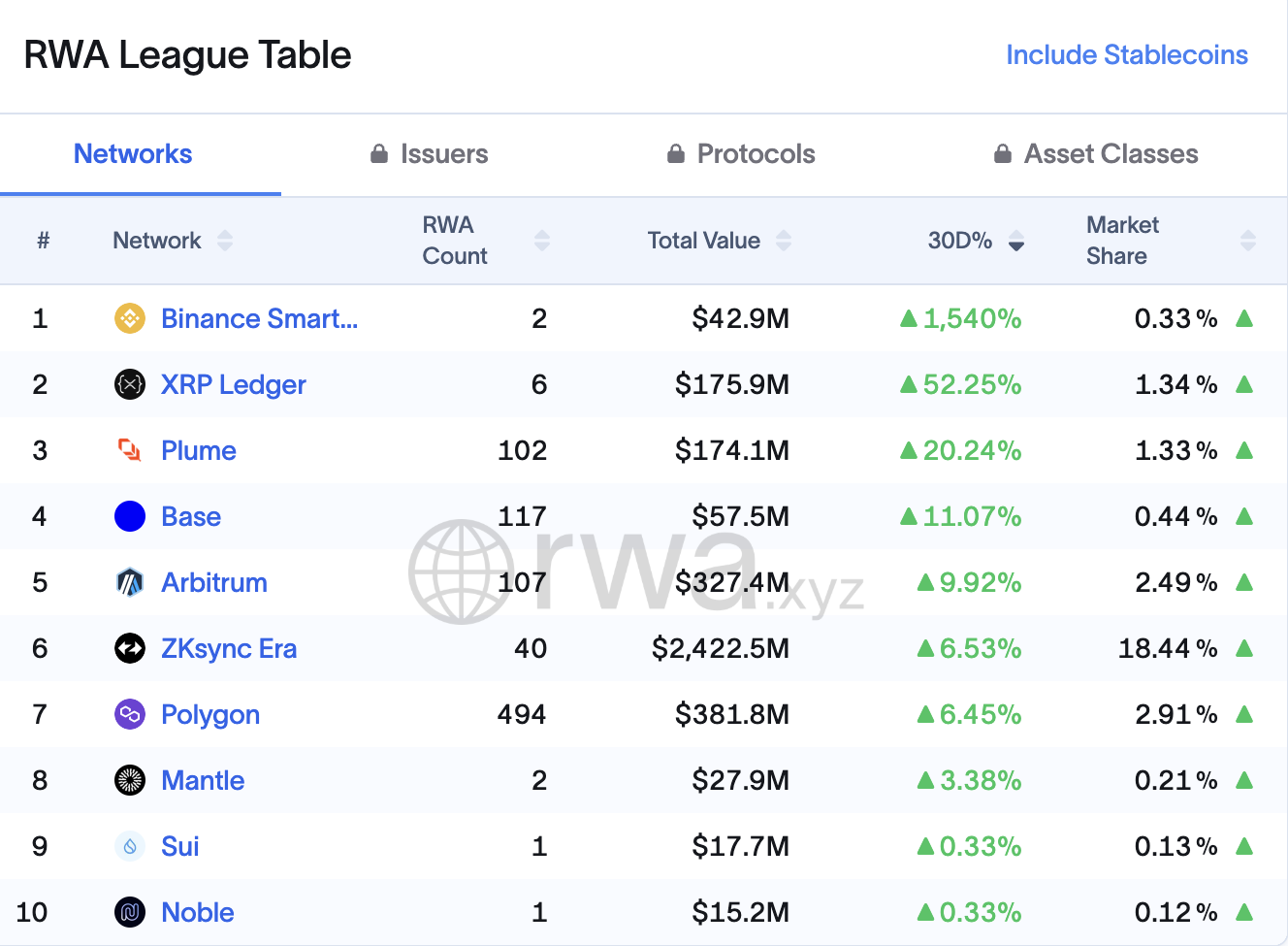

Based on information from RWA.xyz, over the previous 30 days, RWA values on the BNB chain have skyrocketed by 1,540%, making it the perfect winner. Following the community was XRPL, which rose 52.2%.

In distinction, prime protocols by worth together with Ethereum, Aptos, Solana, Stellar, and others all misplaced worth in the identical time-frame.

Main RWA networks from a development perspective. Supply: rwa.xyz

The BNB chain at present holds 0.33% of its market share. Moreover, the primary catalyst for its development is the Vaneck Treasury Fund (VBill).

Vbill is Vanek’s first tokenized fund. It may be used on a number of blockchains, together with BNB chains, Avalanches, Ethereum, and Solana. Supplies chain entry to short-term US Treasury payments.

Equally, the RWA development in XRPL was led by the Openeden Tbill Vault.

“@openeden_x supplies sensible contract vaults managed by regulated entities, offering 24/7 entry to US Treasury invoices (T Buildings) via open Tbill safes, analysts defined.

In the meantime, Easea co-founder Phil Kwok additionally believes he has grown into Ripple’s RLUSD Stablecoin. Beincrypto beforehand reported that Stablecoin is likely one of the quickest rising belongings available in the market.

“A really spectacular development in XRP ledgers. The quickest enhance in real-world belongings in comparison with different blockchains,” Kwok posted.

It’s noteworthy that XRPL has made vital advances in tokenization not too long ago. Beforehand, Ripple labored with Ctrl Alt to assist the true property tokenization undertaking in XRPL’s Dubai Lands division. Moreover, in June, Circle’s USDC Stablecoin was launched on the community.

Particularly, Ripple itself could be very optimistic concerning the development of your entire sector. The report predicted that by 2033 the real-world asset sector may attain $18.9 trillion.

However not everybody shares this optimistic view. Not too long ago, Monetary Large JP Morgan mentioned the general marketplace for tokenized belongings stays “fairly insignificant.”

“This image of disappointment about tokenization displays that conventional buyers haven’t seen the necessity up to now. Up to now, there may be little proof of banks or prospects shifting from conventional financial institution deposits to tokenized financial institution deposits on the blockchain.”

Moreover, the sector is primarily managed by corporations from cryptocurrency, with a complete market capitalization of round $25.7 billion. In truth, its development was comparatively gradual.

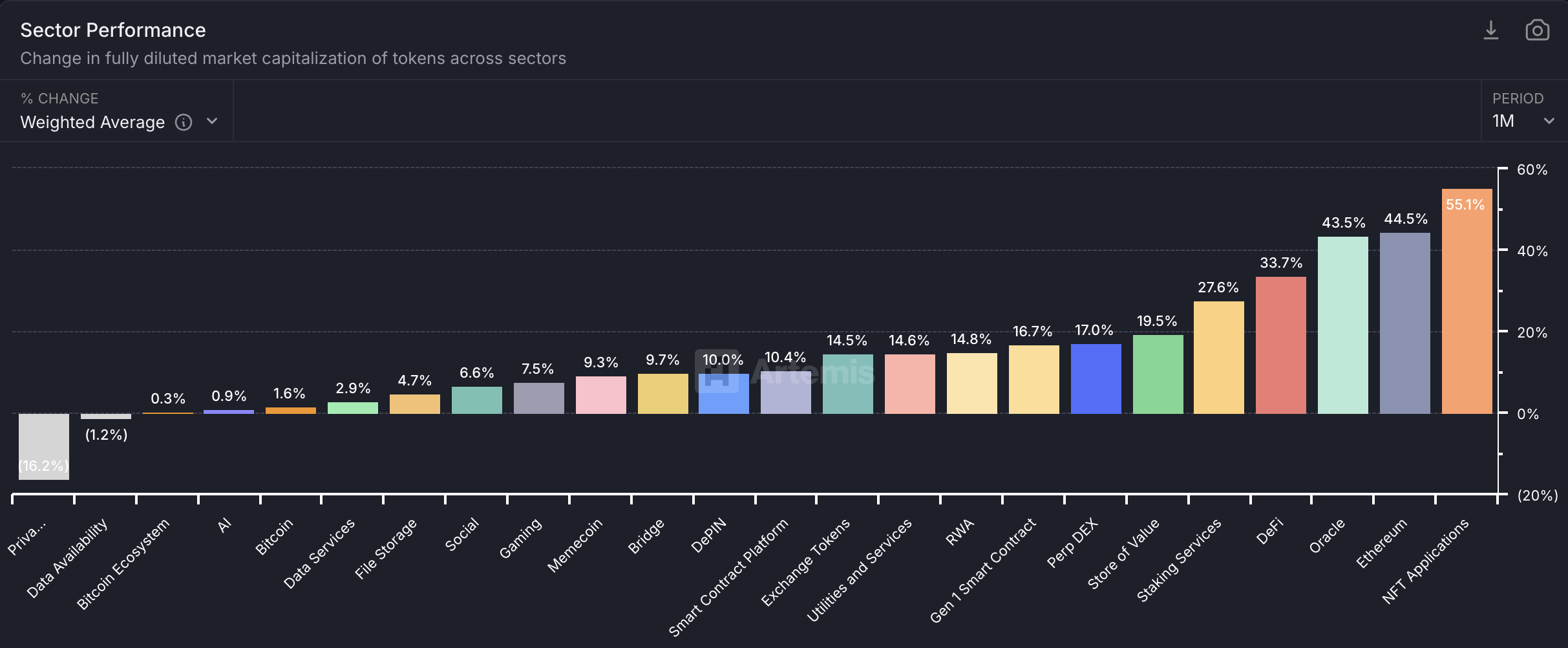

Crypto sector efficiency. Supply: Artemis

Artemis information revealed that RWA has risen by simply 14.8% over the previous month. This determine is extraordinarily overwhelming, particularly when in comparison with the huge development seen in Unimaginable Tokens (NFT), Ethereum, Decentralized Finance (DEFI), and different sectors.