Ethereum costs It is not simply blockchain upgrades and actions on the chain. It additionally results in the identical macroeconomic fashion that shakes shares and bonds. As US authorities closures decelerate vital financial knowledge, the Federal Reserve is going through blind spots forward of its coverage assembly in October. That uncertainty is straight fed to threat property. Consists of ETHthe worth. The chart exhibits the worth of Ethereum in restoration mode, however the shutdown throws it at a brand new layer of volatility.

Why is shutdown essential for ETH costs?

Shutdown will shut down the Bureau of Labor Statistics. This implies there isn’t any official employment stories or inflation knowledge. For the Fed, this is sort of a steering wheel with out devices. Usually, such knowledge facilitates rate of interest choices, which kind liquidity throughout the market. If the Fed hesitates to chop and not using a dependable quantity, dangerous property like ETH costs can lose momentum. Conversely, if personal knowledge (corresponding to ADP pay) seems weak, the Fed could tilt in the direction of extra cuts, improve liquidity and assist ciphers that assist not directly.

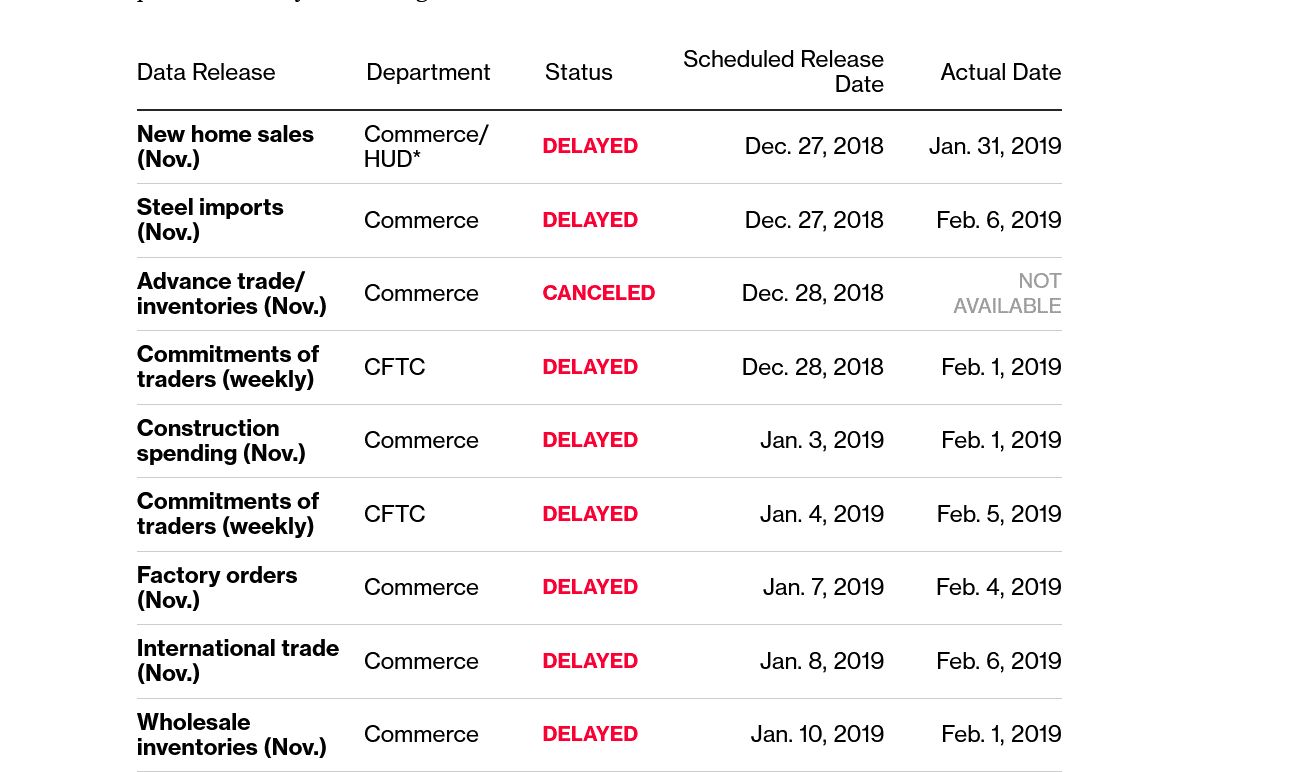

Picture supply: Bloomberg

That is greater than only a principle. Through the 2018-2019 shutdown, delays in reporting have led the Fed to pause hikes charges and spotlight how lacking knowledge will affect insurance policies. If the present shutdown is dragged, ETH costs may swing by shifting Fed coverage expectations moderately than their very own fundamentals. The 17-day closure in October 2013, when BLS was final closed, bringing again stories for each September and October.

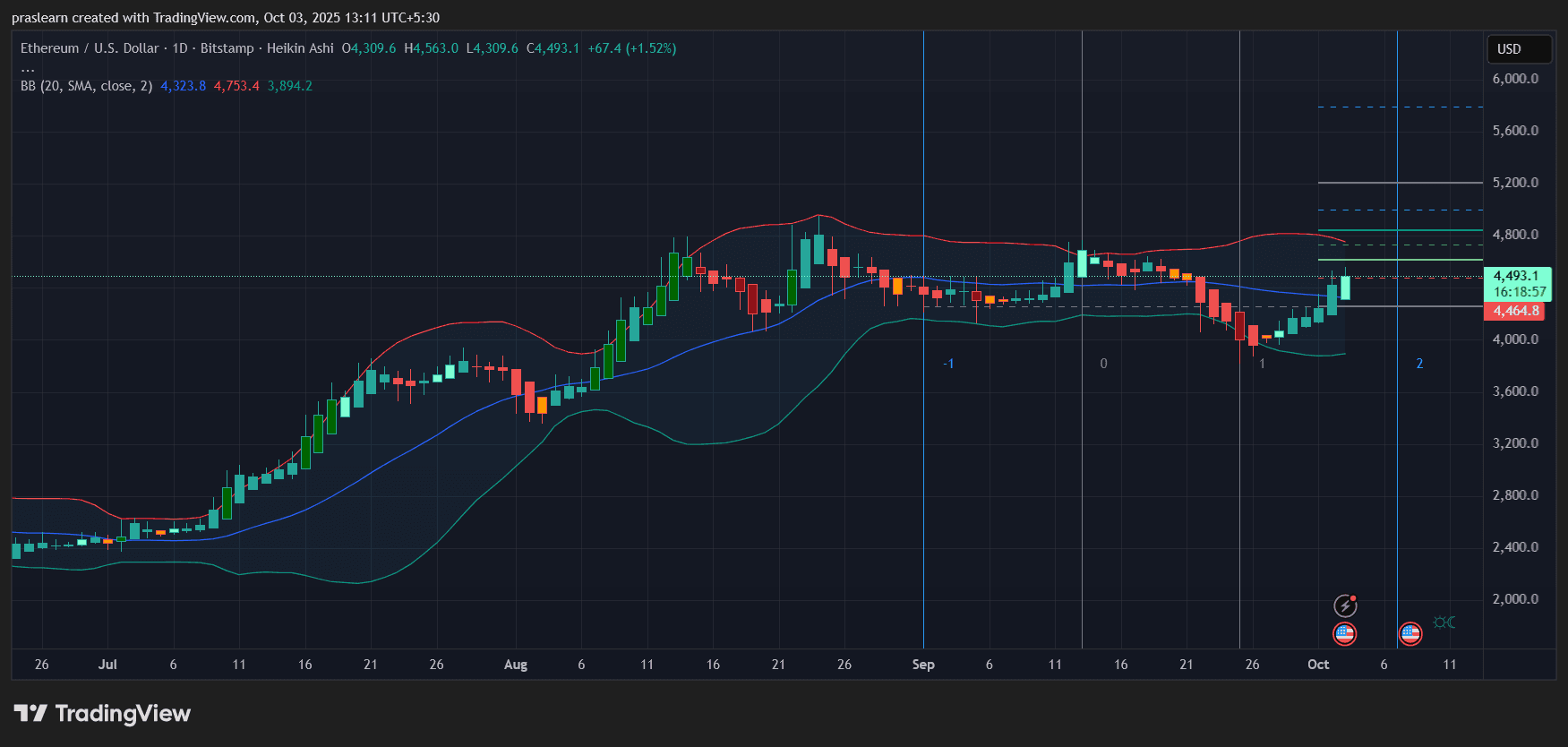

Ethereum value forecast: Learn ETH Every day Chart

eth/usd day by day charts – TradingView

The chart bouncing strongly from the Ethereum priced zone at $4,300 and presently trades round $4,493. Key technical indicators:

- An almost $3,900 Bollinger Band served as assist, with consumers actively intervening.

- Value collects the center band and pushes in the direction of the higher band, which is near $4,750. That is instant resistance.

- A break above $4,750 may see $5,600 when momentum accelerates and open the door to $5,200.

On the draw back, if US authorities closure-driven uncertainty places strain in the marketplace, ETH costs might be revisited at $4,300 after which $3,900. The hikin reed candle additionally exhibits bullish inversion energy, however a quantity examine is required for a sustained breakout.

Shutdown Influence State of affairs for Ethereum Value Prediction

- Quick shutdown, weak personal knowledge

If ADP and different personal indicators present job debilitating and really feel pressured by the Fed to scale back charges, ETH will break by means of resistance and profit from an elevated threat. - Long run shutdowns, meals stalls are given

The dearth of dependable authorities knowledge may end result within the Fed delaying cuts and leaving the market in scope. That indecisiveness allowed him to restrict ETH gatherings and proceed to stuff it with a consolidation of below $4,750. - Market overreaction to uncertainty

If the shares fall into knowledge blackouts and coverage disruptions, ETH can be pulled decrease with the broader threat property and as soon as once more check their $4,300 assist.

Investor Psychology and Macro Correlation

Crypto merchants usually argue that Ethereum costs are indifferent from conventional markets, however historical past exhibits that ETH costs nonetheless react to macrocatalysts. Charges scale back gasoline fluidity, risk-on habits, and stubcoin inflows to defi. Conversely, uncertainty is hungry for speculative demand ETH. At present, shutdowns act as psychological overhangs. Even when Ethereum’s foundations develop into stronger, the dearth of readability from Washington may amplify volatility within the coming weeks.

Conclusion

$Ethereum is on the intersection. Whereas the day by day chart factors to a bullish restoration, the shutdown clouds the Fed’s decision-making course of. That is essential for the following leg of ETH. If the shutdown is resolved rapidly or personal knowledge pushes the Fed in the direction of mitigation, the $ETH may rise to over $5,200. But when political burglars drag and the Fed stalls, Ethereum dangers one other dip in the direction of $4,300. For now, merchants ought to anticipate an increase in volatility and watch each the Bollinger Band stage and the FRED sign fastidiously.