Block, Inc. was based by Jack Dorsey, Twitter co-founder and Ex-CEO. is a monetary know-how firm that deepens its full-stack reference to the Bitcoin business by its subsidiaries. The corporate spans Bitcoin integration, Bitcoin mining {hardware} improvement, open supply software program improvement, decentralized finance protocols for the peer-to-peer market, and even cost apps and service provider instruments with unbiased {hardware} wallets.

Previously known as Sq. and based in 2009, the corporate built-in Bitcoin into its know-how merchandise in 2014 by its most well-known subsidiary, Money App, permitting retailers to just accept Bitcoin funds through the app. In 2021, Sq. Inc formally rebranded Block Inc, doubled its dedication to Bitcoin, affirming its imaginative and prescient for the longer term that Bitcoin blockchain will play an important function. Sq. has develop into a subsidiary of Block Inc and presently offers primarily in cost terminal know-how. Immediately, the block has round $1 billion on its stability sheet, with a median buy worth of $30,405 per Bitcoin.

Of Block’s subsidiaries and investments, most individuals have explicitly linked to Bitcoin or blockchain techniques equivalent to Money App, Bitkey, Proto, Spiral, TBD, and Tidal. All of them drive Bitcoin adoption at varied ranges within the business, growing the affect and appreciation from the Bitcoin group. Jack Dorsey is a serious donor and bootstrapped to a wide range of Bitcoin nonprofits and group efforts, together with OpenSat, which funds open supply Bitcoin improvement and funds many Nostrols (Bitcoin Native Social Community Protocols).

In an unique interview with Bitcoin Journal, Mile Suter and Block product leads, he shared insights into Block’s future imaginative and prescient and his best function for Bitcoin, saying, “I believe Bitcoin will obtain its final future when used as on a regular basis cash. It may well make Bitcoin distinctive and finally keep its core properties that can win in the long run.”

Under is a brief overview of a number of the firms that serve the Bullock Bitcoin-related firms, significantly retailers. This presents an unique quote from Suter about the way it serves its essential function within the path to hyper-bitcoinization.

sq.

Began in 2009, Sq. is a Level of Sale (POS) system that permits retailers to just accept card funds and handle operations equivalent to stock, payroll, enterprise loans and extra. Sq., which served $4 million a yr to sellers as of 2024 and processed $241 billion a yr, has begun rolling out retailers’ Bitcoin funds on the 2025 Bitcoin Vegas Convention, pronounces will probably be in a position to seamlessly settle for Bitcoin through POS {hardware}.

The transfer marks a serious milestone within the integration of Bitcoin with retail cost techniques, establishing a lacking pillar within the enterprise toolkit wanted to make use of Bitcoin as a medium of alternate. “The sq. has greater than 4 million strange retailers, similar to the most effective within the enterprise when it comes to conventional cost processing.

With Bitcoin’s full stack accounting integration, retailers need to settle for digital foreign money, however not as a result of the doorways are broad open attributable to lack of instruments. However the imaginative and prescient is greater than that. “And we will probably be providing a full stack Bitcoin banking suite particularly designed for small companies,” Suter provides, leaning in the direction of the expansion tendencies of Bitcoin finance firms and the methods that dominate Bitcoin information at this time.

Firms will quickly have all of the instruments to just accept Bitcoin funds and can put them instantly into the corporate’s Treasury Division, quite than promoting Bitcoin instantly in {dollars}. If liquidity is required, they’ll already put that bitcoin as collateral and get dollar-controlled loans instantly into their financial institution accounts through firms like Unchained. Suter mentioned, “One in all my favorite issues about this full-stack Bitcoin banking suite is that it democratizes entry to Bitcoin Treasury instruments that have been beforehand solely out there to massive firms. I do not suppose holding Bitcoin in your stability sheet must be a Wall Road luxurious.”

Cache app

Maybe probably the most well-known model within the block portfolio, Money App completes the retail payer aspect the place the Hyper-Bitcoinization Engine Block is constructed. Launched in 2013, Money App is a consumer-centric digital pockets with 57 million energetic customers reported in 2024, providing individual-to-person funds, debit playing cards, shares, Bitcoin transactions and tax returns. Money App reported $10 billion in Bitcoin Supply income in 2024, accounting for 62% of the entire by charging about 2% per commerce.

The Money app can also be the primary mainstream funds app to combine Lightning, the Bitcoin cost community. That is on the forefront of the business, producing probably the most publicly out there and greatest Bitcoin declare revenues, however runs the Lightning community with a 9.7% return. This may solely be achieved by making certain that Bitcoin funds are very environment friendly and dependable, quite than the yield of unusual crypto magic. “To me, it is proof that Bitcoin is already a functioning cost community, not digital gold. It is greater than that. And whereas I do not need to go to weeds right here, we will confidently say that we now have probably the most proficient lightning engineers on this planet engaged on these points.”

Extremely praised for the success of Money App’s Bitcoin integration, Suter mentioned, “I’m very enthusiastic about Lightning’s function in making on a regular basis cash in Bitcoin, and I consider it’s important from Block Inc.’s perspective to Bitcoin’s future, Satoshi’s authentic imaginative and prescient, peer-to-peer digital money.”

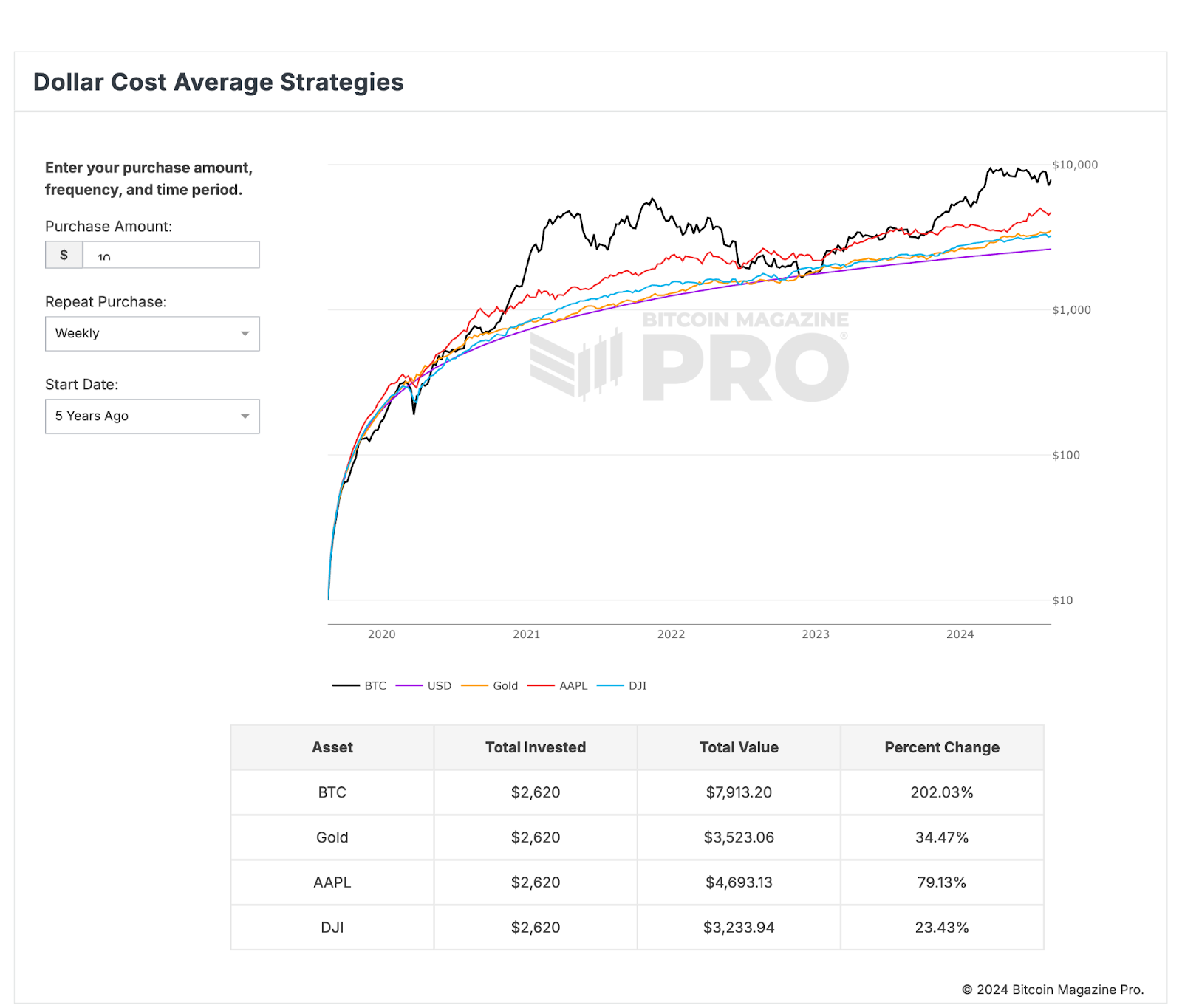

Customers can’t simply buy and ship Bitcoin through money apps, however they can’t automate purchases, an funding technique often known as DCA or greenback price averages.

The mixture of Money App and Sq. unlocks what technicians name the “flywheel.” This can be a time period used to explain a self-enhancing loop of customers and enterprise conduct that may drive companies to new heights, and is often not potential if the constructing blocks of that enterprise logic are lacking. Maybe with these two main integrations, the imaginative and prescient of Bitcoin funds has been dreamed of by early adopters for over a decade, however hasn’t been going very nicely so far, however it’s going to finally develop into a actuality.

Bit key

Fastened to Bitcoin’s basic worth proposition (censorship resistance attributable to particular person freedom and self-control), Block has launched a brand new {hardware} pockets product known as Bitkey. The gadget is designed particularly for Bitcoin safety, which is critical to maneuver Bitcoin to 3 completely different gadgets utilizing a preferred know-how known as multi-signature (personal keys), which decentralizes passwords. Bitkey {hardware} is the third key saved for server restoration, utilizing the person’s credentials and saved within the Google Drive account of the person chosen.

Launched globally in 2024, Bitkey presents a wide range of design decisions that can depart business options different {hardware} wallets. Probably the most main and controversial distinction is that it doesn’t show secret key materials to customers. In contrast to all different {hardware} wallets and most unbiased Bitcoin and crypto apps, Bitkey hides key materials virtually solely from customers, and as an alternative presents a wide range of well-designed instruments to securely defend, recuperate and inherit Bitcoin. Suter mentioned, “We have constructed Bitkey to broaden those that can safely be unbiased. We’re kidding us that Grandma must be unbiased, however that is true and we hear numerous tales of individuals reaching out as a result of onboarding was so seamless.”

This gadget seems to be like each unit with a novel combined stone sample. This can be a deep rethink of self-custody, born from deep criticism of the person expertise of the normal Bitcoin seed backup strategy. The design has been available on the market for only a yr and no public knowledge has been launched on gross sales volumes, however will probably be attention-grabbing to see if they’ll cut up the brand new floor into {hardware} pockets adoption.

This submit is how Jack Dorsey’s Block Inc reinvented funds with Bitcoin, which was first printed on Bitcoin, written by Juan Galt.