Hyperliquid answered the challenges of recent, lasting DEX by opening infrastructure for user-created markets. DEX turns into a everlasting platform with built-in deployed utilizing unbiased liquidity and margin guidelines.

The most important, lasting future Dex, Hyperliquid answered the challenges of its opponents by evolving right into a platform for creating new markets. Alternate founder Jeff Yan has introduced the HIP-3 infrastructure that may allow Builder to create deployed markets.

As cryptopolitan It has been reported Beforehand, excessive lipids have struggled to keep up the enchantment of their platform and enhance native hype tokens. Upgrades and additions will let you maintain excessive lipids forward of your opponents. The HIP-3 market may arrive early subsequent month, permitting for extra various property buying and selling, together with tokenized RWAs. The platform permits builders to show any market right into a everlasting pair of futures, tapping on a wider vary of property outdoors of crypto.

A everlasting new infrastructure that has been depleted with builders often called HIP-3 was introduced in considered one of Hyperliquid’s mismatched channels. The primary launch would require a 500K hype guess, decreased from the unique intention of the 1M hype inventory. As infrastructure matures, the necessities for deploying new, everlasting markets lower.

Initially, the deployer can launch a selected Dex Margin Guidelines Remoted fluidity. Sooner or later, Hyperliquid plans to construct a number of everlasting market alternatives for every deployer. The HIP-3 infrastructure is a bug bounty program that detects some flaws earlier than deploying MainNet, out there on TestNet. Hyperliquid is conscious of bugs and is getting ready fixes, however makes use of them to drive staff engagement.

Excessive lipids present a extra various market

Hyperliquid plans to promote rights to the HIP-3 market at a Dutch public sale. Every new market will launch freed from cost with as much as three property, and maintain auctions for every further everlasting pair.

New markets turn out to be extra various and obtain all property as collateral. It additionally prices twice as a lot as Builder Deployed Dex, however excessive lipids require a 50% discount.

New markets may broaden asset choice and create remoted liquidity in sure initiatives that additionally need their very own everlasting DEX. The platform will evolve with further foolish issues to be decided sooner or later.

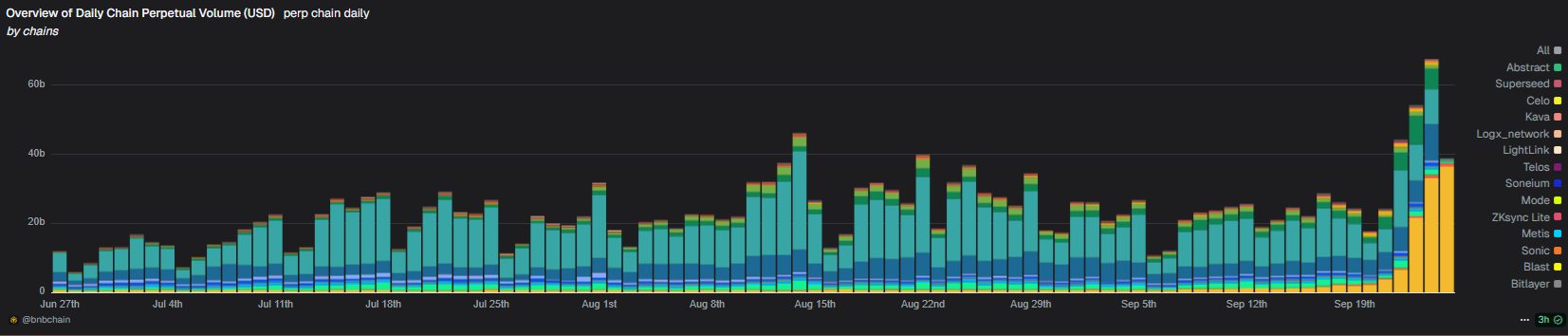

Everlasting Dex extends volumes to new data daily

Over the previous week, Aster’s success has quickly unfold the story of an enduring Dex. This pattern additional affected small markets, with a number of older everlasting DEXs increasing their quantity.

Dex Dex was boosted by the success of Aster Dex, and Dex picked up the exercise. Some small exchanges elevated the day by day quantity by 80% inside days. |Supply: Dune Analytics

Aster has put the BNB Sensible Chain within the highlight as a venue for everlasting futures buying and selling. Over the previous few days, the entire quantity of the 24 main DEX market exceeded $67 billion, with Aster, Lighter and Hyperquid reaching their highest shares.

A few of the emergent everlasting DEXs have questioned the natural nature of quantity progress, rising quantity by 80% in sooner or later. Small markets like Edgex and Paradex are additionally attempting to journey the waves and compete with seen markets.

The competitors knocked out the hype token to $42.45, however Aster additionally fell to $1.92. Additionally, as key property are transferring into the cheaper price vary, Everlasting DEX should face one other market droop.