Bitcoin’s correction took an excellent sharper flip final week as the worth retested the psychological $100,000 worth vary, triggering a heavy wave of liquidations. The premier cryptocurrency has since seen some rebound, however its present market worth remains to be 19.02% off its all-time excessive of $126,198. Hoping for a sustained restoration, the favored analyst beneath the username X PlanD outlined the vital market scenario.

Bitcoin’s 50-week EMA maintains bullish construction – Analyst

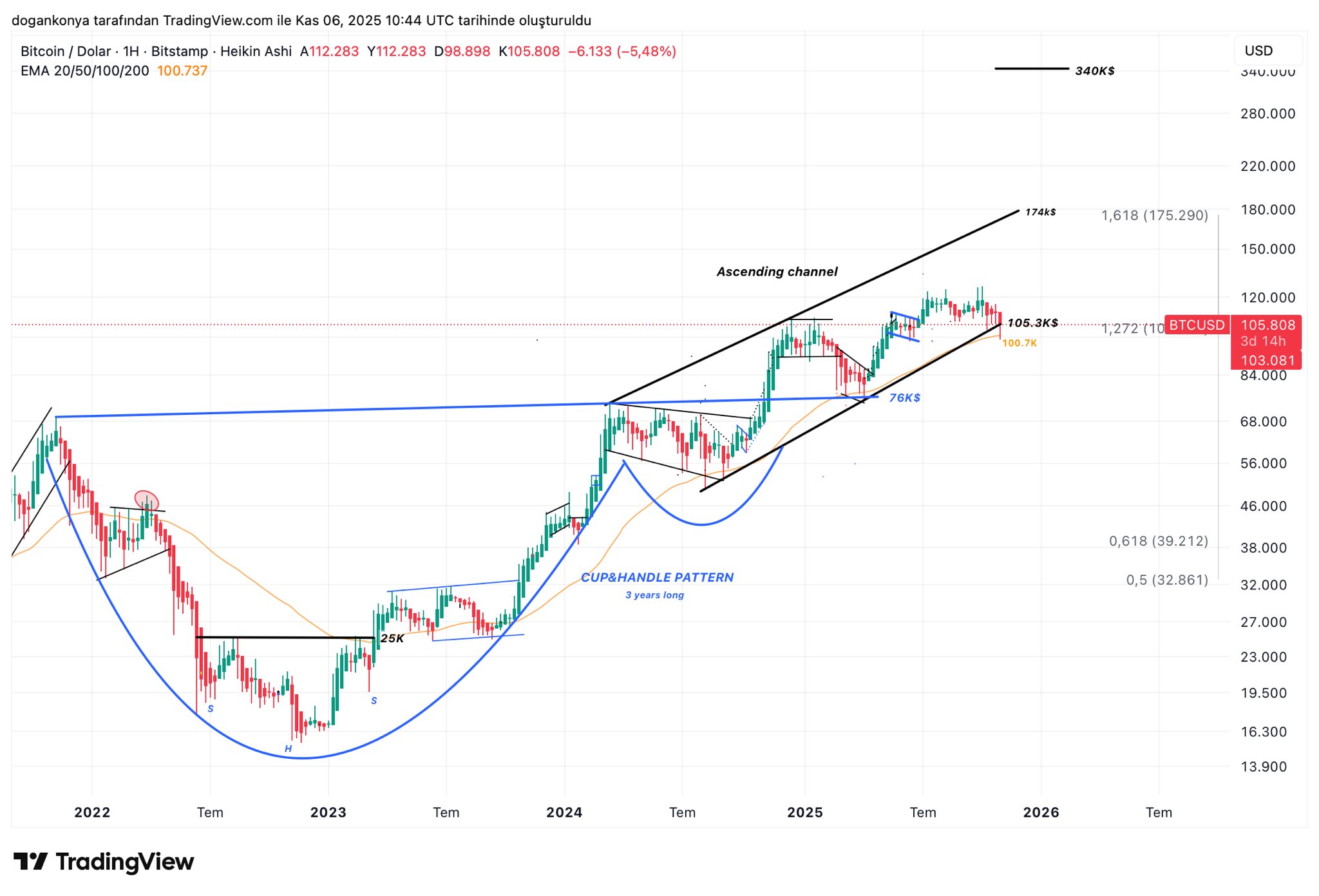

In a November seventh submit on X, PlanD shares an insightful evaluation of Bitcoin’s newest worth actions. A outstanding market skilled factors out that Bitcoin’s rebound to $100,700 could have confirmed the formation of a backside. Whereas a worth decline beneath $100,700 remains to be doable, PlanD emphasised the significance of expecting a bullish weekly shut above this essential help stage.

Specifically, the importance of the $100,700 worth zone comes from its coincidence with Bitcoin’s 50-week exponential transferring common (EMA). Since 2022, this indicator has served as an essential indicator, and worth crosses usually point out modifications in market developments. In the course of the present bull market, Bitcoin has decisively retested the 50-week EMA thrice, every time ensuing within the worth bouncing again to larger ranges.

Bitcoin famously reached this help zone once more in the course of the latest correction, and PlanD explains that that is essential to take care of a bullish construction for a doable rebound. So long as market bulls keep worth factors above this indicator, analysts predict additional bullish worth motion within the close to time period with a possible goal between $116,000 and $120,000.

Following a gradual restoration, additional evaluation from PlanD means that Bitcoin maintains sturdy upside potential, with present momentum per an ascending channel that started in late 2024 and predicted to probably transfer in direction of $176,000. In parallel, a broader cup-and-handle formation has developed since 2023, suggesting an excellent bigger long-term goal of round $340,000, reinforcing the bullish outlook for the asset.

Bitcoin worth overview

On the time of writing, Bitcoin is buying and selling at $102,277, reflecting a slight lack of 0.23% over the previous 24 hours. On the identical time, the weekly and month-to-month losses of 6.98% and 16.23% point out that bearish sentiment nonetheless prevails despite the fact that the worth bounced barely from $100,000.

Bitcoin’s retest of the $100,000 stage has confirmed to be pivotal within the ongoing correction and triggered a number of antagonistic developments. This included buyers’ realized costs dropping to lower than $50,000 and losses for prime consumers amounting to roughly $160 million per hour.

All these occasions, together with the next worth rebound, spotlight the psychological significance of the $100,000 zone within the present market construction.

Featured photos from iStock, charts from Tradingview