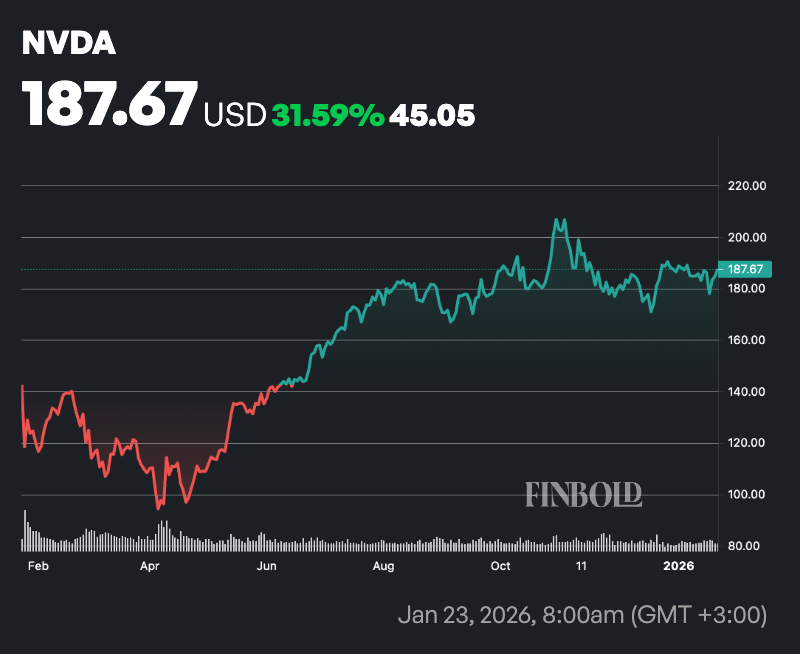

Buyers who purchased Nvidia (NASDAQ: NVDA) inventory instantly after the DeepSeek-related market crash on January 27, 2025 realized vital beneficial properties.

For instance, for those who invested $1,000 on the day of the crash at $118 per share, you’d have acquired roughly 8.47 shares. By January 23, 2026, if NVIDIA trades at $184 per share, that place will likely be price roughly $1,580, reflecting a achieve of $580 and a 58% achieve.

The DeepSeek market crash adopted a pointy decline in expertise shares triggered by the discharge of a sophisticated AI mannequin from Chinese language startup DeepSeek.

The corporate’s low-cost, high-performance fashions, together with the R1 and V3, sparked investor considerations about weakening U.S. management in AI and waning demand for costly {hardware} from firms like Nvidia, prompting widespread promoting throughout the sector.

Nvidia was hit hardest by the selloff, dropping practically 17% in a single transaction, shedding about $600 billion in market worth, the biggest single-day loss in Wall Avenue historical past. The broader market additionally fell, with the Nasdaq down 3.1%.

Nvidia inventory restoration path

Actually, the U.S. tech big started its restoration the following day, rebounding practically 9% as buyers determined the selloff was an overreaction.

Within the months that adopted, the inventory rose steadily on sustained demand for high-performance GPUs in AI coaching and inference.

The robust quarterly outcomes highlighted the resilience of information heart revenues, supported by partnerships with main US expertise firms to broaden their AI infrastructure.

On the similar time, chipmakers’ advances in chip design and software program ecosystems have additional strengthened their place, and sentiment has shifted to the view that extra environment friendly AI fashions will enhance total adoption reasonably than cut back {hardware} demand.

In the meantime, the passion for DeepSeek has died down. Subsequent mannequin updates have been gradual and restricted entry to superior computing, exacerbated by U.S. export controls, which delayed main releases such because the anticipated R2 mannequin.

Geopolitical tensions additionally prevented Western firms from adopting Chinese language AI options, limiting their industrial influence.

On the similar time, U.S. rivals equivalent to OpenAI and Google have strengthened their ecosystem with built-in instruments and enterprise-grade reliability, decreasing DeepSeek’s cost-conscious enchantment.

Featured picture by way of Shutterstock