Newest inflation information means that the Fed is prone to stay conservative in its rate of interest cuts.

abstract

- US Companies inflation remained excessive in August, eradicating hopes for larger rate of interest cuts

- The Fed may reduce rates of interest by 25 foundation factors, as anticipated

- It may damage Bitcoin greater than anticipated rates of interest

Newest inflation information undermines the chance that the Fed will reduce charges greater than anticipated. On Thursday, September 4th, Bitcoin (BTC) was buying and selling at $109,444, reporting a 2.4% decline in service with a excessive inflation fee. Moreover, Altcoins misplaced even additional, with their prime 20 tokens down 2.7%.

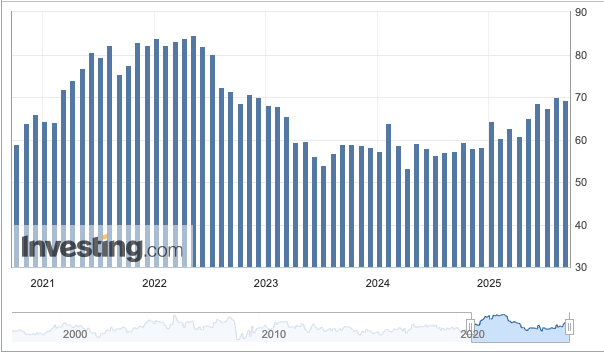

Crypto Markets responded to the ISM Service Value Index, which was 69.2 in August. Service inflation was under the anticipated 69.5 and 69.9 ranges the earlier month. Nonetheless, this determine stays on the degree final seen in 2023, with readings above 50 which means costs are rising.

You may prefer it too: If Bitcoin management is assessed as 57%, you get altcoins: the decline of the Fed’s story?

US Non-Manufacturing Costs | Supply: Investing.com

A rise in inflation numbers may make the Federal Reserve extra cautious when figuring out rates of interest at its September seventeenth assembly. Nonetheless, a 25 foundation level fee discount stays the probably end result, with Polymarket Merchants casting an 86% probability.

You may prefer it too: Program to drop the Federal Reserve, which has elevated scrutiny of banks

The probabilities of a significant fee discount for Trump is much less possible

The brand new inflation information most likely means Donald Trump is pushing for enormous rate of interest cuts. The president has been in search of near-low rates of interest since he was elected. Nevertheless, since July, Trump has set a brand new 1% goal, which has modified considerably from the present 4.25% to 4.50% vary.

Nonetheless, Trump has extra methods to bypass the Fed. For one, the Treasury Division, which is underneath Trump’s direct management, continues to purchase its personal Treasury Division on September 3, and extra not too long ago $2 billion.

You may prefer it too: Bitcoin and crypto markets liable to battle after official Fed warning