MLG Crypto noticed a dramatic worth surge, however rapidly deserted most of its earnings after allegations of an influencer-driven pump-and-dump scheme surfaced. Ought to I put money into MLG?

abstract

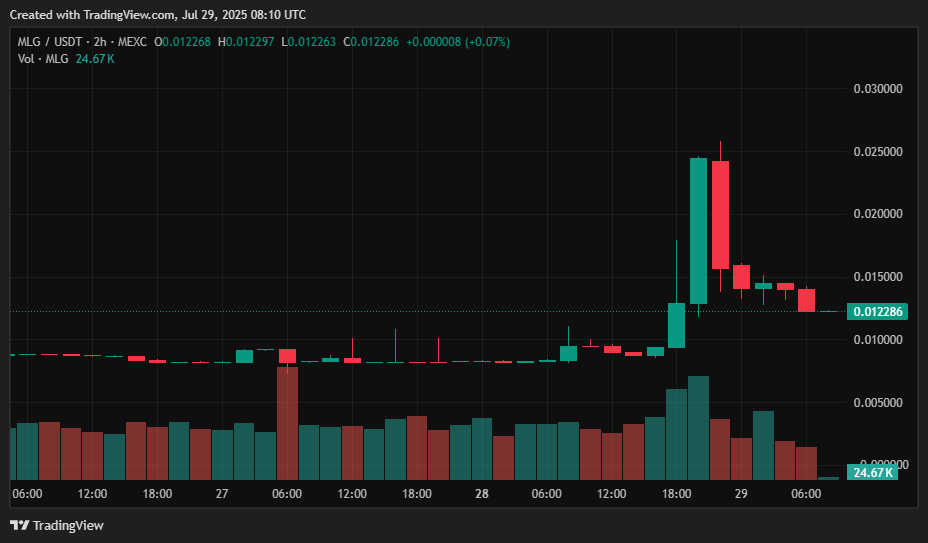

- MLG Crypto went above 180% on July twenty ninth to return to $0.013.

- A lot of the hype was pushed by controversy over alleged pump and dump schemes involving MLG.

- Primarily based in Solana, Meme tokens primarily commerce with decentralized exchanges equivalent to Raydium and Lbank.

Knowledge from crypto.information exhibits that tokens skyrocketed by greater than 180%, reaching an intraday excessive of 0.023 on Tuesday, July twenty ninth. Nonetheless, the assembly was short-lived. The worth rapidly pulled again, stabilizing round $0.0122 on the time of writing.

Supply: crypto.information

Regardless of current spikes, MLG is sort of 92% beneath the all-time excessive of $0.162, recorded in January 2025.

What’s MLG?

MLG is the ticker image for the 360Noscope420blazeit, a Solana-based meme token launched in April 2024. The identify “MLG” nods to main league video games and attracts inspiration from the job calls and aggressive gaming tradition of the early 2010s.

Nonetheless, it is very important be aware that MLG Crypto doesn’t have any official ties to main league video games or dad or mum firm Activision. The tokens use comparable visuals and themes, however these are a part of a nostalgic meme attraction and never an authorized model partnership.

You may prefer it too: Cathy Wooden’s Ark Invests Sol Technique for Solan Staking

Why do MLGs collect?

The most recent rally seems to have been pushed by social media hype and a surge in buying and selling actions, allegedly promoted by well-known influencers, together with Faze Banks, the co-founder of eSports group Faze Clan.

Buying and selling volumes have skyrocketed throughout platforms equivalent to Raydium and Lbank, making MLG/SOL pairs one of the crucial energetic Solana-based decentralized exchanges.

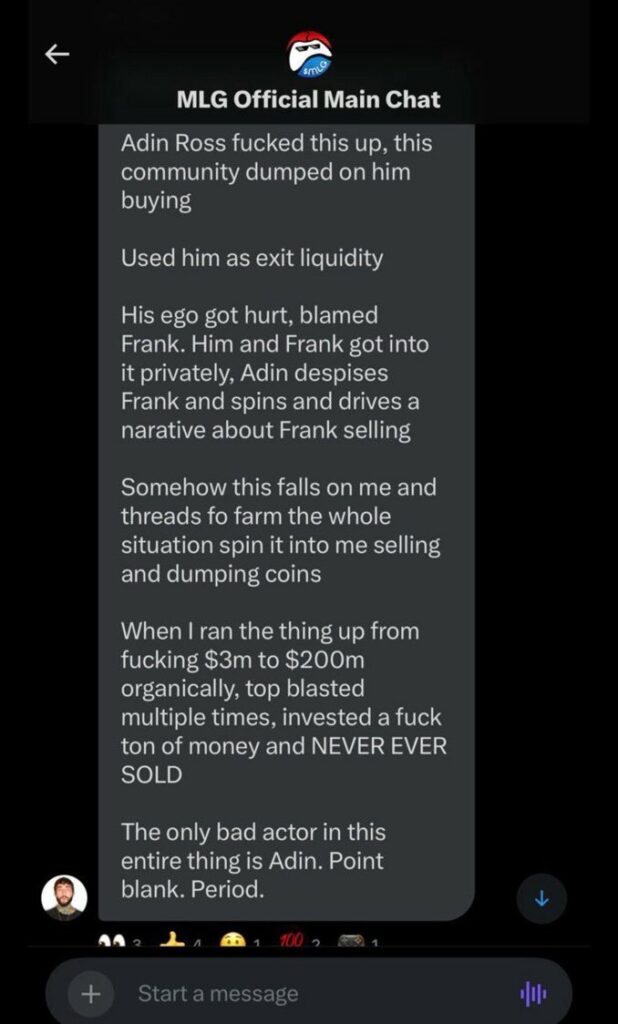

The controversy escalated after financial institution and streamer Adin Ross was accused of manipulating the worth of token earnings. Though each denied fraud, the financial institution introduced that he had resigned as CEO of Faze Clan, citing emotional burnout and harm to his repute.

Banks was seen denounce Ross in a screenshot of the rounds in X.

Supply: Chris on X.

The repulsion contributed to a pointy retracement of the token shortly after peaking.

This isn’t Faze’s first brush with Crypto controversy. In 2021, a number of Faze Clan members have been concerned in selling the “Save the Youngsters” token.

Faze Kay was faraway from the group, however others have been suspended following claims of insider buying and selling and misleading advertising. That historical past added additional skepticism about MLG’s current pumps.

Ought to I put money into MLG?

At present, MLG stays a extremely speculative asset. Its worth isn’t backed up by formal utility, income or product roadmap, however depends on neighborhood momentum, nostalgia, and influencer-driven hype. It could supply short-term revenue alternatives, however its long-term funding outlook is extraordinarily unsure.

The primary concern for future buyers is the character of its commerce atmosphere. MLG is primarily traded on decentralized and uncared for exchanges equivalent to Raydium, Lbank, Xt.com and Meteora.

These platforms are inclined to have extra stringent liquidity administration and fewer restrictive, making it simpler for whales and coordinated teams to govern worth actions with out supervision. This will increase token volatility and makes you weak to pump-and-dump cycles, particularly throughout hype-driven gatherings.

For merchants with excessive danger tolerance, MLGs could be uncovered to quick worth fluctuations and the cultural novelty of meme coin buying and selling. Nonetheless, for prudent or long-term buyers, the shortage of transparency, excessive volatility, and a historical past of influencer-related operations must be thought-about a severe pink flag.

learn extra: Plasma Stablecoin Layer 1 raises $373 million in subscribed token gross sales

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.