Tokenization is shifting from pilot to observe. The World Financial Discussion board predicts that the non-public fairness and enterprise capital market might develop to round $700 billion, which shall be tokenized. Its potential scale will nonetheless reshape international finance.

APAC is already shifting ahead. Hong Kong’s spot ETF raised $400 million on its first day. Japan is getting ready an SBI-backed ETF with Franklin Templeton. Singapore has arrange a tokenization framework. These ETF milestones are essential individually and as stepping stones to broader tokenization.

Promotion of ETFs in Japan: People first, institutional investments later

In an unique interview with BeInCrypto, Max Gokman, deputy chief funding officer at Franklin Templeton Funding Options (FTIS), defined why retail flows, proxy bets, and sovereign implementation might drive the following section.

His feedback spotlight each alternatives and dangers. Whereas ETFs signify an preliminary entry level, the larger story is how tokenization can prolong past asset courses and reset market constructions. Nevertheless, as historical past has proven, markets hardly ever transfer in a straight line.

Japan’s Monetary Providers Company (FSA) up to date its fund pointers in 2025, making room for brand new ETFs with companions comparable to SBI Holdings. Gokman believes retail will present the preliminary liquidity. He argues that after the secondary market matures, monetary establishments will observe go well with.

He sees retail as a catalyst, however historical past means that with out robust demand from pensions and endowments, early capital flows might disappear. The Japanese ETF story exhibits how short-term retail demand can lay the muse for a tokenized market that monetary establishments could finally undertake.

Goffman emphasised that monetary establishments have little curiosity in fractional LP funds. As an alternative, they need a way to handle volatility and improve liquidity, the circumstances needed for large-scale adoption.

“It begins on the retail degree…Retail may have extra liquidity, however as soon as retail is large enough and the secondary market actually begins to flourish, it gives liquidity to monetary establishments as nicely.”

Proxy bets and $2.7 billion Solana provide

Earlier than ETFs, traders chased brokers. MetaPlanet revealed that it has gathered over 15,000 BTC. Remix Level additionally attracted a variety of hypothesis. Hong Kong regulators have warned concerning the leverage and counterparty publicity of spot ETFs when they’re launched.

Goffman famous that Solana already has $2.7 billion in commitments within the lending market. This squeezes provide and drives up costs, demonstrating urge for food however growing systemic danger. These proxy bets show rising demand and clarify why regulated tokenized autos are important for stability.

“Proxy merchandise could be leveraged and carry larger counterparty danger. For instance, lots of the Solana bonds are shopping for up much more provide, however round $2.7 billion has already been dedicated. As extra demand meets restricted provide, costs rise. For ETFs, most conventional crypto ETFs are 1:1, that means that purchasing shares means holding the underlying property on-chain, just like gold ETFs.

APAC Tokenization Edge

APAC markets are the primary to maneuver, however they’re additionally shifting deeper. At Token2049 in Singapore, Franklin Templeton executives met with household workplace and OCIO shoppers. They wished a structured technique fairly than easy publicity.

Singapore’s MAS has expanded Mission Guardian to finish a framework for tokenized funds focusing on retail entry by 2027. The WEF report estimates that the PE/VC market might attain as much as $7 trillion by 2030, of which as much as 10% (roughly $0.7 trillion) may very well be tokenized.

Whereas ETF progress exhibits ambition, APAC’s deeper institutional involvement means that tokenization is a bigger transformation underway. In distinction, Europe focuses on compliance. The US stays mired in uncertainty.

Gokman famous that whereas the US stays Franklin Templeton’s general largest income driver, shoppers within the Asia-Pacific area have gotten extra mature in digital property. This break up exhibits how international technique should stability U.S. scale with Asian innovation.

“Inside APAC, we’re seeing much more sophistication amongst our household workplace and OCIO shoppers particularly in comparison with Western areas. They don’t seem to be simply saying, ‘I would like publicity,’ they’re asking us to construction it a sure means or stroll them via layer two analysis. APAC is certainly a key driver for us.”

Geopolitics and de-dollarization

BIS has documented that the greenback’s dominance is slowly declining. Goffman argued that Trump-era insurance policies made the greenback much less enticing and accelerated demand for digital property.

He mentioned the context was geopolitical. Demand for the greenback weakens because the US clashes even with its allies. For cross-border funds, avoiding SWIFT makes blockchain a transparent different. This dynamic strengthens digital property as impartial rails for international transactions. De-dollarization might function a geopolitical push, making tokenized rails extra pressing than adopting ETFs alone.

“The Trump administration has really been very useful by way of growing the demand for digital property because the greenback has change into much less enticing. Sovereign authorities bonds are being de-dollarized. As giant firms get into DeFi and begin shopping for at scale, that asset class ought to change into extra centralized and fewer unstable. An asset class with 30% annualized volatility is far simpler to consolidate than one with 70% annualized volatility.”

tokens by no means sleep

Not like conventional property that shut down on weekends, tokenized property function 24/7. Goffman expressed this in a single sentence. “Cash by no means sleeps, however tokens by no means sleep.”

For traders, which means tokenization is extra than simply increasing the product menu. It should reset the monetary tempo. Portfolios must adapt to a world the place markets are by no means switched off.

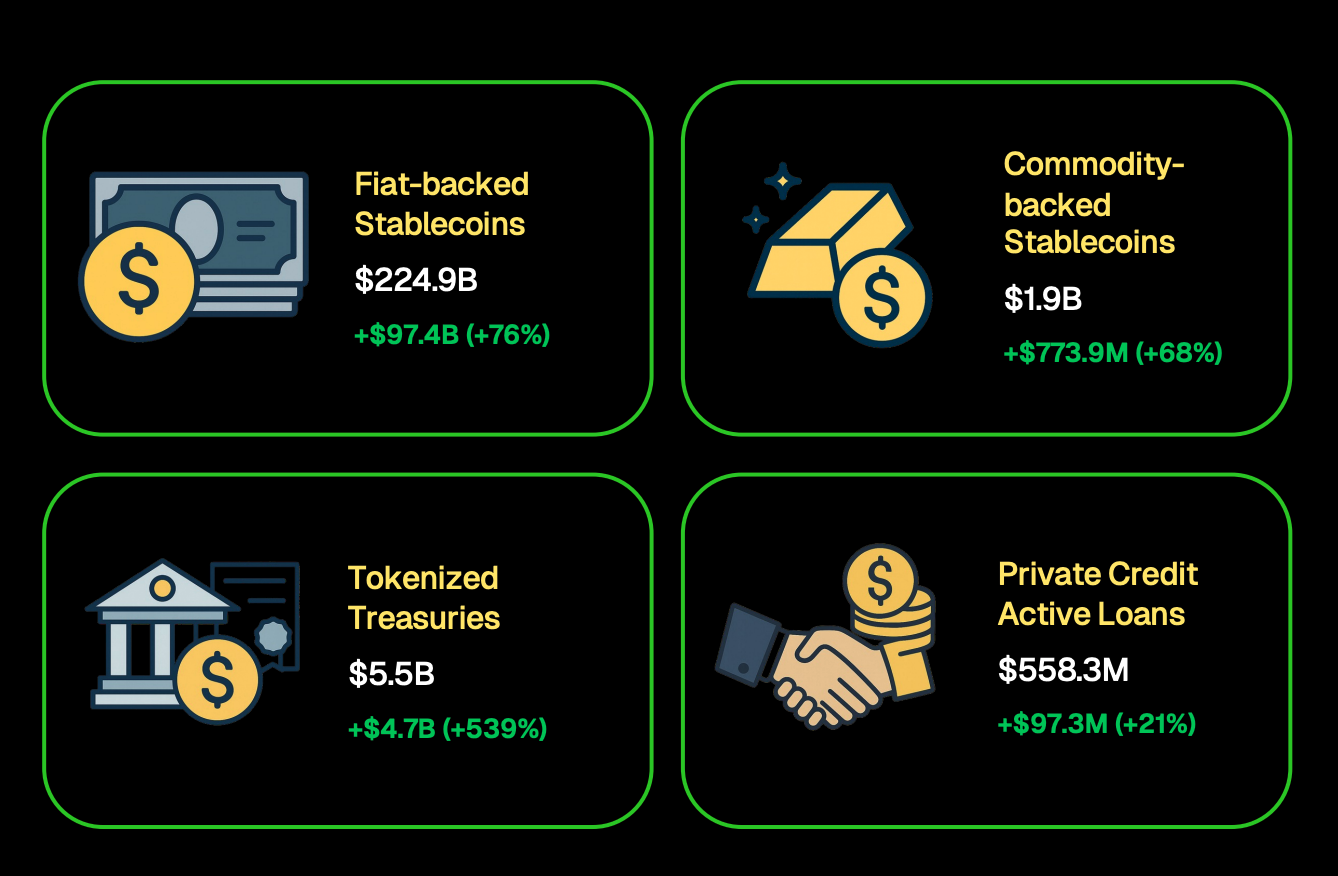

In reality, CoinGecko discovered that tokenized authorities debt has exceeded $5.5 billion and stablecoins have reached $224.9 billion. Whereas ETFs have the potential to deliver crypto publicity to extra traders, tokenization has the potential to redefine how property are traded, settled, and saved worth.

Useful resource: CoinGecko

Within the first wave of tokenization, it’s unlikely that every one property shall be lined without delay. Traditionally, markets begin with devices which can be already liquid and institutionally trusted. Meaning cash market funds, authorities bonds, and index-tracking ETFs are doubtless early candidates.

As soon as belief is constructed, tokenization might broaden to non-public credit score, actual property, and even cultural property. That is an space that Goffman believes blockchain is uniquely enabling.

“We imagine the way forward for all property is tokenized. Conventional markets have legacy operational dangers. To organize for that, we’re actively creating our personal on-chain stack, turnkey portfolio that blends digital, public, and personal asset courses, and even exploring classes like cultural property that may solely exist via tokenization.”

innovation and partnership

Past ETFs, Franklin Templeton is testing new autos. Gokman hinted that the corporate can be contemplating different strategic alliances to broaden its tokenization use circumstances, though particulars concerning the partnership with Binance are nonetheless restricted.

The takeaway for traders is that asset managers are increasing their experiments to scale, regardless that many methods stay secret. The partnership is not only about market share, however how incumbents are getting ready for tokenized infrastructure to go mainstream.