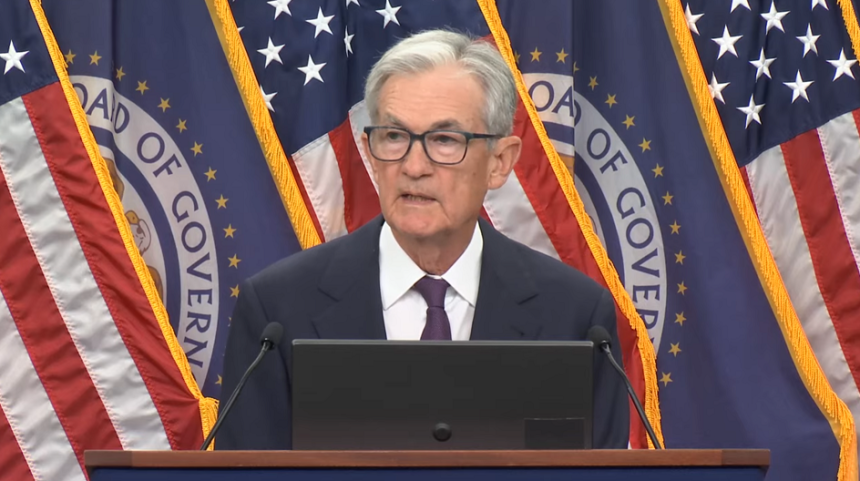

Federal Reserve President Jerome Powell defended the Federal Open Market Committee’s determination to chop rates of interest by 25 base factors. The size locations the goal vary from 4% to 4.25% per 12 months, and the motion he described corresponds to the stability between inflation and employment dangers.

“At the moment, the committee determined to decrease the bottom price at a share location and in addition determined to proceed chopping securities,” Powell stated in a later speech. He added that the Fed continues to give attention to the double mission of most employment and value stability. And that the actions adopted shall be justified by the slowdown in job creation and inflation rebound over the previous few months.

Latest information reveals GDP progress has eased to 1.5% within the first half in comparison with the recorded 2.5% final 12 months. Shopper spending has misplaced energy, however enterprise investments in groups and intangible belongings have elevated. Official forecasts are anticipated to develop at 1.6% in 2024 and 1.8% in 2025.

Within the labor market, unemployment charges rose to 4.3% in August, with job creation falling to 29,000 areas a month on common over the previous three months. Powell defined that among the cuts will reply to lowered participation in duties. And slowing down labor progress. The Fed’s forecast factors to an unemployment price of 4.5% on the finish of the 12 months.

Annual inflation measured by the PCE value index was 2.7% in August, whereas the underlying element was 2.9%. These numbers are increased than these registered originally of the 12 months as a result of rising product costs. In distinction, service inflation maintains a downward trajectory. The median US Central Financial institution estimate stipulates that this 12 months’s indicator will shut by 3% and can drop to 2.1% in 2027.

Powell emphasised that the choice was adopted within the context of rigidity: the upward dangers and employment corridor of fame in inflation. “The downward dangers to extend employment have modified the stability of threat, and because of this, we imagine this assembly could be applicable to take one other step in the direction of a extra impartial coverage place,” he stated.

The market had already discounted the choice. In line with a by-product of the CME Group platform, the likelihood of an annual discount of 4% earlier than the assembly reached 94%.

Bitcoin responds with volatility

The announcement revealed that Bitcoin (BTC) costs confirmed unbelievable volatility. Digital foreign money retreated from $116,000 in 114,900 minutes. He then regained the bottom till he stabilized about $115,500 on the finish of this report. Since then, the response has been sudden Fee reductions are normally interpreted as a stimulus to market liquidityin principle, it helps different belongings equivalent to BTC.

Powell has repeatedly maintained its place because the Fed depends on information and adjusted its financial coverage as inflation and employment evolves. “We’re able to reply in a well timed method to the potential for financial improvement,” he stated. He additionally recalled that the forecast didn’t represent a closure plan and that the financial coverage path could be topic to uncertainty.

Powell was already peering on the rate of interest cuts. As reported by Cryptonoths, he did it in August in the course of the event. On the time, I had already argued that the US labor market was in a “onerous stability of curiosity” and that there was a slowdown in each the 4.2% unemployment price and employee demand.

The chief additionally revealed in the course of the assembly that extra gross sales forecasts have been made at rates of interest for the remainder of the 12 months and since. He stated there was an estimate of Costs begin from 3.6% on the finish of 2025, 3.4% on the finish of 2026, and three.1% on the finish of 2027. He additionally stated the trajectory was a fourth % decrease than the trajectory predicted in June.

Nevertheless, he warned: “As regular, these particular person forecasts are topic to uncertainty and never the committee’s plans or selections.”