essential notes

- The common value of an ETH place at Pattern Analysis is $3,265, and it borrowed $958 million in stablecoins on Aave to purchase Ether.

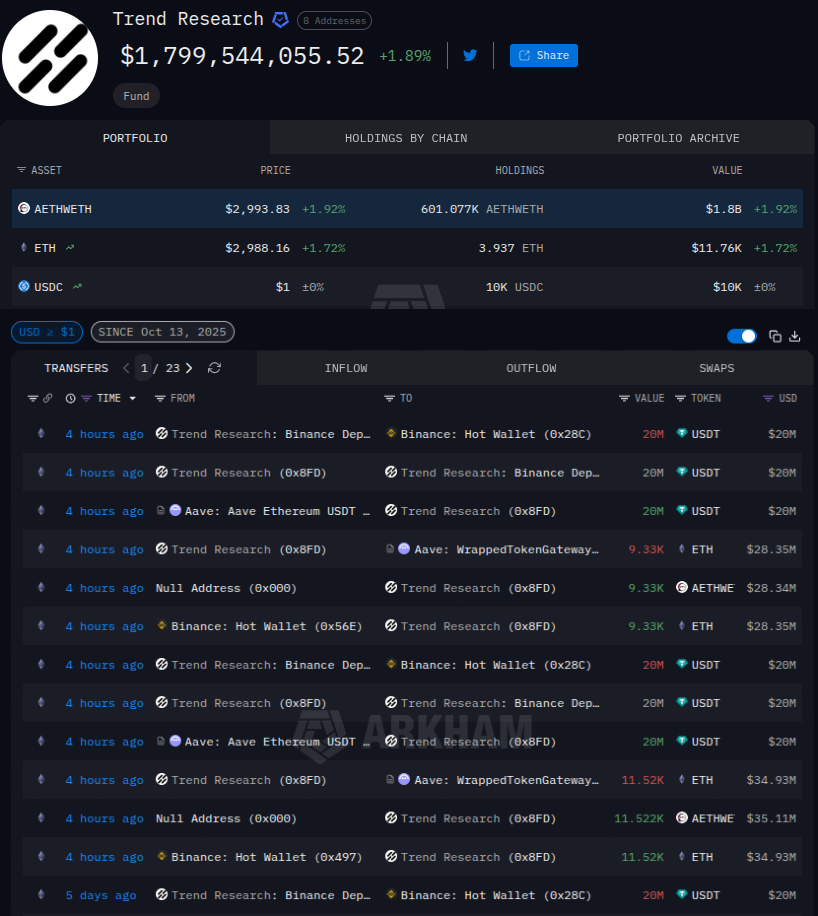

- The corporate holds $1.8 billion in ETH collateral held in Aave’s interest-bearing token, AETHWETH.

- Current exercise on December twenty ninth included two 20 million USDT loans on Aave, each deposited to Binance addresses, adopted by one ETH withdrawal.

Funding agency Pattern Analysis holds a protracted spot place in Ethereum. Ethereum $2,914 24 hour volatility: 0.8% Market capitalization: 35.652 billion {dollars} Vol. 24 hours: $2.341 billion Earn roughly $1 billion in nominal worth by depositing ETH collateral, borrowing stablecoins, buying Ether, and redepositing to Aave. ghost $150.4 24 hour volatility: 2.7% Market capitalization: $23.1 billion Vol. 24 hours: $218.66 million For prime-confidence play with leverage.

This lengthy place was found and reported by Lookonchain on December twenty ninth and its exercise dates again to October 2025.

In keeping with a current submit on X, Pattern Analysis has borrowed $958 million in stablecoins from Aave for its targets.

Pattern Analysis (@Trend_Research_) continues to borrow $USDT to buy $ETH.

Pattern Analysis at the moment holds 601,074 $ETH ($1.83 billion) and owes a complete of $958 million in stablecoins from #Aave.

Primarily based on the on-chain $ETH withdrawal worth from #Binance, the typical buy worth is… pic.twitter.com/MLNVeN8r2l

— Lookonchain (@lookonchain) December 29, 2025

The corporate leverages Ethereum’s DeFi protocol by depositing ETH as collateral and borrowing stablecoins on Aave.

You then use the borrowed stablecoin to purchase Ether on Binance, withdraw the bought ETH to an on-chain tackle, and redeposit a portion again to Aave to collateralize additional leveraged positions and enhance your capability to borrow.

Associated article: Ethereum on the street to $8,500? Analysts affirm preparations for large rally

In keeping with Lookonchain, Pattern Analysis estimates the typical greenback value of buying ETH to be $3,265.

How does Pattern Analysis take lengthy positions on ETH?

On the time of writing, the corporate holds over 600,000 ETH deposited in Aave, which equates to a place value $1.8 billion on the present worth of $2,993 per ether.

This will likely be held within the type of AETHWETH, an interest-bearing token issued by Aave when customers make mortgage deposits, which might later be redeemed by withdrawing collateral, Arkham stated.

The current exercise on December twenty ninth began with a withdrawal of 11,520 ETH from Binance, 5 days after depositing 20 million USDT on the alternate.

This quantity was totally deposited into Aave’s mortgage settlement and used as collateral for the acquisition of one other 20 million USDT deposited with Binance.

This sample was repeated by withdrawing 9,330 ETH from Binance, depositing it again into Aave, then borrowing 20 million USDT once more and depositing it into Binance.

Pattern Analysis stability and on-chain exercise as of December 29, 2025. Supply: Arkham Intelligence

ETH has struggled to interrupt above the $3,000 resistance degree, a key degree that many analysts are watching as a sign of a bullish reversal for the second-largest cryptocurrency by market capitalization. Analysts imagine that if momentum continues, Ethereum might rise as excessive as $8,500.

In the meantime, Aave, Ethereum’s major lending and borrowing DeFi protocol, is experiencing a historic second when it comes to governance.

Aave Labs is pushing a “token alignment” proposal in ongoing neighborhood discussions, however an preliminary associated proposal failed with report token-weighted participation.

Disclaimer: Coinspeaker is dedicated to offering truthful and clear reporting. This text is meant to offer correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Market circumstances can change quickly, so we advocate that you simply confirm the data your self and seek the advice of knowledgeable earlier than making any selections primarily based on this content material.