Bitcoin costs have fallen about 2% prior to now 24 hours and are down almost 3% from yesterday’s highs. At first look, there may be nothing engaging in regards to the worth.

However issues on the backside of the chart, particularly on-chain, have modified for the primary time in nearly three months, and one thing else modified this week. These two adjustments don’t verify an uptick as 2026 approaches, however they may very well be the primary constructing blocks of an uptick.

Momentum begins to vary, however proof is required

Two indicators appeared concurrently. Though they’re separate, timing is vital.

The primary is On Steadiness Quantity (OBV). OBV measures shopping for and promoting stress by way of quantity. From December twenty first to December twenty sixth, the value of Bitcoin was on an upward pattern. OBV didn’t comply. It lowered the treble. It is a bearish OBV divergence. This explains why the value failed to interrupt out (lengthy wick on December twenty sixth), because the small worth improve was not accompanied by quantity.

Weak OBV Might Turn into Stronger: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

This week, OBV broke above the pattern line connecting these decrease highs. This breakout means that stronger shopping for stress is constructing. No sign is seen till the OBV exceeds 1.58 million. If that occurs, Bitcoin worth could lastly react. That hasn’t occurred but.

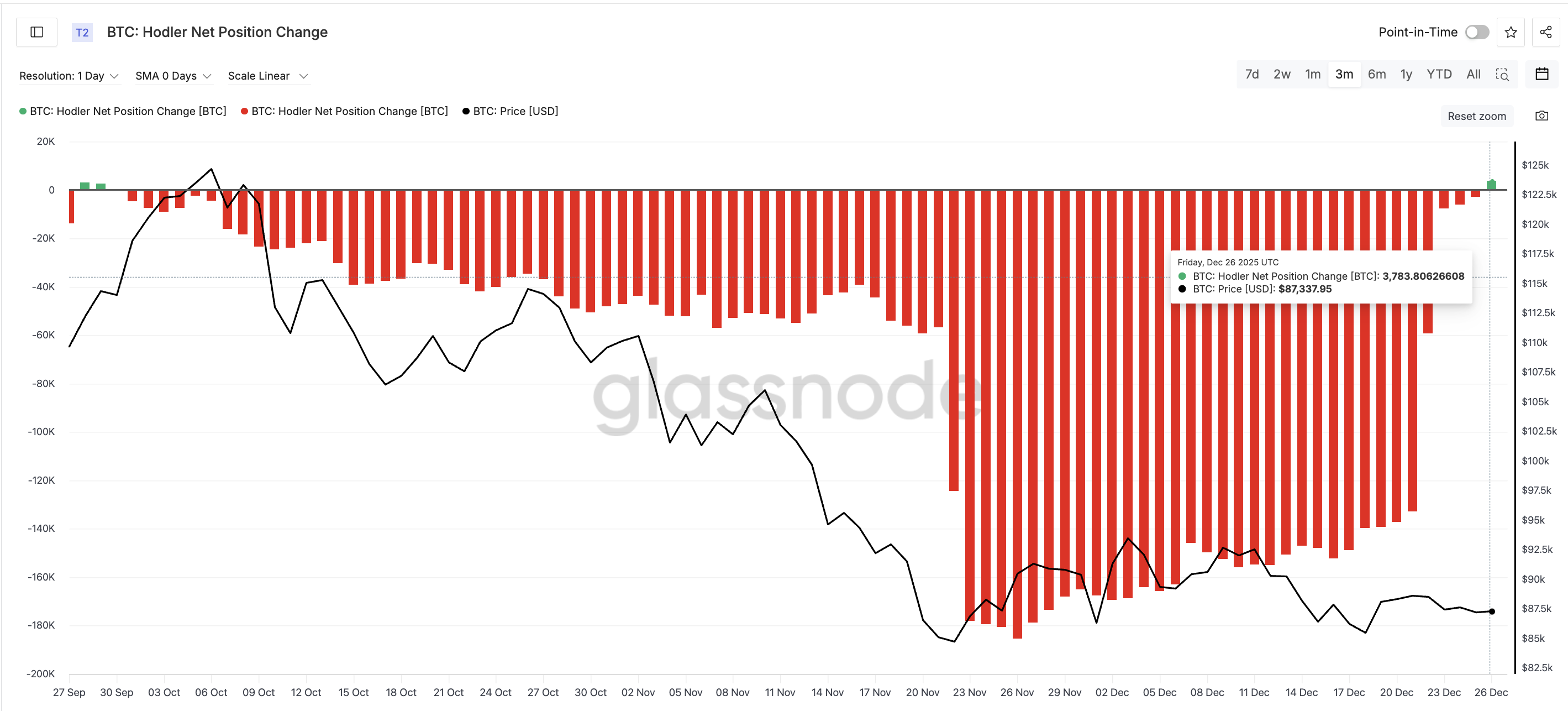

The second sign comes from Hodler’s web place change metric. This tracks wallets held for greater than 155 days. They’re the slowest transferring firms out there.

On December 26, the indicator turned constructive for the primary time since late September. Lengthy-term holders added 3,783.8 BTC. They do not purchase for short-term strikes. They purchase with confidence. That is the primary responsible verdict in almost three months.

BTC HODLers Added Once more: Glassnode

Reduction rallies want each side. OBV should be adopted to the top. Hodler has to maintain including. The absence of 1 or the opposite will not be sufficient.

Bitcoin worth map that can decide the top or starting of 2026

Bitcoin worth nonetheless has work to do. The worth stage tells the reality.

Bitcoin did not regain $90,840 for nearly two weeks. This stage rejected the value on December twelfth and has blocked all makes an attempt since then. Any pullback will really feel short-term till the value rises above that stage.

Above $90,840, the primary actual aid rally checkpoint is round $97,190. BTC worth fell under that stage on November 14th.

If the rally extends, the subsequent zones could be $101,710 and $107,470.

Bitcoin Worth Evaluation: TradingView

On the draw back, the help worth is $86,915. It has been occurring since December nineteenth, and a loss would go away $80,560 in room. Low year-end liquidity will increase that threat. For now, primarily based on long-term investor positioning, Bitcoin worth might rise in direction of $90,840 and even past if the help at $86,910 holds.

The publish Is Bitcoin Worth Heading for a Rescue Rise? The publish Charts Have the Reply appeared first on BeInCrypto.