Bitcoin worth seems to have gotten off to an ideal begin, spending a lot of the new yr above the psychological degree of $90,000. Though main cryptocurrencies have slowed in latest days, the market has proven appreciable bullish intent thus far in 2026.

Now, this newest expression of optimism considerably contradicts latest predictions that Bitcoin costs could also be initially of a bear market. This begs the query – might the bull market be near resuming or is the BTC worth simply witnessing a rescue rally?

BTC’s latest rally is only a bear market rescue rally — Analyst

In a January 9 publish on the X Platform, cryptocurrency analyst Martun shared an attention-grabbing information level to reply the query of whether or not Bitcoin’s latest worth enhance is significant or only a bailout rally. Market consultants have supplied solutions based mostly on each on-chain and technical worth information.

First, Martun acknowledged that the latest surge is inevitable as Bitcoin costs have discovered assist close to the ETF realized worth of $85,000. This worth degree represents the common value foundation of BTC ETF traders, and as anticipated, consumers defended their positions, resulting in a worth rebound.

This phenomenon has been highlighted by the Coinbase Premium Hole, one other on-chain metric that measures the distinction in Bitcoin costs between Coinbase and international exchanges. Maartung mentioned the index began rising simply after New 12 months’s Eve, indicating renewed shopping for exercise by U.S.-based traders.

Moreover, a couple of days after Coinbase’s premium hole rise, we began seeing robust capital inflows into spot exchange-traded funds. “This seems to be extra like strategic shopping for and portfolio rebalancing (new quarter, new yr) than emotional FOMO,” Martun added.

Supply: @JA_Maartun on X

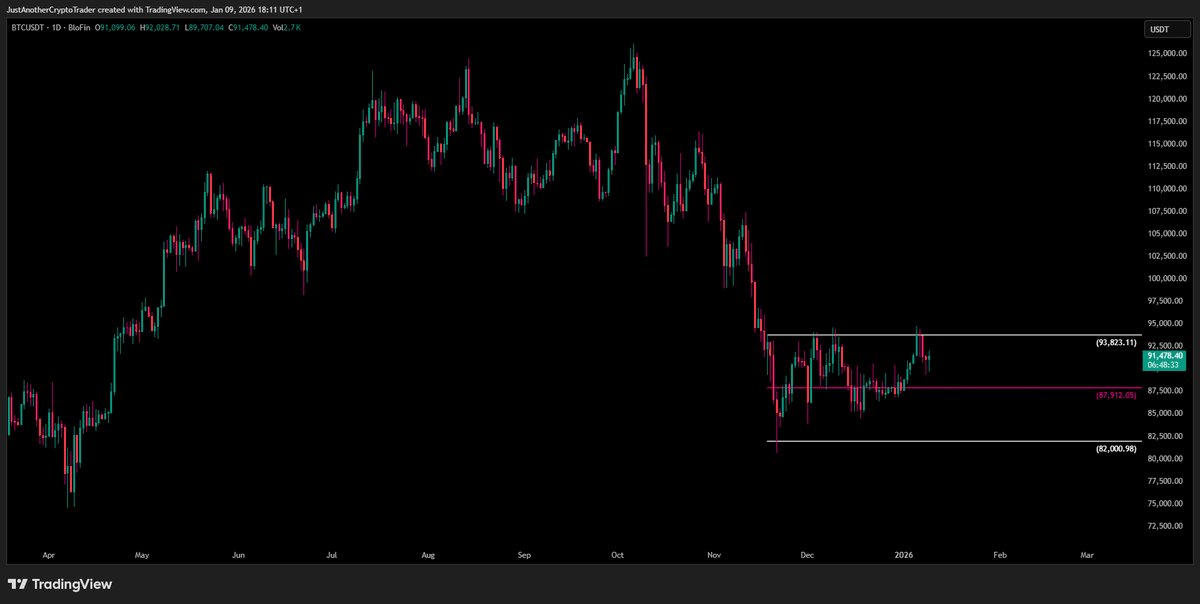

Nevertheless, the crypto analyst identified that this rally was solely rejected by Bitcoin worth rising to a excessive of $94,000. Primarily, this means that the flagship cryptocurrency doesn’t have the bullish power to interrupt by means of its resistance.

Moreover, Martun mentioned Bitcoin remains to be buying and selling beneath key on-chain ranges reminiscent of short-term holder realized worth and whale realized worth, each of that are performing as important overhead resistance.

On-chain analysts identified that although costs rose by round 10%, on-chain observations recommend that this latest rally is solely a bear market easing rebound and never a continuation of the development. Martin concluded that solely a clear break and sustained shut above $94,000 would point out a powerful intention for the Bitcoin worth to rebuild the bullish construction.

Bitcoin worth overview

As of this writing, the value of BTC is $90,360, reflecting a drop of just about 1% over the previous 24 hours.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView