New demand is steadily coming into the area as Bitcoin (BTC) experiences a recession amid ongoing market droop.

Regardless of the worth drop, getting a full 1 BTC is changing into more and more difficult for brand spanking new patrons. This means the change in asset accessibility and investor conduct.

Why proudly owning one bitcoin is a uncommon milestone

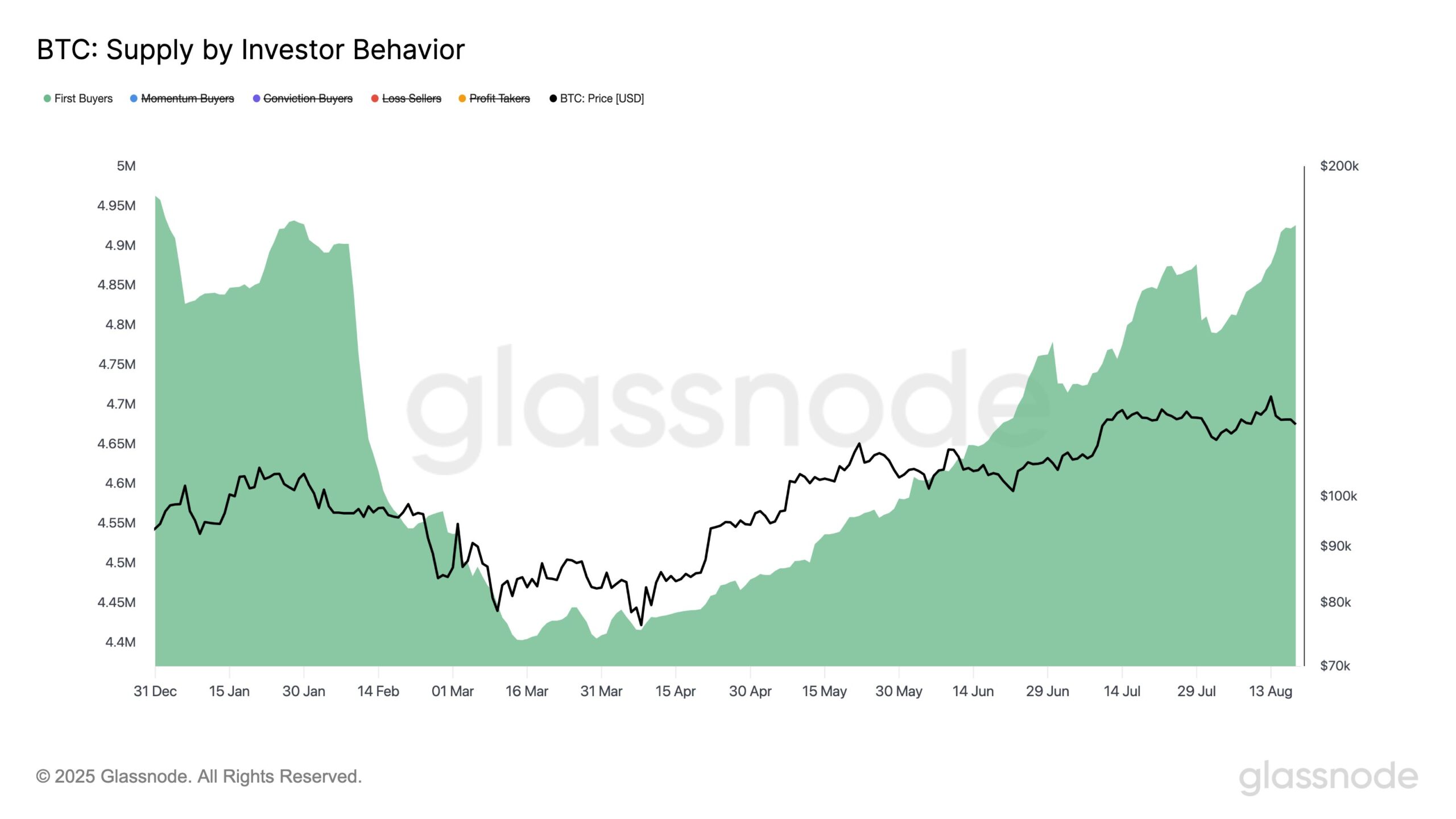

GlassNode, a blockchain knowledge and intelligence platform, reported a 1.0% improve in provide held by first-time patrons. Over the previous 5 days, it has risen from 4.88 million to 4.93 million btc, indicating new demand.

Provide of Bitcoin held by first-time patrons. Supply: X/GlassNode

The current improve in demand for Bitcoin is promising, however at this level it requires a big quantity of capital to amass belongings. This might not be the case for a lot of traders. Coingecko’s report highlights a lower within the variety of pockets addresses holding a number of BTC, correlates with a surge within the value of belongings.

The report revealed that solely about 1 million addresses maintain greater than 100 Bitcoins worldwide. Most of those homeowners had collected Bitcoin by 2018. This was very true when the costs have been very low in early 2017 when Bitcoin traded about $1,000.

Coingecko famous that between 2010 and 2017, such addresses surged from 50,000 to 700,000. Nonetheless, since 2018, solely 300,000 further addresses have been added. This has now totaled over 1 million.

“When Bitcoin exceeds $100,000, which means you will be 100 instances extra Coiner than 2017. You will additionally discover that the general Coiner quantity has really decreased since 2024, in keeping with Bitcoin ETF approval and facility adoption,” the report learn.

Coingecko steered that a rise in institutional traders contributes to the focus of Bitcoin wealth among the many wealthiest people. This development could clarify the decline within the general variety of Coiners, as some early Bitcoin holders who collected belongings previous to 2018 could also be promoting their holdings to patrons of those establishments for long-term earnings.

Moreover, the report famous that, after accounting for misplaced cash, substitute reservations and holdings throughout the facility, lower than 4 million BTCs are theoretically out there for retail acquisitions. This rarity underscores the rising problem of attaining “all coiner” standing. This might carry one thing extra psychological than its precise significance.

Nonetheless, Coingecko defined that as Bitcoin costs rise, possession of fractions may nonetheless characterize substantial wealth.

“Bitcoin’s most optimistic value mannequin means that we’re heading in the direction of a actuality the place a single coin may attain $500,000 or $1 million. If these predictions show correct, proudly owning even 0.1 Bitcoin (equal to $50,000-$100,000 at these costs) may characterize a big wealth,” the report added.

Trade leaders are additionally redefining the idea of proudly owning full Bitcoin. Changpeng Zhao (CZ) has beforehand steered that 0.1 BTC can surpass conventional benchmarks like homeownership, and has positioned it as a brand new American dream. This modification displays the altering perceptions as Bitcoin matures.

“The present American dream is to personal a house. The longer term American dream is to personal a 0.1 BTC. This might be greater than the worth of a US dwelling,” CZ stated.

However, different components that have an effect on traders’ conduct moreover value could possibly be a decrease Bitcoin volatility. Since 2022, BTC has proven that it has much less volatility than megacap expertise shares like Nvidia.

“And regardless of putting a brand new excessive and present process a serious revision since 2024, volatility continues to say no, and it’s now nearing a five-year low, which is strictly what you’ll be able to count on from a mature asset.

This stability is in keeping with expectations for established belongings. Nonetheless, it contrasts with the high-risk, high-reward attraction that draws many retail traders.

Posts are making Bitcoin too costly for retail traders? It first appeared in Beincrypto.