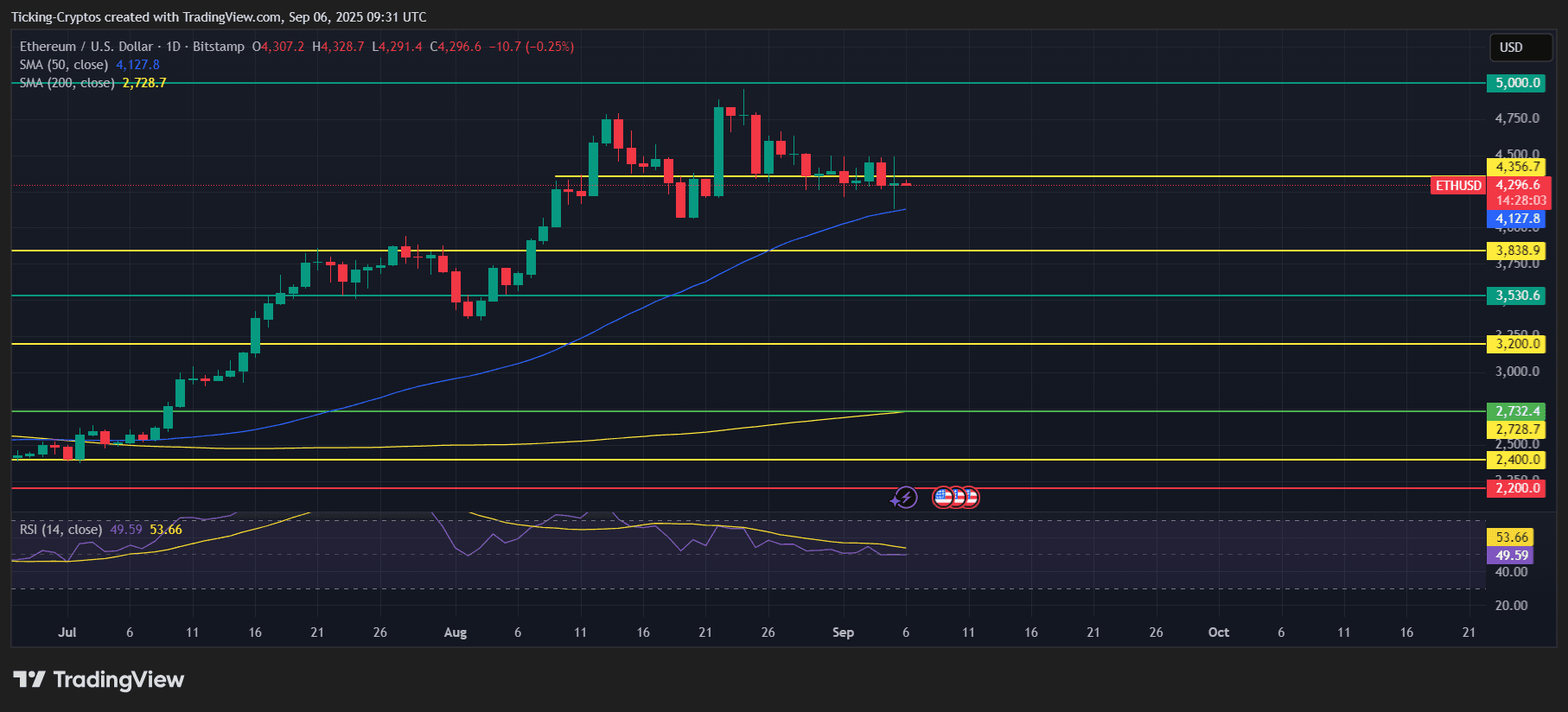

Ethereum ($ eth) It’s on the essential level of the chart. After weeks of volatility, the worth will merge round $4,300, balancing sturdy technical assist and harsh resistance. As Crypto Market searches for instructions, Ethereum efficiency permits you to set the tone for the following main Altcoin motion:

Key assist and resistance ranges

- Quick assist: $4,127 (50-day SMA)

- Resistance zone: $4,356 – $4,500

- Secondary assist: $3,838 and $3,530

- Key assist: $2,728 (200-day SMA)

- Upside Goal: $5,000 psychological barrier

ETH/USD 1-Day Chart – TradingView

The chart exhibits ETH is repeatedly testing the $4,127 stage. Right here, the 50-day transferring common serves as a cushion. The decisive bounce right here might promote a pushback to $4,356 or later, however the breakdown might open the door to $3,838 or $3,530.

Momentum and RSI indicators

Ethereum’s RSI is hovering close by 49–53sitting on impartial floor. This means that the market continues to be undecided and neither the bull nor the bear holds management. Breaks above RSI 55 could cause bullish momentum, however slips under 45 may also affirm draw back strain.

Portfolio Supervisor Takes Ethereum Costs

From an expert buying and selling and portfolio administration perspective:

- A bullish state of affairs: If the ETH breaks past $4,127 and exceeds $4,356 resistance, it is more likely to cross to $4,750, and finally $5,000. Portfolio managers can justify a rise in publicity if the institutional influx displays the energy of Bitcoin.

- Bearish state of affairs: The danger of underneath $4,127 will drive gross sales strain and convey ETH again to $3,800 or $3,530. The portfolio supervisor might take into account a place trimming or hedge publicity if this assist fails.

Danger administration stays vital as ETH is built-in close to short-term trendline assist.

Ethereum worth forecast: What’s subsequent for ETH costs?

Within the quick time period, $Ethereum might commerce inside Vary of $4,127 – $4,356 Till the catalyst offers off momentum. If it exceeds $4,356, a retest of $4,750 can be set, and finally $5,000. On the draw back, shedding 50 days of SMA might set off sharper fixes in the direction of $3,800 and $3,530 earlier than stabilizing.

For long-term buyers, the $2,728 200-day SMA stays a line within the sand. So long as the ETH is stored above it, the macro-up pattern stays.