Ethereum is barely crossing the crucial $3,000 degree because the broader cryptocurrency market battles excessive promoting strain. Fears stay excessive, liquidity is reducing and buyers are bracing for larger volatility. However regardless of the decline, some analysts argue that this setting is beginning to appear like a traditional oversold setup that has traditionally offered long-term gamers with highly effective accumulation alternatives.

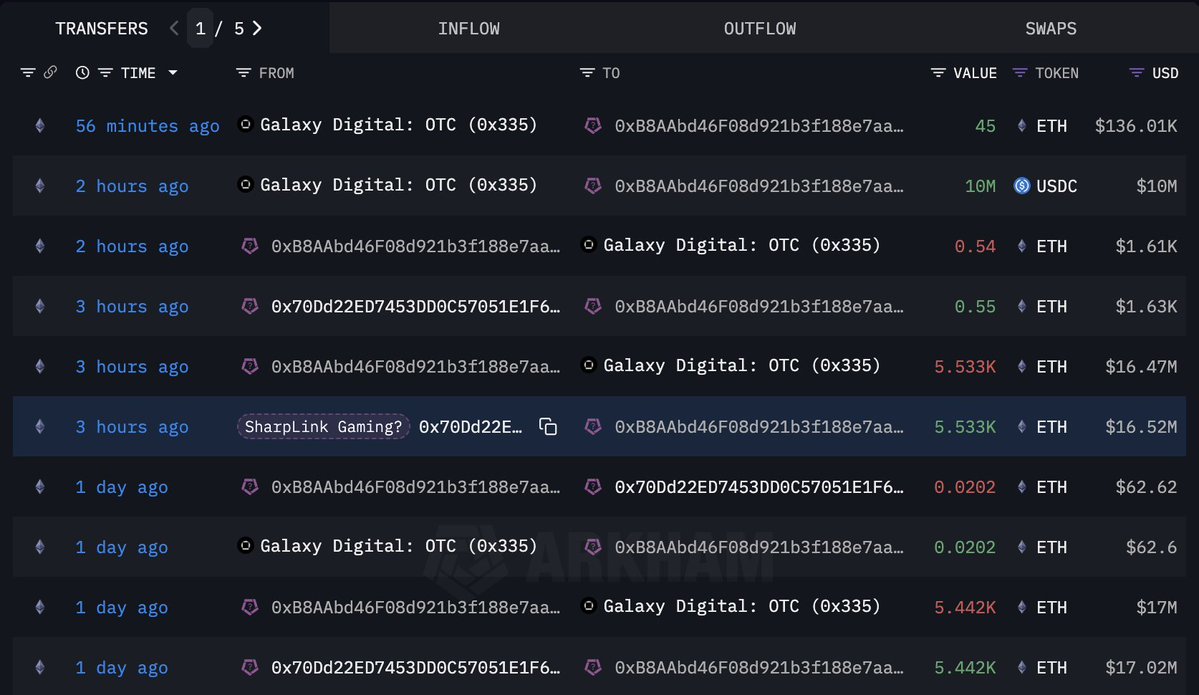

Including to the intrigue, new knowledge from Lookonchain exhibits uncommon on-chain exercise involving wallets doubtlessly linked to SharpLink Gaming. The transfer sparked intense hypothesis throughout markets. It’s because massive OTC trades usually indicate strategic repositioning of institutional individuals fairly than panic promoting.

This exercise is noticeable at moments when Ethereum is testing key assist ranges and sentiment is overwhelmingly bearish. The truth that important OTC flows are nonetheless occurring means that good cash is working beneath the floor whilst retail panic grips public markets.

SharpLink linked pockets sparks sell-off hypothesis

A pockets doubtlessly linked to SharpLink Gaming (handle), based on new knowledge from Lookonchain. 0x70dd) has executed a sequence of large-scale transactions which might be gaining consideration throughout the Ethereum market. Within the final two days, the pockets transferred 10,975 ETH, value roughly $33.5 million, to the Galaxy Digital OTC pockets. Quickly after, 10 million USDC was returned from the identical OTC handle, elevating questions concerning the nature of this motion.

Lookonchain publicly asks the query floating round amongst analysts: Is SharpLink Gaming promoting ETH? The transaction is just like a structured OTC sale, the place massive holders offload belongings with out affecting the general public order guide, however there was no affirmation but that the funds belong on to the corporate. Nevertheless, the timing of the switch is attracting consideration. Ethereum is buying and selling close to a key assist zone round $3,000, with liquidity tightening throughout the market as panic promoting accelerates.

Whereas massive OTC flows like these usually signify strategic repositioning fairly than emotional promoting, they’ll nonetheless form market sentiment. If this was actually a sale, it could add to the narrative that the establishment decreased its publicity throughout the adjustment course of. If it have been merely a Treasury reorganization, the influence could also be a lot lower than it seems. The market is presently watching intently.

$3,000 assist examined as momentum weakens

Ethereum is hovering simply above the crucial $3,000 assist space, which has change into a battleground between consumers looking for to defend the development and sellers looking for a deeper decline. The each day chart exhibits a transparent and sustained downward development that started after ETH didn’t regain the $4,000 area in late October. Since then, decrease highs and decrease lows have outlined the value motion, with ETH unable to interrupt above its 50-day shifting common. It is a signal of weakening momentum.

The 100-day and 200-day shifting averages are additionally exhibiting a downward development, reinforcing the bear market construction. Costs are presently hovering under all main shifting averages, which is commonly a precursor to prolonged corrections in previous cycles. Nevertheless, the $3,000 to $2,950 vary has acted as a robust demand space a number of instances all year long, and consumers are trying to defend it as soon as once more.

The candle has an extended, low wick forming close to this degree, suggesting that some dip consumers are concerned, however confidence remains to be restricted. If ETH decisively loses $3,000, the subsequent notable assist degree can be round $2,750-$2,800. However, a restoration of the 50-day MA close to $3,400 can be the primary signal of a possible change in momentum after a number of weeks of promoting.

Featured picture from ChatGPT, chart from TradingView.com