The NFT motion seems to be gaining momentum once more, and is projected to develop considerably over the following few years, pushed by a rise in adoption ranges.

Though sure metrics present regular rejuvenation, we stay removed from the glory period we skilled a while in the past.

Progress is predicted

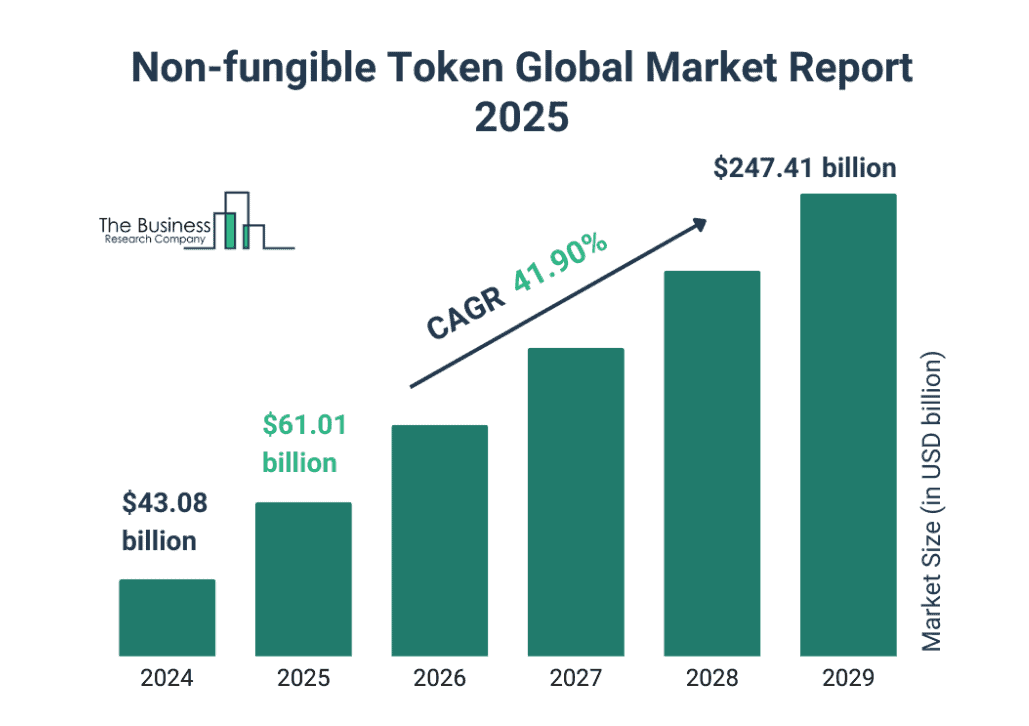

The inappropriate token (NFT) market exhibits indicators of revival, based on a report by analytics platform coinlaw.io. It’s projected to develop lots of of billions by the tip of the last decade by transferring from speculative artwork to an interconnected ecosystem starting from trend, gaming and even authorized points.

Present forecasts present that the worldwide NFT market will exceed $600 billion in 2025, with a mixed annual progress price (CAGR) of practically 42% to exceed $247 billion by 2029.

The foremost traits stay gaming and digital artwork, accounting for the market measurement of 38% and 21% of worldwide NFT transactions, respectively. A number of upcoming strikes, corresponding to actual property, have surpassed $1.4 billion in quantity, with plant tokens linked to bodily items, main transaction volumes elevated by 60%.

Institutional and enterprise capital (VC) corporations additionally appear to be interested in the market, with the latter investing $4.2 billion in NFT tasks this 12 months alone. Monetary giants like Goldman Sachs and JPMorgan have regarded into tokenization for collateralizing digital belongings, whereas corporations like SoftBank and Sequoia Capital have expanded tokenized digital belongings.

Moreover, there have already been purposes by Canary Capital, the Asset Supervisor of Pudgy Penguins ETF, which may probably retain a mixture of Pudgu Meme Coin and Pudgy Penguins NFT collections.

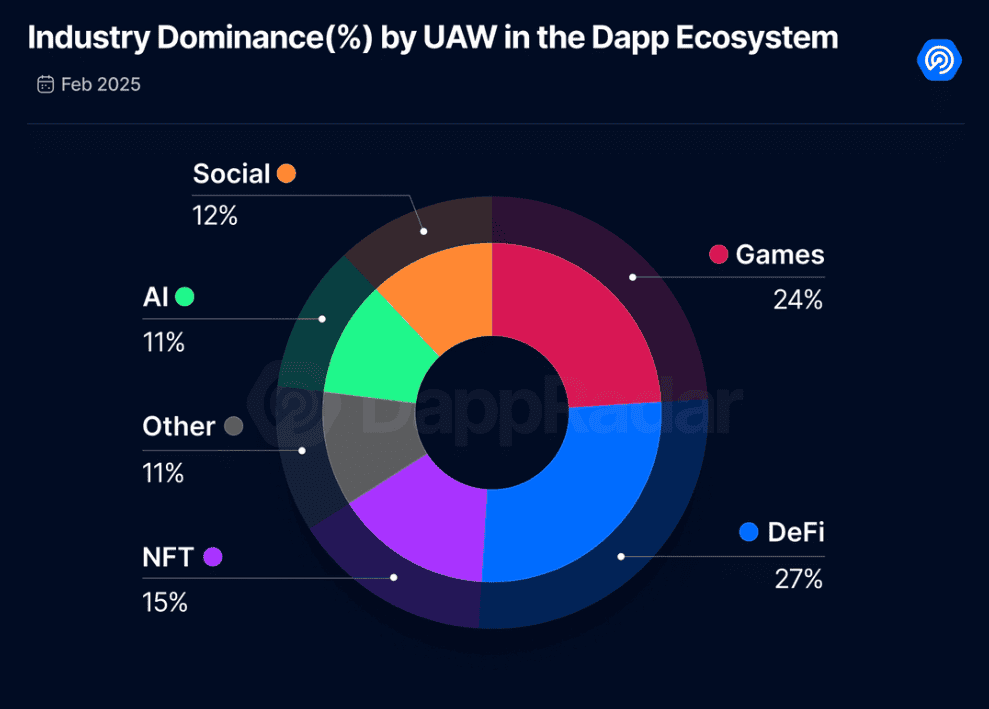

Moreover, inconceivable tokens have a bigger share than AI and socially distributed purposes (DAPP), ensuring to grasp the trade’s benefit, significantly in the case of distinctive energetic wallets (UAWs).

Transaction quantity and gross sales

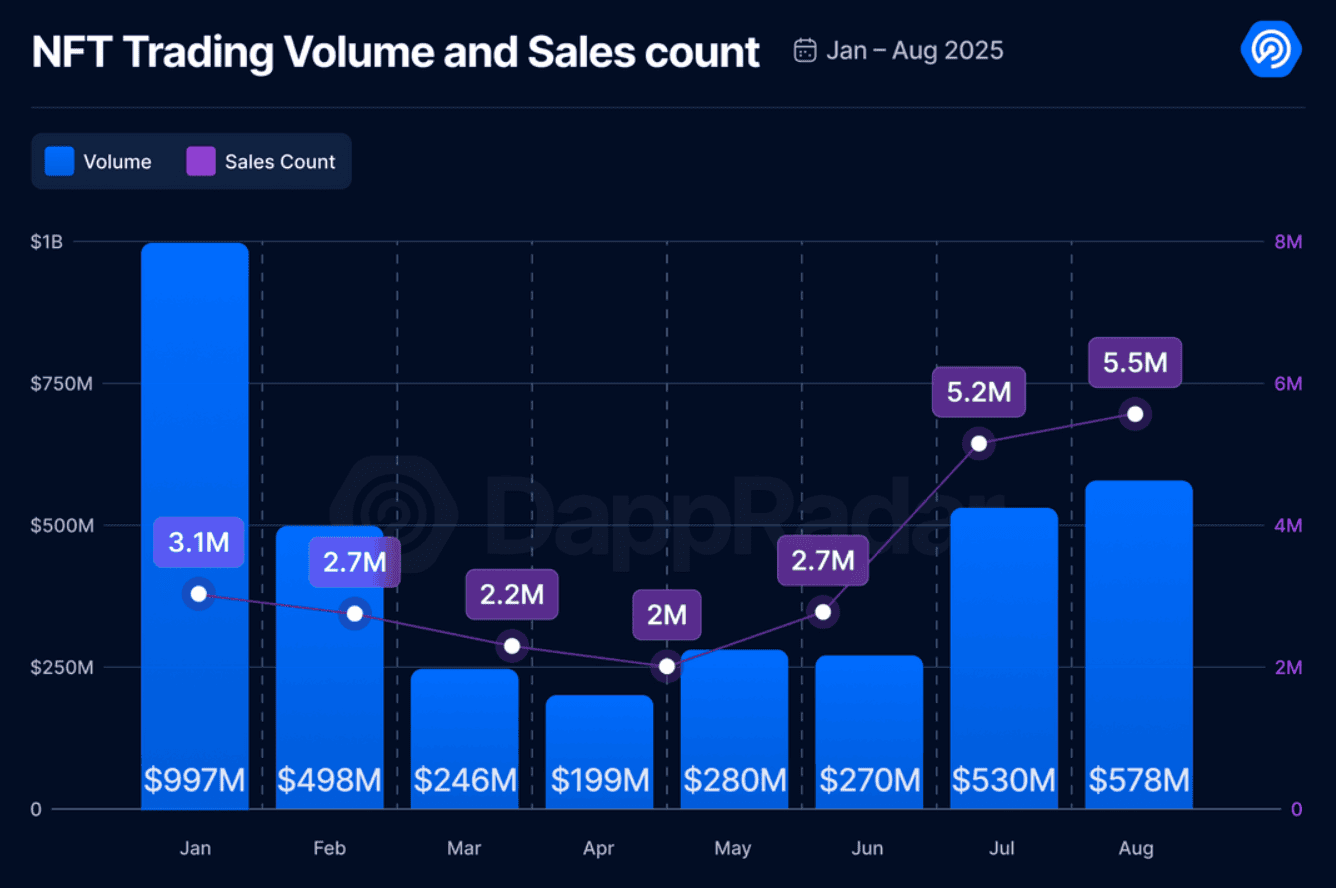

NFT gross sales have been steadily rising because the starting of the 12 months, however buying and selling volumes skilled dips with a leap of about 2m and a drop of $419 million, respectively.

In accordance with the charts, July and August noticed the strongest rebounds because the mid-term stoop, including about 1 billion to the NFT’s market capitalization and a rise in pockets depend of 90,000.

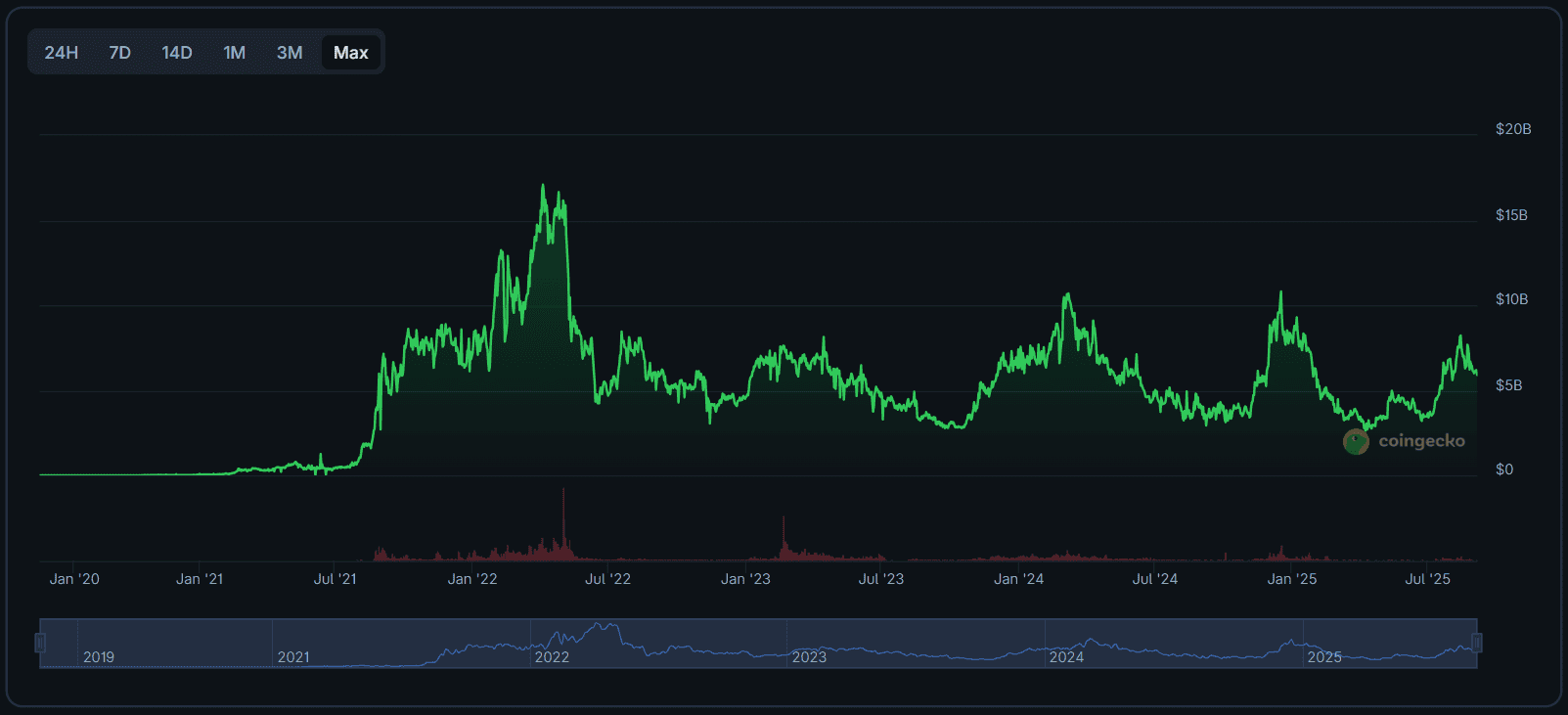

There are indicators of a restoration, however the market area of interest is much from its peak in 2022, with a market capitalization of round $24.7 billion, with present ranges at simply $6 billion, a major drop in print time knowledge from Coingecko.