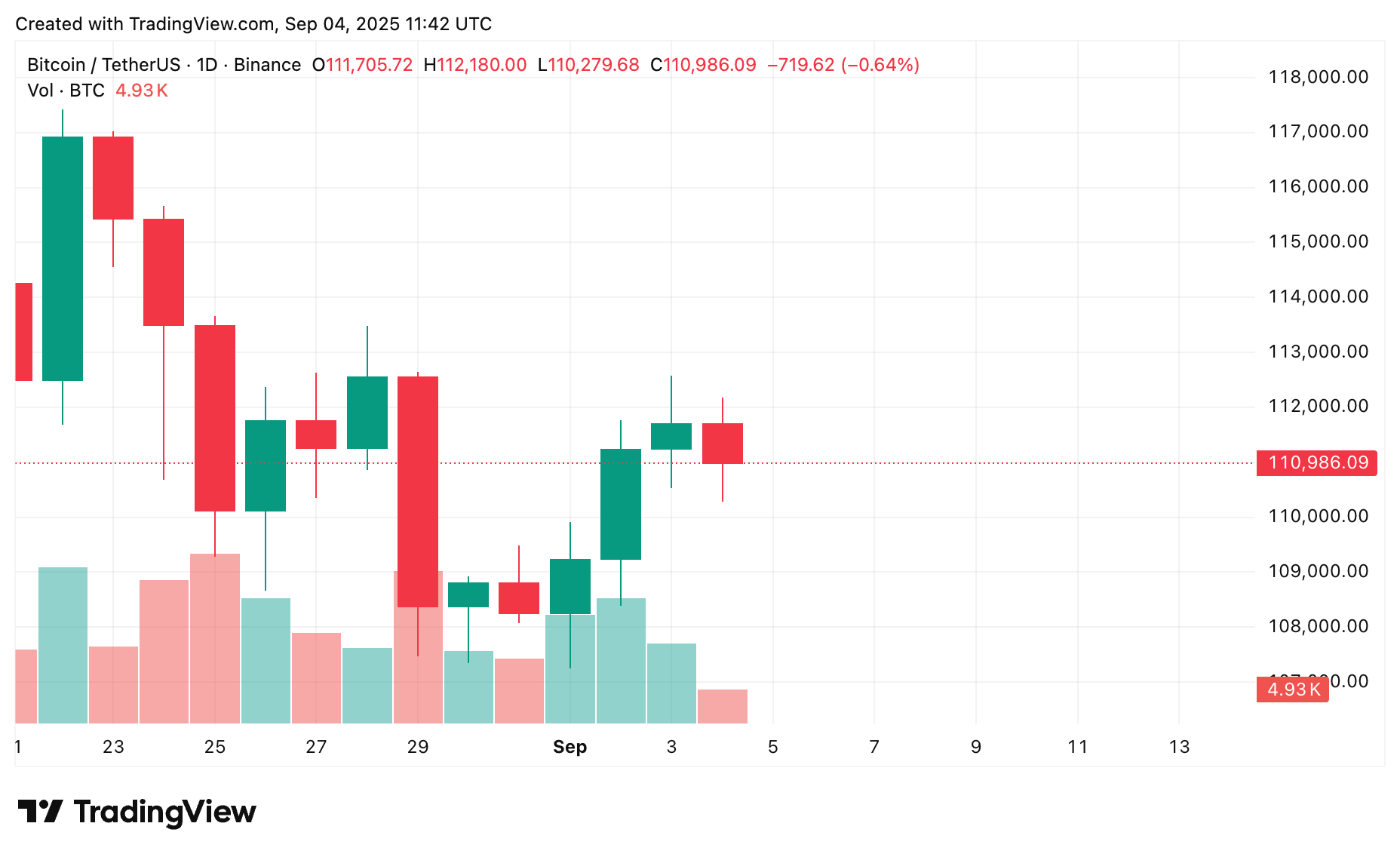

Bitcoin is stabilizing round $110,900 at present after a uneven August stuffed with worth shaking and macroeconomic unrest, affecting present Bitcoin worth forecasts.

Issues appear to be calm, with feelings bettering behind the ETF inflow, with extra optimistic macro pictures, and a rise in motion within the derivatives market. Merchants are monitoring $112K as the principle resistance degree and $100,000 for close by assist as Bitcoin trades inside the hardest vary.

So, what’s your future outlook for Bitcoin?

desk of contents

abstract

- BTC has stabilized round $110,900 after a unstable August, with resistance specializing in $112,000 and $108,000 in assist.

- ETF inflows and stubcoin liquidity assist worth stability and emotional enhancements.

- A break above $112K may set off a rally from $116,000 to $118,000, notably utilizing bullish macro information.

- As volatility is constructed, drops under $108K are in danger to $104,000 and even $100,000 on the minus facet.

- Bitcoin worth forecasts stay cautiously bullish, with institutional flows and macro alerts keying within the subsequent transfer.

Present BTC worth situation

At this level, Bitcoin is buying and selling in a tricky vary between 110.3k and 112,000, supported by rising stability liquidity and optimism surrounding Bitcoin ETFs.

There’s so much occurring within the derivatives discipline as nicely. Open curiosity sits at round $114 billion. Merchants are marking necessary strain factors, notably trying on the $110,000 and $112.2,000 ranges that the liquidation cluster has amassed.

BTC 1-Day Chart, September 2025 | Supply: crypto.information

Usually September does not have a lot for Bitcoin (and subsequently known as “Purple September”), however this yr it is potential that it isn’t following the standard script. Extra establishments are participating by way of ETFs, which may change the way in which the moon unfolds.

Optimistic influence on Bitcoin costs

If Bitcoin (BTC) is decisively broken $112K, we might even see a robust rally that can enhance costs from as much as $116,000 to $118,000, which is more likely to be pushed into extra speculative inflow, particularly from businesses related to ETF merchandise.

The influx of Bitcoin ETFs is at the moment just about according to the inflow of huge gold ETFs, indicating a serious change in how institutional buyers play the sport. These secure influxes can keep worth will increase, particularly when the macro picture is optimistic.

And the US employment report, which exceeds expectations, may elevate expectations for a Fed charge reduce and add extra gas to Bitcoin rallies. It drives danger urge for food and means that you can convey extra money into the code within the brief time period.

Damaging influence

If Bitcoin doesn’t violate the $112,000 degree, the chance of pullbacks will increase. A setback to $108,000 assist is a priority in the intervening time, and if bearish sentiment is strengthened, additional declines from $104,000 to the $100,000 vary can’t be dominated out.

You may prefer it too: Company Bitcoin’s funds are a risk to market stability | Opinion

The historic danger of September weak spot provides one other layer of consideration. Merchants are more and more hedged in opposition to volatility, as proven within the rising choices market information and implicit volatility metrics. This means that the market is making ready for sharp actions in both route.

Bitcoin is in a unstable place because the liquidation danger zone kinds simply above and under the present worth. Minor catalysts – optimistic or damaging – may cause necessary worth actions.

Bitcoin worth forecast based mostly on present ranges

The important thing vary to watch within the brief time period is $108K-112K.

- If Bitcoin clears $112K, it may launch a robust rally heading in the direction of $116K or $118K, particularly if the ETF continues to boost funds and the market stays wholesome.

- Conversely, for those who fall under $108K, the door opens to go all the way down to $10,000, with $100K as your subsequent main assist.

For now, Bitcoin worth forecasts stay on the cautious facet, however everyone seems to be ready for clearer indications from the economic system and institutional flows. There’s one factor for certain. As Bitcoin approaches this necessary turning level, volatility can improve.

Primarily, BTC worth forecasts depend upon what occurs subsequent on this slim vary. Medium-term forecasts are bullish as establishments step up, however merchants ought to anticipate some hiccups with seasonal and macro challenges within the combine.

learn extra: Analysts say asset managers will transfer from Bitcoin to Ethereum amid a unstable August

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.