Jupiter mirrored Solana’s buying and selling growth, securing greater than $46 million in income within the third quarter. This platform combines native DEX with aggregation and different providers and is considered one of Solana’s most generally used platforms.

Jupiter achieved income of $46 million within the third quarter and secured an everyday supply of inflows with out the necessity for added exterior funding. The app has turn out to be sustainable as one of many go-to providers for token buying and selling on Solana. The variety of lively wallets prior to now quarter was 8.4 million, up from 8 million within the second quarter.

Jupiter achieved excessive benchmark charges within the third quarter, highlighting its earnings. Perpetual futures have been the most important driver of income within the third quarter, including $24.6 million to the underside line. The protocol collects $1.38 billion in annual charges and stays the highest Solana app.

Jupiter has improved income streams from a number of actions primarily based on a brand new product remodeled into the Solana tremendous app. |Supply: Jupiter Q3 Report

As of October 23, Jupiter generated $4.1 million in charges. The app achieved $176.8 billion in spot buying and selling quantity within the third quarter, matching demand for meme token buying and selling. Jupiter expanded in perpetual futures buying and selling, a development that accelerated within the fourth quarter.

The platform can be within the prime 5 fee era apps, approaching Hyperliquid’s each day commissions. Whereas Jupiter’s workforce has been targeted on constructing, common income was additionally supplied as proof that the mission was accepted.

Jupiter’s workforce touted the robust income as proof that the app is constructing a sustainable mannequin and does not want new sources or funding..

In its current quarterly report, the Jupiter workforce sees vital upside room for DeFi exercise because it makes an attempt to meet up with the centralized cryptocurrency market. The platform expects DeFi customers to develop tenfold within the coming months and years, capturing a bigger share of merchants.

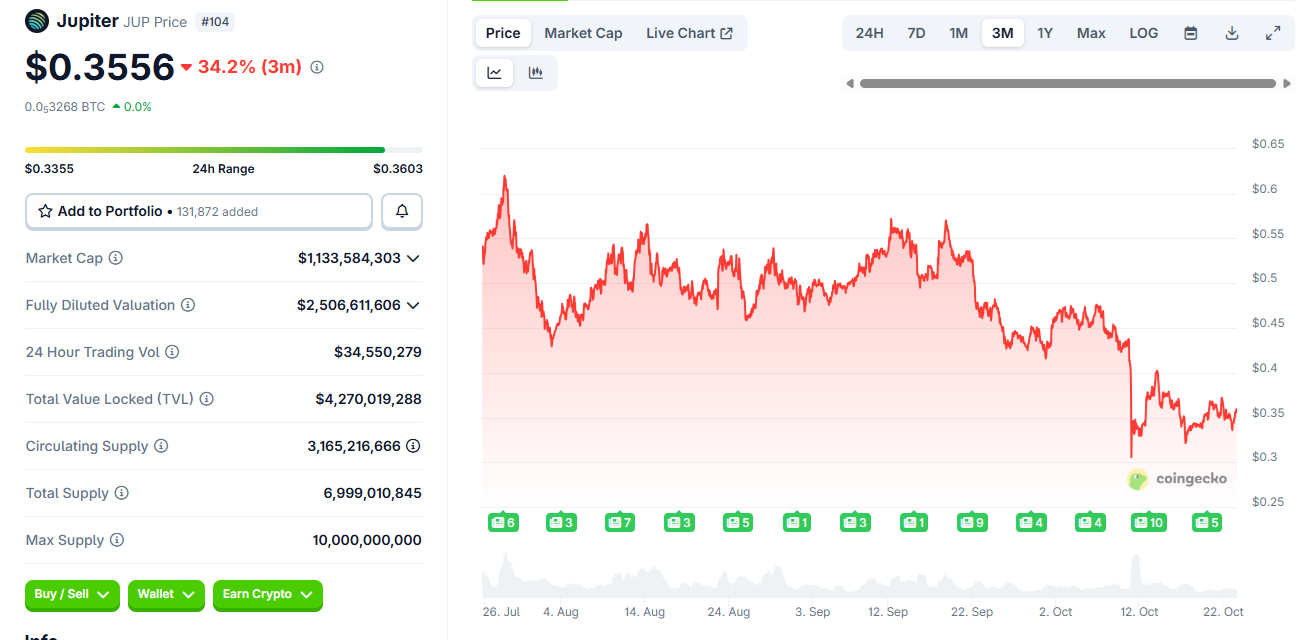

Jupiter’s JUP token trades close to three-month lows

Regardless of Jupiter’s sustained earnings, its native token continues to say no. Continued unlocking and perk gross sales are placing strain on JUP.

JUP doesn’t replicate profitable income from Jupiter apps. The workforce introduced that it’s going to search to strengthen the function of the token with the objective of ending the long-term decline. |Supply: Coin Gecko

As of October 23, JUP is buying and selling at round $0.35, close to a three-month low. Based mostly on present market actions, we imagine JUP could also be undervalued relative to Jupiter’s exercise and demand.

The Jupiter workforce additionally said that it’s going to change its strategy to the JUP token. The usage of JUPs to vote on minor points will lower, and holders will solely vote on necessary points. The workforce goals to combine JUP into Jupiter’s actions and enhance the token’s worth and income sharing potential.

Jupiter expands as Solana tremendous app

Jupiter has grown from a buying and selling and routing aggregator to a objective of changing into a “tremendous app.” The mission secured validator standing on Solana, making it the third largest validator.

The mission at the moment has a complete of $3.28 billion locked in from DEX liquidity and newly launched lending enterprise.

As a validator, Jupiter has secured over $1 billion and earned $531,400 in income from JupSOL. The influx will go to Jupiter’s DAO reserves.

In Q3, Jupiter additionally added a token launch pad, with over 34,000 tokens launched and buying and selling quantity of $1.32 billion. For now, Jupiter stays a minor addition to the Solana-based meme launch as Pump.enjoyable stays the chief.