The emergence of Kevin Hassett because the front-runner to exchange Jerome Powell in 2026 has brought about an uncommon break up throughout monetary markets. Whereas crypto merchants are celebrating, bond traders are warning of risky rate of interest cuts.

The rift has deepened with a brand new report detailing personal issues raised with the U.S. Treasury Division.

Bond market warns of aggressive fee cuts

The newspaper mentioned bond traders had privately instructed the Treasury Division they have been involved that Mr. Hassett would push for speedy, politically aligned rate of interest cuts. monetary occasions.

Consultations in November with Wall Road banks, main asset managers and members of the Treasury Division’s Borrowing Advisory Committee revealed constant issues that Hassett’s Fed would prioritize the administration’s needs over controlling inflation.

The report exhibits traders are involved that Mr Hassett may insist on indiscriminate fee cuts even when inflation stays above the two% goal.

Contributors within the assembly additionally famous that Hassett had centered on non-market political matters in earlier conferences and questioned the Fed’s independence.

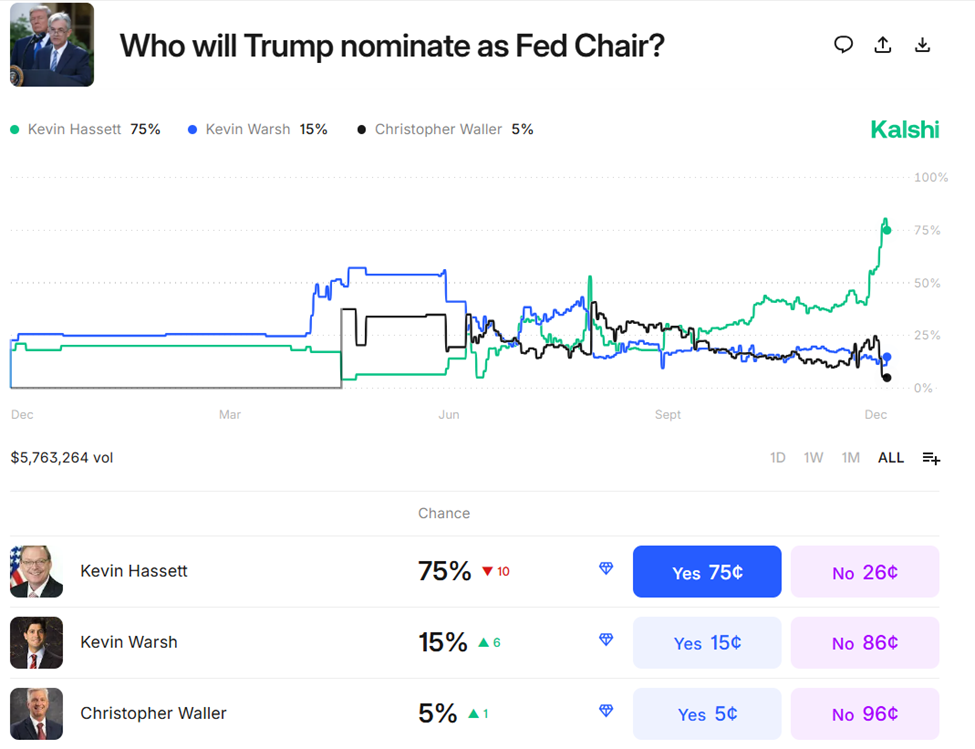

Present prediction markets give Hassett a few 75% probability of changing into the following Fed chairman, effectively forward of rivals Christopher Waller and Kevin Warsh.

Chance of changing into the following Fed chairman. Supply: Karshi

A dovish tailwind blows within the digital foreign money market

The cryptocurrency market takes the other view. Merchants are deciphering Hassett’s stance as a inexperienced gentle for quicker easing, extra liquidity, and a weaker greenback, a mixture that has traditionally supported Bitcoin, Ethereum, and high-beta altcoins.

Hassett has vowed to chop rates of interest instantly if he leads the Fed. That dovish stance is a cautious goal for Powell, who’s an advisor to Coinbase and owns greater than $1 million in COIN inventory.”>This can be a clear distinction to advisors, creating each battle of curiosity points and expectations for a extra crypto-friendly regulatory setting.

Who’s Kevin Hassett?

Is Trump the frontrunner to turn into the following Fed chairman?

Longtime Trump ally: CEA Chairman (2017-2019), now NEC Director for Trump 2.0

Tremendous dovish: repeatedly requires aggressive rate of interest cuts, prioritizing progress and jobs over combating inflation

Will perform Trump’s dream… pic.twitter.com/ePpeAaXkOx

— 0xMarioNawfal (@RoundtableSpace) November 30, 2025

Juan Leon, a strategist at Bitwise, lately argued {that a} Fed led by Hassett can be “very bullish,” citing Hassett’s work selling crypto regulation and his historical past of criticizing present rates of interest as “too excessive.”

If Kevin Hassett turns into Fed Chairman, the impression on cryptocurrencies shall be extraordinarily bullish.

1. Aggressive “doves” who publicly criticize present rates of interest as too excessive and advocate for quicker fee cuts.

2. Main the White Home Digital Belongings Working Group to form the cryptocurrency motion…

— Juan Leon (@singularity7x) November 25, 2025

Political stress intensifies divisions

President Trump has steadily elevated his criticism of Powell, repeatedly suggesting that he has “already determined” who would be the subsequent Fed chair. He’s anticipated to announce his successor quickly.

On the similar time, there are stories that President Trump could promote Treasury Secretary Steven Mnuchin to chief financial adviser if Hassett is appointed. This highlights the administration’s efforts to realign financial management round a extra aggressive progress agenda.

BREAKING NEWS: President Trump is reportedly contemplating making Treasury Secretary Bessent his prime financial advisor if Kevin Hassett turns into the following Fed chairman.

This shall be along with Mr. Bessent’s present work as Treasury Secretary.

A brand new period of financial coverage is upon us. pic.twitter.com/d8ehhItjnY

— Kobeissi Letter (@KobeissiLetter) December 3, 2025

Political dynamics are including to the uncertainty within the bond market. Buyers are involved a few state of affairs by which the Fed strikes to speedy easing whereas inflation stays excessive. These strikes, in addition to fiscal deficits and issuance at traditionally excessive ranges, undermine the credibility of central banks.

Hassett’s candidacy crystallizes a uncommon market divergence. Cryptocurrencies are priced in for upside from liquidity, whereas bonds are priced in for coverage threat and volatility.

The approaching weeks will form expectations for each financial coverage and digital asset markets, as Powell’s time period ends in Could 2026 and last interviews are underway.

Formal nominations are anticipated to be made early subsequent 12 months. Till then, traders will proceed to commerce on the rising probability of a dovish crypto-aligned Fed and the accompanying pushback from conventional finance.

Kevin Hassett Sparks a Crypto-Bond Market Cut up as Fed Race Heats Up appeared first on BeInCrypto.