Ripple Labs CEO Brad Garlinghouse has expressed assist for the Readability Act, a legislative challenge geared toward offering a proper construction to the U.S. cryptocurrency market. Though the proposal is at present stalled in Congress, the chief govt burdened the necessity to advance accessible rules to stop the dearth of clear guidelines from persevering with to influence growth on this space.

In an interview, Garlinghouse addressed the legislative course of and questioned the gridlock the Readability Act has precipitated. “We’re on the verge of getting the Readability Act in place.” markup Gaining approval from the Senate Banking Committee would have been an important constructive step. Nevertheless it stalled,” he stated.

Resistance on the a part of the trade to enhancements that may be made within the authorized textual content for Ripple directors It may be counterproductive in the long term.

In her remarks, Garlinghouse urged pragmatism from her colleagues and lawmakers. “What I am saying about that is, let’s cease disguising public anger over particular issues as being consultant of the trade as a complete as one thing that perhaps could be improved,” he stated.

My level is primarily that I feel it is apparent that readability is best than chaos. And the legislation of readability, as written, shouldn’t be good. Nobody right here has ever seen an ideal legislation. You might not prefer it, however do not let the pursuit of perfection cease you from progressing.

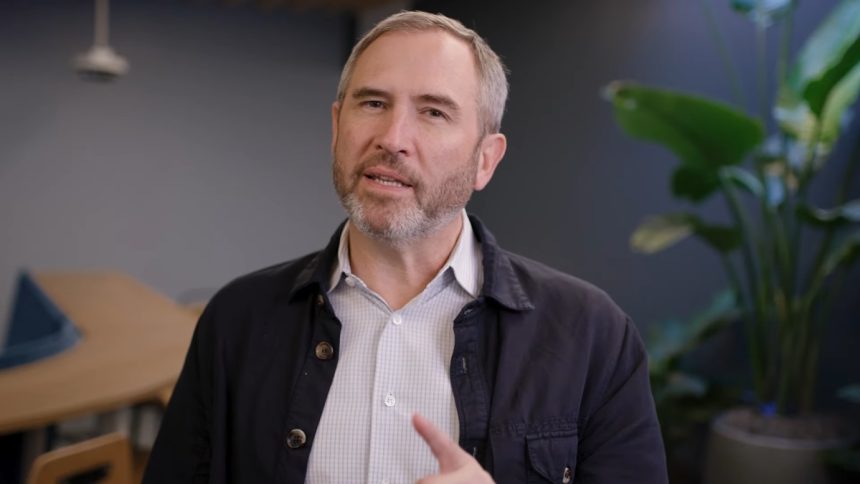

Brad Garlinghouse, Ripple Labs CEO

Equally, Garlinghouse recalled his firm’s practically five-year authorized battle with the Securities and Alternate Fee. The businessman was sentenced by federal choose Annalisa Torres to the digital asset XRP issued by his firm. not safety. This clarified the rules for the entity and its operations.

Nevertheless, the manager warned: This authorized certainty is private and doesn’t apply to different individuals. of the market. “There is no such thing as a regulatory readability for the trade as a complete, and whether or not we prefer it or not, Ripple’s fortunes will rise and fall with the fortunes of the crypto trade,” he acknowledged.

Based mostly on this assumption, Ripple’s CEO estimated an 80% probability that the Readability Act can be signed into legislation by President Donald Trump by the top of April 2026. This prediction differs considerably from others, together with that of Patrick Witt, govt director of the President’s Advisory Council on Digital Property. As reported by CriptoNoticias, he estimated that Readability can be signed into legislation on April 3.

Garlinghouse’s imaginative and prescient contrasts with that of different representatives of the crypto sector, corresponding to Brian Armstrong, CEO of Coinbase, the most important trade in america. He threatened to withdraw his assist for the Readability invoice, citing disagreements over its present phrases.

The core of the battle lies in the advantages that stablecoins present to customers. At the moment, it isn’t but totally outlined whether or not corporations like yours will be capable of present returns to those that retailer stablecoins on exchanges.

The normal banking neighborhood claims it will lead to deposit flight of as much as $6 trillion, equal to 30% of U.S. business deposits. In the meantime, the cryptocurrency sector claims that stablecoin beneficial properties open the door to competitiveness.