Based on a seven-year report issued by Coingate, Litecoin (LTC) stays one of the crucial used cryptocurrencies for funds. The report, together with Bitcoin (BTC) and Tether (USDT), locations Litecoin as the highest three world fee strategies on the platform.

After the 2021 breakout 12 months, if there’s a 521% enhance in Litecoin orders processed in comparison with 2020, use is powerful. In 2024, LTC funds rose 52.7% year-on-year, marking the second 12 months of development. In 2025 thus far (January-August), Litecoin accounted for 13.9% of all Coingate funds, after solely BTC (23%) and USDT (21.2%).

For a brief interval in June and July, it rose to second place, overtaking the USDT because the regulatory implications affected steady use.

Business and buying conduct

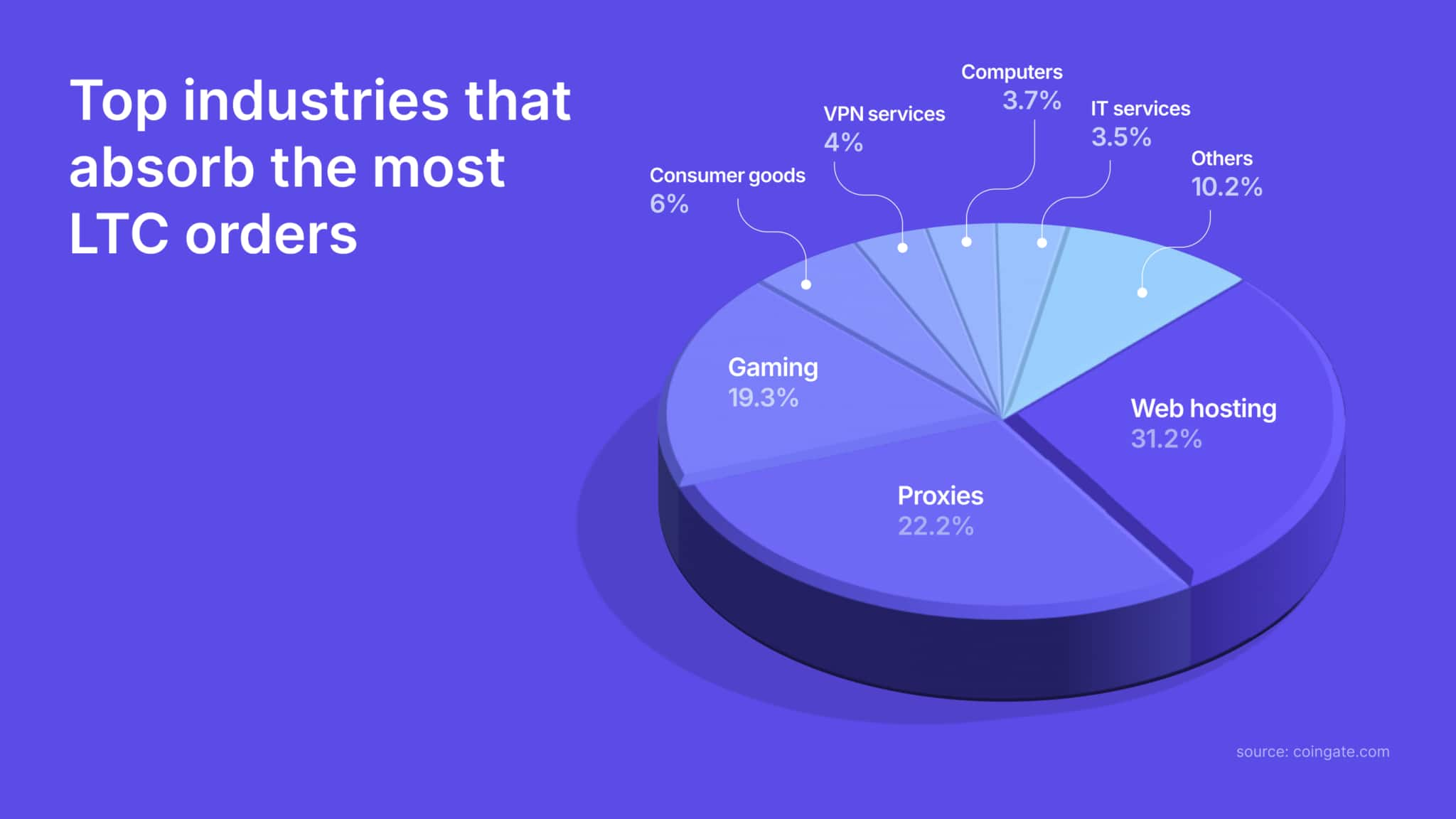

Based on the report, internet hosting (31.2%), proxying (22.2%) and gaming (19.3%) accounted for nearly three-quarters of all Litecoin transactions in 2025. Specifically, LTC is guided by PlainProxies, Ping Proxies, and Thunderproxy All within the Highproxy levels, with PlainProxies, Ping Ping Ping in Thunderproxy, PlainProxies, Ping Ping Ping in The Excessive within the Excessive within the bitcoin. Ethereum (ETH), or Stablecoins.

Briefly, Litecoin carries the candy spot as a foreign money of alternative for patrons paying for repeat digital first providers, and is especially related to internet hosting, proxying and gaming retailers.

Up to now, in 2025, the typical Litecoin order dimension is 44.5 euros, intently aligns with the worth vary of internet hosting subscriptions, proxy packages and gaming providers. The height was recorded at 52 euros per order in 2022, indicating that LTC has been used for medium-sized digital purchases reasonably than a one-time, high-value expertise.

For companies, this buying conduct is outstanding. Litecoin attracts repeat prospects with regular spending patterns, whereas supporting massive orders when wanted. The mixture of flexibility and predictability contributes to its place as probably the greatest fee strategies.

Geographical distribution

The US has generated the biggest share of the Litecoin order in 2025 (23.8%) thus far in 2025, adopted by Germany (8%) and Nigeria (7.1%). Different notable markets embrace the UK (5.8%), the Netherlands (5%), France (3.7%) and Poland (2.9%).

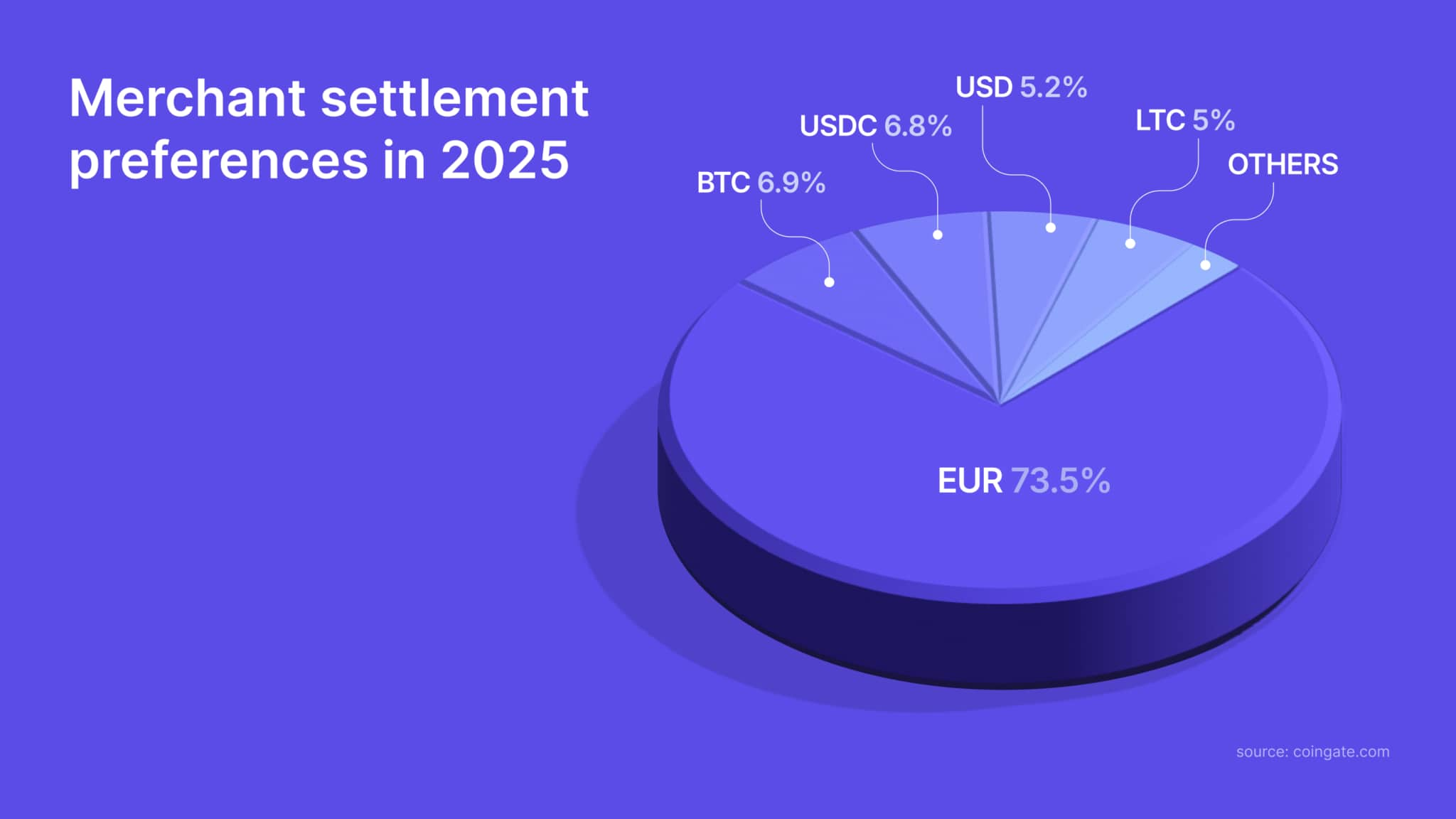

Retailers’ settlements present elevated confidence

The report additionally checked out how retailers deal with the Litecoins they acquire. In 2025, 5% of retailers selected to carry the very best proportion since 2022, LTC. The bulk nonetheless selected to transform to the euro (73.5%), adopted by BTC (6.9%), USDC (6.8%) and USD (5.2%).

As anticipated, most retailers favor Fiat’s predictable accounting, however the smaller shares have chosen to both maintain Litecoin straight or reassign it to BTC or USDC. The info exhibits that accepting LTC can shortly enhance the flexibleness of monetary administration, whether or not they favor hedging, retaining or conversion.

Particular photographs through ShutterStock.