Bitcoin costs remained below stress on Thursday as traders remained on the sidelines amid rising considerations. BTC is buying and selling at $91,940, a big drop from its year-to-date excessive of $126,300. On this article, we’ll contemplate among the important the explanation why the coin could rebound quickly.

Bitcoin value rebounds as crypto concern and greed index slumps

Copy hyperlink to part

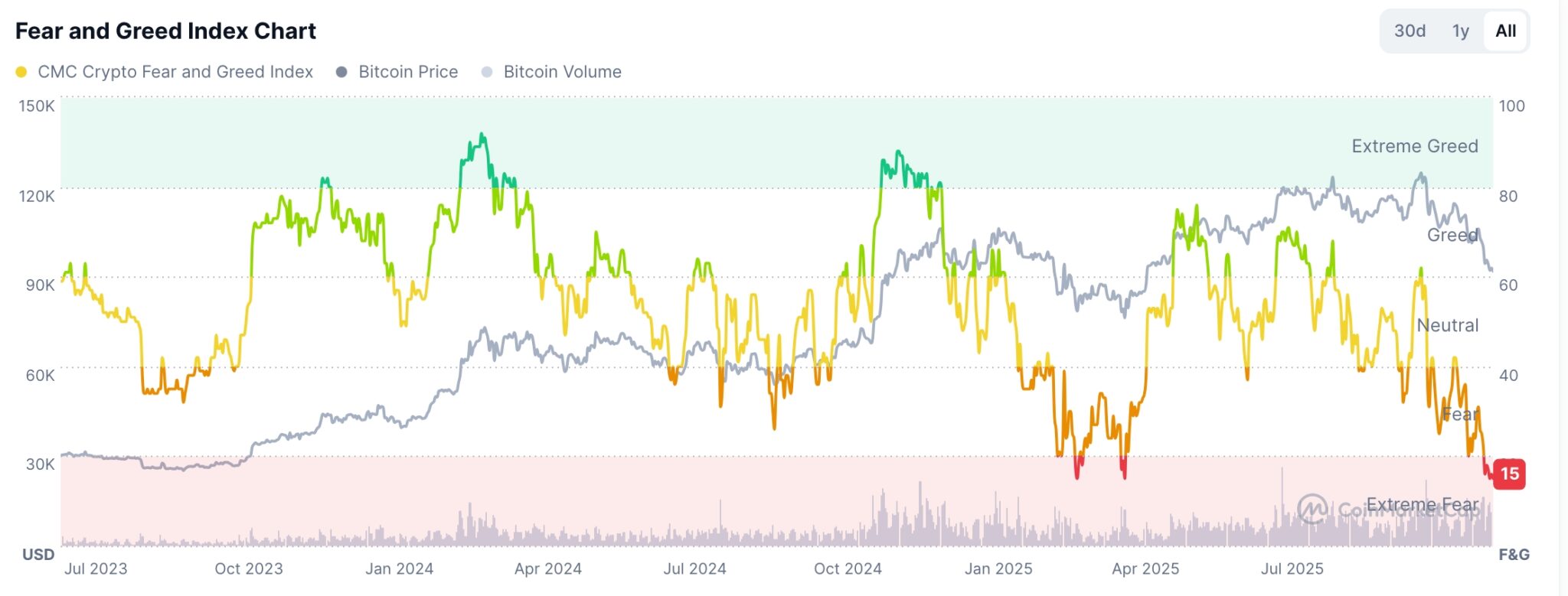

One of many important underlying components for Bitcoin costs is that traders have gotten more and more fearful. The Crypto Worry and Greed Index has fallen to fifteen, the acute concern zone, the bottom degree since April of this yr. Freefall continues after peaking at Greed Zone 80.

In idea, if market individuals really feel concern, the worth of Bitcoin and different cryptocurrencies ought to fall. However in actuality, Bitcoin and altcoins usually rebound when concern conditions develop into excessive.

BTC Worth and Cryptocurrency Worry and Greed Index

instance of that is what occurred in April of this yr when Bitcoin and the Worry and Greed Index fell after Donald Trump introduced reciprocal tariffs. Bitcoin costs hit a brand new all-time excessive in Could.

An identical factor occurs within the inventory market, which normally rebounds every time the CNN Cash Worry and Greed Index dips into the acute concern zone. For instance, this occurred in April when the index fell under 10 attributable to a pointy decline within the inventory market. Presently, main US indexes such because the S&P 500 and Dow Jones are hovering close to file highs.

Bitcoin value at all times emerges from a bear market

Copy hyperlink to part

One other main purpose why Bitcoin costs may bounce again quickly is that historical past is on our facet.

Bitcoin was created in 2009 and has managed to rise from lower than $1 to its present value of $91,000. The leap to its all-time excessive of $126,000 was something however linear. As an alternative, there have been at all times main reversals over time.

instance is the large crash that occurred in 2022 because the Federal Reserve raised rates of interest and firms like Terra and FTX went bankrupt.

In latest occasions, the Bitcoin value has fallen by about 13% from its August twelfth excessive and September 1st low, earlier than rebounding to a brand new all-time excessive.

BTC value is oversold

Copy hyperlink to part

One other main purpose why Bitcoin costs may rebound is that Bitcoin has been extraordinarily oversold over the previous few days in the course of the ongoing sell-off.

For instance, the Relative Energy Index (RSI) has moved to the oversold degree of 30. Equally, the Cash Stream Index (MFI), a novel type of the RSI, has moved to an oversold degree of 24.

Superior Oscillator has been under the zero line since October twelfth. Due to this fact, if traders begin shopping for the dip quickly, the coin may rebound.

BTC Worth Chart |Supply: TradingView

Nvidia’s sturdy earnings enhance crypto market

Copy hyperlink to part

One other potential catalyst for Bitcoin costs is Nvidia’s latest earnings. This means that the corporate’s enterprise is doing higher than anticipated.

Information reveals NVIDIA’s income soared to $57 billion final quarter, and administration expects it to leap to greater than $65 billion this quarter.

Robust earnings boosted the inventory market, with the Nasdaq 100 and S&P 500 indexes up greater than 1%. Nvidia itself soared greater than 5% in premarket buying and selling. These numbers imply that different property just like the cryptocurrency market will proceed to recuperate.